Trusted by

Trusted by

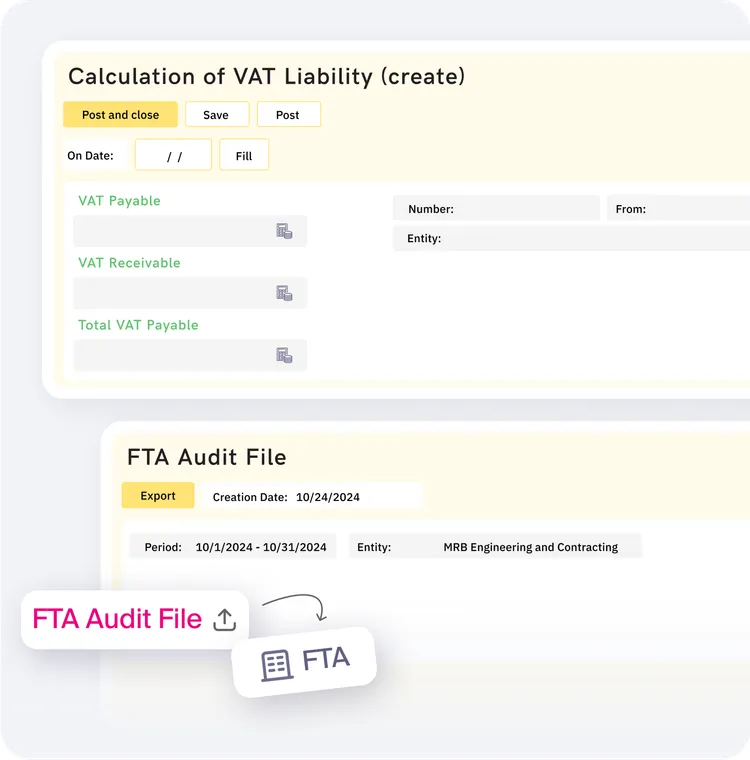

CALCULATE

Ensure accurate tax calculations

-

Automatically calculate and record VAT and CIT liabilities within a unified VAT compliant ERP system, ensuring compliance with UAE regulations

-

Keep tax records updated in real time, avoiding manual errors

-

Streamline tax data integration with other financial processes for full accuracy across the system through VAT accounting software in UAE

Request a demo

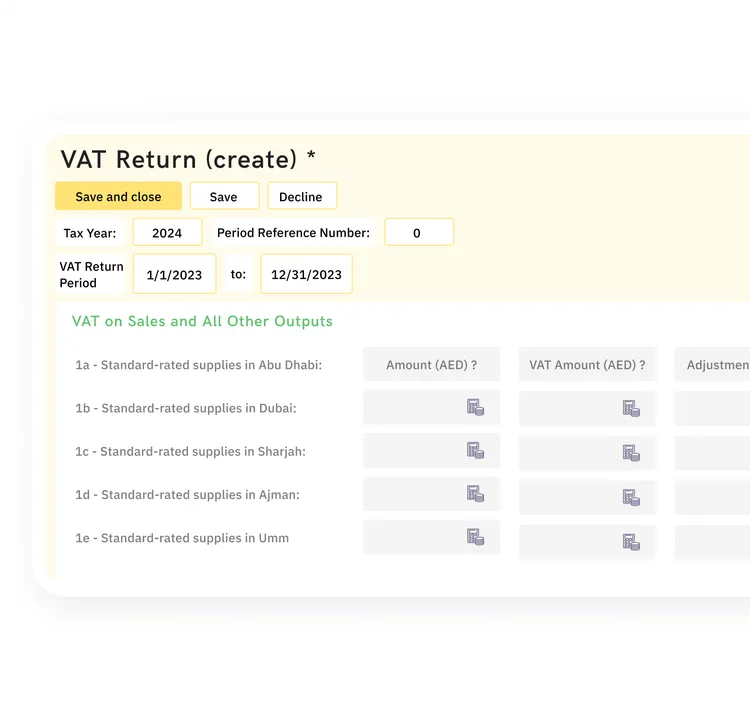

REPORT

Simplify tax submissions

-

Automate the preparation of VAT returns and CIT filings, reducing manual effort

-

Use predefined templates to simplify complex tax calculations and ensure timely, accurate submissions — including your VAT return report

-

Easily generate detailed reports to track tax process including payments, refunds, and pending liabilities

Request a demo

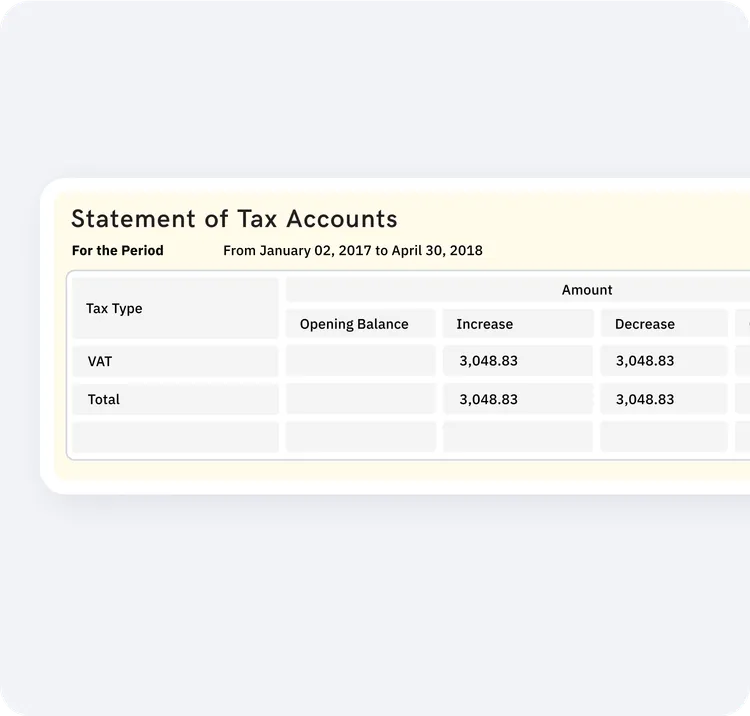

TRACK

Gain full control over tax accounts

-

Get a complete overview of all tax-related transactions through detailed tax account statements

-

Monitor and reconcile VAT and CIT payments, credits, and liabilities in real time

-

Maintain accurate records for audits and compliance, ensuring transparency across all tax activities

Request a demo

Achieve your goals with these features

Here are FirstBit ERP tools and reports to enable full tax compliance of your construction business.Explore our solutions approved by FTA

Frequently asked questions

Don't find an answer? Meet our expert to get a detailed quote.

Contact us

What is VAT and CIT tax software?

What is the best software for VAT?

What is the most common method of accounting for VAT?

Is FirstBit ERP FTA-approved?

What reports can I generate with the FirstBit Taxes module?

Does FirstBit ERP integrate tax processes with accounting?

Can FirstBit ERP handle multi-currency tax calculations?

What happens during an FTA audit? Can FirstBit ERP assist?

What is the accounting standard used in UAE?

Can I submit VAT without software?

Don't find an answer? Meet our expert to get a detailed quote.

Contact us

See FirstBit ERP solutions in action

Discover how our system solves the unique challenges of contractors in a personalized demo.

After the demo you will get a quotation for your company.

After the demo you will get a quotation for your company.