In the construction industry, knowing exactly where your money is going is key to staying profitable. Job costing allows you to track project expenses in detail – by phase, task, labor, and materials. This way you can manage budgets and timelines effectively.

This article explores job costing in construction, how it works, and its benefits for your business. You’ll also learn about software you can use to make smarter financial decisions and increase overall project profitability.

What Is Job Costing in Construction?

Job costing is a method of tracking costs in a single construction project throughout all of its phases: from initiation to handover. It involves categorizing costs to monitor and analyze them.

These categories include:

-

Direct costs. Expenses directly tied to a project—materials, labor, equipment, subcontractor fees, and payroll taxes.

-

Indirect costs. They support the project but aren’t linked to a specific task—site utilities, security, temporary facilities, project management salaries, and equipment depreciation.

-

Overhead costs. They cover ongoing business expenses—office rent, insurance, administrative and executive salaries.

Job costing is essential for managing construction delivery—it lets you carefully monitor expenses and timelines, ensuring financial control as well as operational efficiency.

Key benefits:

-

Get insights into the profit or loss associated with each project

-

Compare estimates to actual costs in real-time

-

Detect inefficiencies early so you can take decisive action

By implementing accurate job costing, you gain visibility into project cost overruns, unexpected spending, and deviations from budget. This valuable data helps you track profitability, manage client expectations, and make smarter bids on future projects.

Pro tip: The more detailed your job costing is, the more effective it can be in helping you manage late deliveries and address overspend.

The Benefits of Construction Job Cost Accounting

By mastering job costing, you can unlock a range of advantages for your construction business:

-

Tracking of expenses. You can have full control and oversight of every expense of your project. When overspend occurs, you can identify it early and pinpoint exactly which task or category is affected.

-

Budget management. When you compare actual vs budgeted expenses, you can quickly identify deviations and take corrective action.

-

Accurate forecasting. Thanks to detailed cash flow reports, you can better plan for upcoming payments and efficiently allocate resources for new projects.

-

Data-driven estimating. Former and current project data can help you build better tender estimates, so you can bid accurately in the future. It also ensures your bidding investments deliver real value.

-

Risk mitigation. Routine, real-time reporting can reduce the risk of unforeseen financial issues and help you adapt strategies to manage risks of further overspend.

-

Client trust and satisfaction. It’s essential to keep clients in the loop, using effective reporting and delivery estimates. If overruns are on the horizon, you can manage client expectations early on and propose solutions to keep them satisfied.

Pro tip: You can leverage historical data from prior job costing to build credibility in the job market. This can lead to repeat business and even referrals.

Keep every project on budget

Request a demo

How Construction Job Costing Works

Job costing requires that managers follow a precise sequence of steps because each phase builds on the last—missing or rushing one can compromise the entire process. If this happens, budgeting goes off-track, forecasting becomes unreliable, and critical financial insights vanish.

Sticking to a structured framework transforms job costing from a reactive spreadsheet exercise into a strategic tool—ensuring every project is both well-managed and profitable.

In the next section, we’ll explain the three key steps to completing job costing effectively in the construction industry.

Step 1: Identify and Categorize All Project Costs

Accurately documenting every cost, whether estimated, committed (contracted), or actual, is essential for reliable job costing. Follow these steps:

List Every Cost

Start by cataloging all expected and actual outlays, organized by task or work package. Examples include:

-

Excavation

-

Foundation

-

Framing

-

Permits

-

Utilities

-

Insurance

-

Materials

-

Equipment rentals

These costs must all be reported separately.

Sort into Cost Categories

You can classify each cost under one of three industry categories by asking specific questions:

-

Direct costs – “Does this cost link directly to a specific construction task?”

Examples: excavation labor, framing materials, and concrete costs. -

Indirect costs – “Is this expense necessary but not traceable to a single task?”

Examples: permit fees, utility setup, project insurance. -

Overhead costs – “Does this cost support the business across multiple projects?”

Examples: office rent, accounting services, administrative staff.

Assign Job Numbers and Task Codes

For clarity and traceability, assign:

-

Job number: Unique identifier for the entire project (e.g., “JOB‑2025‑123”).

-

Task code or number: Unique sub‐identifier for each cost line (e.g., “01‑A3” for excavation, “02‑B1” for framing).

Every cost entry should include:

-

Job number

-

Task code

-

Description

-

Cost category (direct, indirect, overhead)

-

Estimated, committed, and actual amounts

Step 2: Allocate Costs

Once you’ve recorded all costs (estimated, committed, actual), the next critical step is allocating them accurately to each job or task.

Start Direct Cost Allocation

These are straightforward—allocate exactly where they belong:

-

Labor: Use timesheets detailing hours worked by employee and task/job.

-

Materials: Allocation based on actual usage per job (via inventory or PO tagging).

