Payroll to Revenue Ratio: What It Is and Why It Matters

- Labor cost efficiency. This ratio indicates how effectively you're converting payroll dollars into revenue. A lower ratio often signals cost-effective labor use, while a higher one could mean you're paying too much for each dollar earned.

- Workforce optimization. It provides HR with the clear insights necessary to structure salaries and bonuses. It helps to balance fixed and variable pay based on performance plus financial results. This data-driven approach ensures compensation plans are both motivating and cost‑effective.

- Strategic decision-making. It empowers leadership to align labor expenses with revenue targets and growth strategies. It becomes a critical tool for resource allocation—determining when to hire, where to invest, and how large your team should be, based on revenue growth projections.

- Predicting profitability. HR and finance teams can forecast labor expenses, plan future payroll budgets, and anticipate recruitment costs. This enables a clear view of how labor costs will impact profitability and provides a structured framework for budgeting future staffing needs.

- Builds investor & lender confidence. Maintaining a stable payroll-to-revenue ratio shows discipline and financial credibility. It can make businesses more attractive to investors or lenders. In fields such as construction, this is crucial for securing larger projects and securing funding.

Factors that Influence Payroll to Revenue Ratio

1. Business Model

When your model depends on hiring experts from your industry, expect a higher payroll-to-revenue ratio. If it relies on workers performing standard tasks without much prior experience, the ratio will be lower.

2. Industry Standards

-

Professional, scientific, and technical services — 39%

-

Construction — 20%

-

Beauty Salons and Barber Shops — 44%

-

Retail — 10% to 20%

-

Health care and social assistance — 41%

-

Restaurants — 30%

-

Manufacturing — 12%

-

Hospitality — 30%

3. Company Size

4. Geographic Location

The average annual salary in Dubai (~AED 52K) exceeds that in Abu Dhabi (~AED 42K)[?].

5. Market Conditions

Inflation in the UAE stood at 1.4% in Q1 2025, mainly due to lower energy costs[?].

Track expenses in FirstBit ERP

How to Calculate the Payroll to Revenue Ratio

Step 1: Calculate Total Payroll Costs

-

Gross salaries and wages. The total compensation paid to employees before deductions (including base pay, hourly wages, and contractor fees). UAE businesses can use ERP tools like FirstBit ERP to streamline this process.

-

Employee benefits. In the UAE, many packages include pensions, end-of-service gratuities, paid leave, accommodation, transportation allowances, and health insurance.

-

Payroll taxes and statutory contributions. These may include the employer’s share of UAE medical insurance or pension fund payments for UAE nationals (via GPSSA).

-

Bonuses and commissions. Any incentive payments tied to performance or sales.

-

Other labor-related expenses. Overtime, housing allowances, travel stipends, and mobile or vehicle reimbursements.

Tip: In the UAE, expatriate labor often involves unique payroll elements, such as relocation costs or visa fees. These should be included for accuracy.

Step 2: Calculate Your Total Gross Revenue

-

Project revenues

-

Sales of goods or services

-

Any other operating income streams

Step 3: Divide Payroll Costs by Total Revenue

Payroll-to-Revenue Ratio = (Total Payroll Costs / Total Revenue)

Step 4: Multiply by 100 to Get the Percentage

Payroll % = (Payroll-to-Revenue Ratio) x 100

-

Total payroll costs: AED 920,000

-

Total revenue: AED 4,600,000

Payroll-to-Revenue Ratio = 920,000 / 4,600,000 = 0.20 Payroll % = 0.20 x 100 = 20%

6 Tips To Reduce Your Payroll-to-Revenue Ratio

- Use industry benchmarks. Compare your payroll‑to‑revenue ratio with industry benchmarks and key competitors. If your ratio is higher, you need to make targeted cost adjustments.

- Optimize staffing levels by role. Analyze performance metrics and workload data to ensure that the correct number of employees are assigned to the right roles. Adjust team size based on actual demand to prevent overstaffing during low-output periods and maintain productivity.

- Employee skill development. Investing in upskilling programs that improve employee efficiency. This will increase output per staff member. Teams will manage higher workloads without adding headcount. That’s why companies with formal training earn over 218% more income per employee[?].

- Choosing the right payroll schedule. Adjust it to better match your company’s cash inflow patterns. For instance, you can time your bonuses or commissions with peak revenue periods. This will help improve cash flow management and also reduce pressure during low-revenue months.

- Outsource non‑core functions. Delegate roles such as IT support, customer service, and other administrative tasks to specialized third-party providers. This approach offers greater budget flexibility, allowing you to pay only for the services you need.

- Set clear KPIs for your workforce. For example: productivity rates, customer satisfaction scores (e.g., CSAT or eNPS), and OKR progress. Conduct regular performance reviews. Reward top performers, while swiftly addressing underperformance through feedback or coaching. This approach ensures that your payroll investment aligns with measurable business outcomes.

Payroll to Revenue Ratio in Construction

-

Skilled labor shortage. UAE employers often increase pay to attract and retain skilled workers; when they’re not available, existing workers work overtime, pushing labor costs up.

-

Overtime premiums. Standard overtime = +25%, night shifts (10 PM–4 AM) = +50%.

-

Safety & compliance. PPE, safety training, accident insurance, and compliance monitoring—all necessary and costly.

-

Recruitment burden. Skilled-worker visa, recruitment, onboarding, and training costs average ≈ AED 3,404 per worker/year[?].

-

Wage Protection System (WPS) & payroll complexity. Construction companies must submit a monthly SIF containing payroll details and proof of salary transfers. Any discrepancies, late, or incomplete payments trigger non-compliance actions.