-

Equipment: Charge based on rental/usage logs (e.g., hours or days of use).

Perform Indirect and Overhead Allocation

Indirect costs (overhead) require allocation methods such as:

-

Percentage‑based allocation. Apply a standard overhead rate (e.g., 15%) to direct labor or the total direct cost of a job.

-

Labor‑hour or labor‑cost basis. Allocate overhead based on actual labor hours or cost.

-

Activity-based costing (ABC). Allocate based on activity drivers such as inspections, machine hours, or square footage.

-

Square footage. Calculate the cost of the total square footage of the space under construction.

-

Hybrid or dual-overhead method. Combine multiple bases, e.g., one rate for labor and equipment, another for materials/subcontract costs.

Utilize Software

Automate allocations using construction ERP software like FirstBit to reduce errors and increase efficiency.

Allocation, from start to finish:

-

Define allocation bases (e.g., total labor hours, machine hours, square footage)

-

Calculate overhead rate: total overhead/allocation base

-

Apply rate to each job based on its share of the base (hours, cost, etc.).

-

Ensure all cost records (timesheets, invoices, POs) are tagged with a job number and task code

Step 3 – Monitor Job Cost Reports

Generating routine reports is the most crucial part of the process. These outputs provide better oversight of budget versus actual costs, committed costs, remaining budgets, and estimated future expenses.

Key Report Types to Generate

Use your project management or accounting system to produce these reports automatically:

-

Budget vs. actual reports. Compare planned budget against actual spend across cost categories and WBS levels—ideal for pinpointing overruns or underspent areas.

-

Work-in-progress (WIP) reports. Show the percentage of costs incurred versus billed or completed progress.

-

Cash flow forecast reports. Project total expected cost using actual spend and progress metrics.

-

Earned value management (EVM) reports. Visualize Planned Value (PV), Earned Value (EV), and Actual Cost (AC) to reveal cost/schedule performance via CPI, SPI, etc.

-

Accrual and Change‑Order Reports. Show committed vs. paid costs and captured scope changes, essential for tracking liabilities or approved adjustments.

Set Reporting Frequency by Risk

Adjust the cadence based on project stage and risk level:

-

High-risk or overrunning projects: Daily or weekly.

-

Stable, low-risk phases: Monthly is sufficient.

Pro tip: Schedule reports in sync with stages, when you will be making key decisions.

Overcoming Job Costing Challenges in Construction

Below are the key challenges commonly faced in construction job costing and their solutions.

Lack of Real-Time Cost Tracking

Job costing depends on accurate data for decision-making. Yet inefficient cost tracking results in reports being delayed by days or weeks. You can’t make informed decisions based on outdated or incomplete figures. This can result in unexpected budget surprises.

This problem is often caused by firms using spreadsheets or paper forms. These don’t allow collaboration, require manual data entry, and are often not updated in time. This exacerbates delays, as weeks can pass before you realize a phase has overrun.

Solution: Implement a cloud-based ERP to directly address the issue by synchronizing real-time entries across all devices. As crew members clock in, they can update project progress, inventory levels, and expenses through desktop or mobile apps.

Afterwards, this information instantly updates dashboards, enabling you to detect overruns the moment they occur and respond proactively, rather than weeks later.

Misallocation of Costs

Differentiating between direct costs (labor, materials) and indirect costs (equipment maintenance, site overhead) is often mishandled. Misallocation skews project profitability insights. That’s why properly attributing indirect costs requires careful setup of cost drivers and frameworks.

Solution:

-

Clearly define cost categories. Distinguish direct costs (e.g., labor, materials, equipment) from indirect costs (e.g., site overhead, equipment maintenance) using standardized cost codes.

-

Set up cost pools for indirect expenses: Group related overhead costs—like utilities, site facilities, and administrative support—into identifiable pools.

-

Choose appropriate cost drivers: Assign each pool a measurable driver such as labor hours, machine hours, square footage, or number of purchase orders.

-

Allocate indirect costs based on usage: Distribute overhead to individual projects by applying cost drivers, ensuring costs align with actual consumption.

Inefficient Labor Cost Tracking

Labor makes up 30–50% of project costs[?]. Mis-tracked hours, errors in time entry, or fluctuating pay rates can massively distort actual costs. Productivity problems (waiting, rework, low efficiency) can also go unnoticed if not tracked via job phase.

Solution:

-

Measure workforce productivity with benchmarks and KPIs. Use indicators like Overall Labor Effectiveness (OLE) or productivity indexes to compare actual performance to targets, guiding resource allocation and mitigating delays.

-

Track time by task and phase. Assign labor hours to specific job phases or tasks, enabling granular analysis of productivity and revealing inefficiencies early.