What Your Payroll to Revenue Ratio Reveals and What to Do

High PTR (> 30–40%)

-

Overstaffing

-

Inefficiencies

-

Wage inflation

-

High overtime

-

Lost profits

-

Low productivity

-

Pause the hiring process until you achieve revenue growth.

-

Review bonuses and benefits. Consider combining fixed and variable compensation.

-

Reduce inefficiencies by cross-training teams or automating routine tasks.

-

Invest in software that helps you allocate labor and control attendance.

-

Limit overtime. It can increase payroll with extra hours.

Low PTR (< 15%)

-

Understaffing

-

Outsourcing

-

Low payroll expenses

-

Short-term profits

-

Higher risk of burnout

-

Turnover

-

Inability to scale

-

Invest in strategic hiring to boost your production capacity or enter new markets.

-

Raise compensation or perks to stay competitive and prevent the loss of skilled employees.

-

Organize training for your employees to improve their skills.

Balanced PTR (15–30%)

-

Effective use of workforce to generate revenue

-

Moderate regional labor costs

-

Balanced mix of skilled laborers and supervisors

-

Stable cash flow

-

No cost overruns on payroll

-

Profitability + competitive pay

-

Monitor the ratio regularly. Track payroll and revenue trends to stay in range.

-

Real‑time dashboards. Use software with access to a centralized dashboard, where you can monitor your construction projects.

-

Cross‑train employees. Boost flexibility without adding headcount.

-

Embrace automation and AI: streamline your operations.

How To Use FirstBit ERP To Manage Payroll Efficiently

-

Automated payroll calculation. Calculate wages automatically by factoring in attendance, overtime, and applicable deductions.

-

Salary statement. Monitor and administer accrued liabilities, including salaries, overtime, leave payouts, and end-of-service benefits.

-

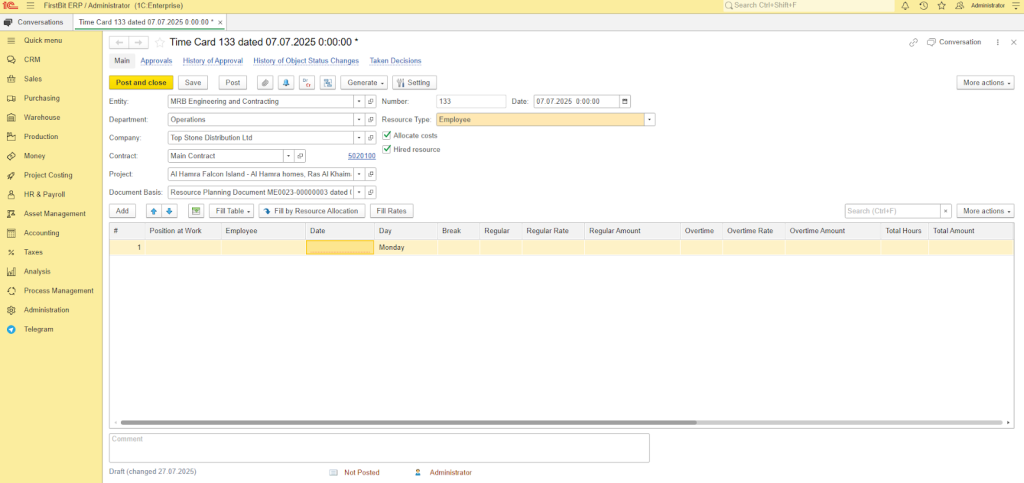

Time card. Monitor on-site employee attendance using digital time cards.

-

Employee contract change. Store all employee information—such as personal details, contracts, attendance, and accruals—in a single, unified system.

-

Employee expenses. Manage employee expenses, including loans, fines, and other deductions, efficiently within the payroll system.

-

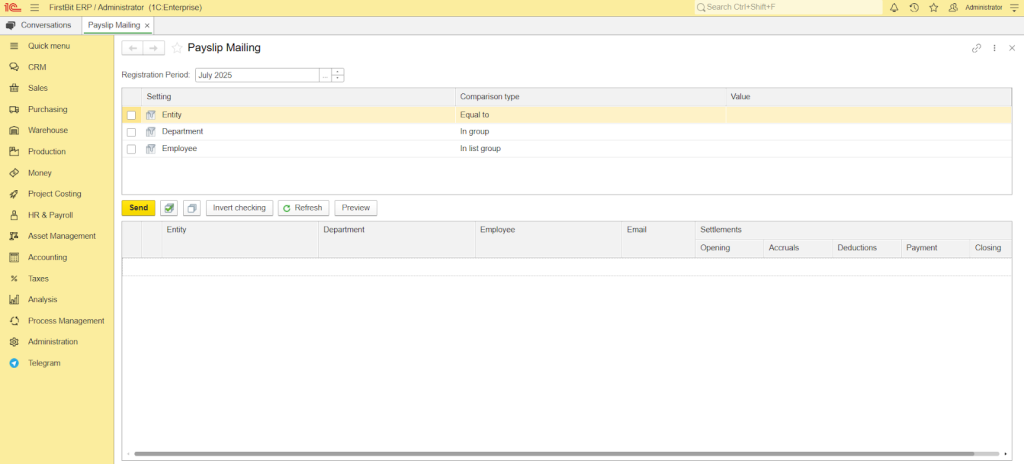

Payslips. Automatically deliver digital payslips to employees upon completion of payroll processing.

Use FirstBit to compare planned vs. actual costs

Conclusion

See FirstBit ERP solutions in action

After the demo you will get a quotation for your company.