-

Integrate with payroll and project-management software. Syncing time data directly with payroll and ERP systems, like FirstBit, reduces errors. As a result, payroll processing accelerates.

Change Orders and Cost Overruns

When project scope shifts due to change orders, these adjustments introduce additional expenses—labor, materials, overhead, and delays. Changes in project scope are often added to original budgets instead of being tracked separately. This makes it difficult to identify whether cost overruns are due to estimation error or extra work. Proper coding and documentation of change orders are essential for preserving margins.

Solution:

-

Promptly identify and document changes. Use formal written notices (RFIs or CCDs) when site conditions, client requests, or design issues arise; early identification is key.

-

Use detailed change-order templates. Include scope description, cost breakdown (labor, materials, equipment, overhead), schedule impact, and formal signatures before beginning extra work.

-

Assign unique change-order IDs and cost codes. Tag each change separately in your accounting system to clearly distinguish overruns from base-budget performance.

-

Estimate cost/time impacts upfront. Prepare a thorough cost/time analysis and negotiate terms before work begins to safeguard margins.

-

Track and integrate changes into project reporting. Update budgets, schedules, as well as invoices promptly to reflect the effects of each change order and to gain real-time insights into profitability.

Costs of Construction Equipment

In construction job cost accounting, equipment usage and depreciation are frequently overlooked. It often leads to underreported project costs and undermines profitability.

Solution:

-

Define all ownership and operational costs. Include depreciation, insurance, taxes, fuel, maintenance, and idle time when calculating equipment cost rates.

-

Choose an appropriate depreciation method. Example: straight‑line, declining-balance, units-of-production, or MACRS. Select it based on each machine’s estimated useful life and usage pattern. You can automatically calculate depreciation using the ERP system that takes into account asset type and usage duration.

-

Track actual equipment hours on the job site—ideally via time cards or telematics—and tie those hours to each project using cost codes.

-

Allocate overhead based on equipment usage within an Activity-Based Costing (ABC) framework or hybrid method, ensuring indirect costs (like depreciation) are assigned in alignment with actual equipment activity.

Material Price Volatility

Fluctuating material prices pose a serious risk to job cost accuracy in construction. Many firms underestimate material costs during initial estimates, which leads to overspending and budget overruns when prices spike.

Solution:

-

Include escalation clauses in contracts. Enable price adjustment when key material costs rise above predefined thresholds.

-

Incorporate a contingency budget. It’s typically 10–20% depending on market volatility. You can calculate it using statistical methods like Mona te Carlo simulation.

-

Continuously monitor real‑time material prices. Identify trends and update budgets dynamically throughout the project lifecycle.

Get paid faster and on time

Automate invoice creation by milestones with FirstBit

Request a demo

Master Job Costing with FirstBit ERP

Job costing helps construction projects stay on budget by maintaining good oversight of all direct and indirect costs. To achieve this, you must track multiple cost categories that change daily. Doing it manually can be very time-consuming.

That’s why the FirstBit ERP has a module for “Finance management” that aims to make the process of job costing faster, easier, and more accurate. Here are some of its key features:

-

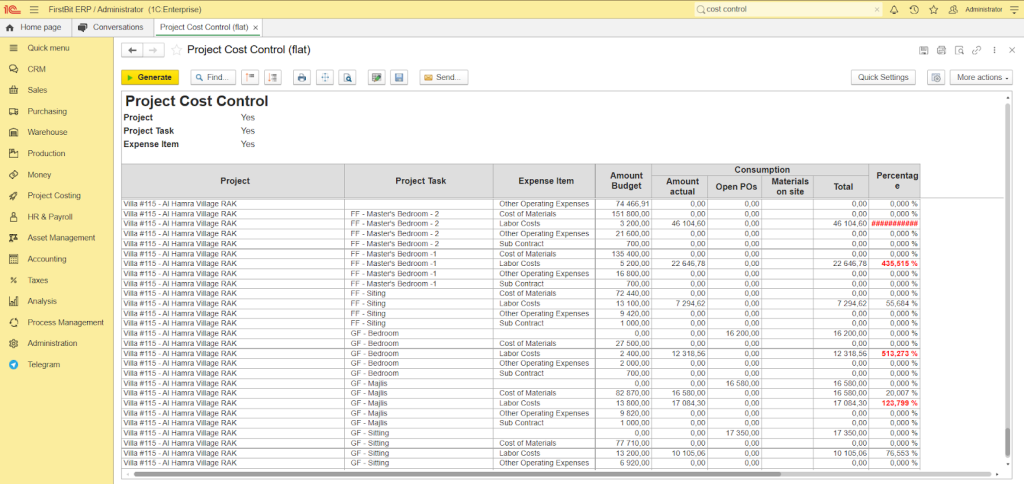

ProProjectst control. Track all spending throughout the project, including materials, labor, equipment, subcontractors, and overhead. Compare these costs against the planned budget.

-

Cash flow by project. Plan, forecast, and monitor each project’s cash inflows together with outflows in real time.

-

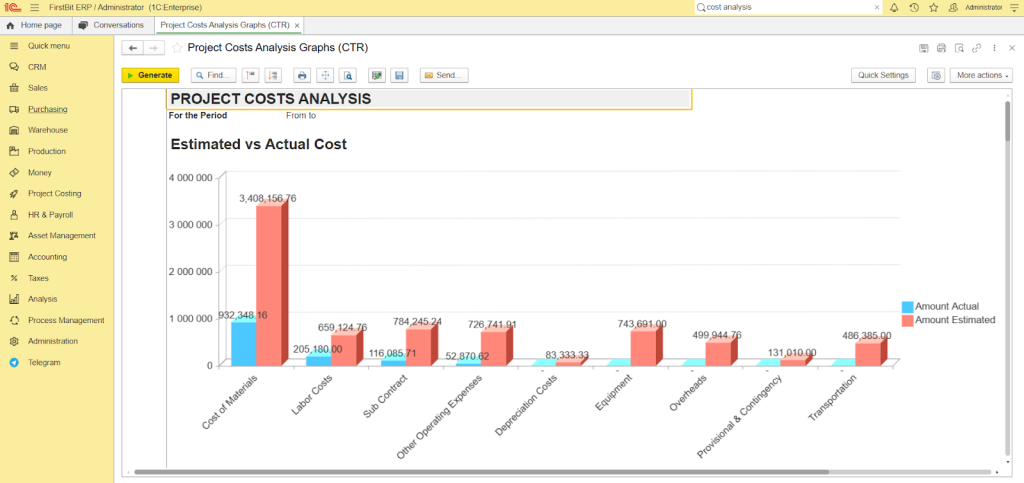

Cost analysis. Use graphs to visualize project expenses and compare actuals with estimates. Detect recurring overspend patterns before they impact profitability.

-

Project loss and damages report. Analyze cost overruns and their impact on the project to adjust the budget better.

-

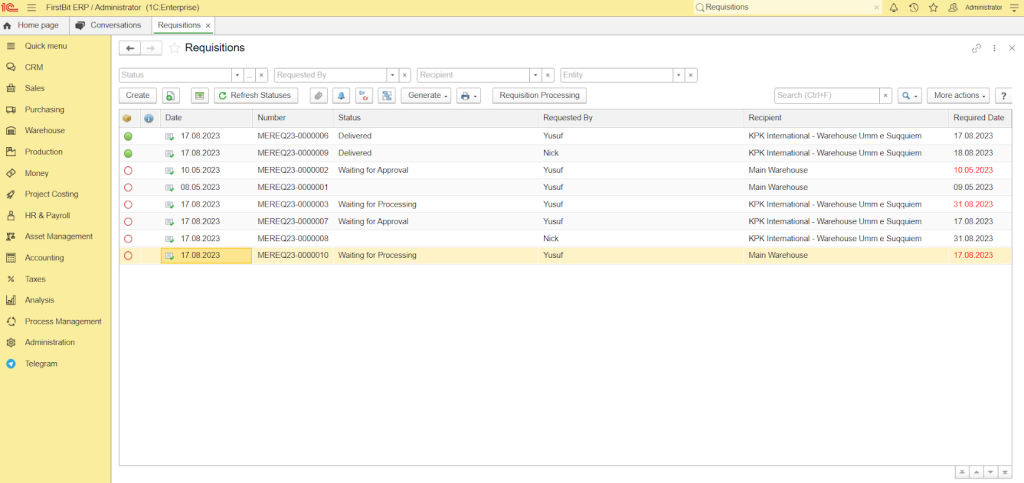

Requisitions. Optimize the purchasing process by ensuring that all requests remain within the budget.

Conclusion

Job costing plays a crucial role in maintaining financial control over construction projects. It gives you the ability to track every cost with precision—whether direct, indirect, or overhead. This way, you can react quickly to budget overruns and mitigate them.

For more accurate job costing, consider using FirstBit ERP. Its built-in finance management tools help you gain better insights into profitability, improve bidding accuracy, and reduce financial risks, even when dealing with scope changes or material price fluctuations.

Get paid faster and on time

Request a demo

FAQ

What are the key components of job costing in construction projects?

What tools or software are best for implementing job costing in construction?

Can job costing help construction companies improve profitability?

What are the main benefits of using job costing for construction projects?

Amy Reed

Contributing Author

See FirstBit ERP solutions in action

Discover how our system solves the unique challenges of contractors in a personalized demo.

After the demo you will get a quotation for your company.

After the demo you will get a quotation for your company.