Invoicing in construction projects can be complex and fraught with challenges, from late payments to disputes over billing details. Many contractors, project managers, and finance teams face difficulties in keeping expenses organized and ensuring that payments are made on time.

The construction industry is particularly vulnerable to inefficiencies in invoicing due to its multifaceted nature, which often involves multiple stakeholders, fluctuating costs, and changing project scopes.

If you've found yourself here, it’s likely because you're experiencing frustration with late payments or billing conflicts or simply want to improve how you track expenses. This article will provide insights into these issues and offer actionable strategies to optimize your invoicing process.

What is an Invoice in Construction?

An invoice in construction is a formal request for payment from a contractor or supplier to a client detailing the costs associated with the work completed. Whether it's a large-scale project or a smaller renovation, accurate invoicing is crucial to maintaining cash flow and ensuring project success.

Accurate invoicing ensures transparency between all parties, helps avoid payment delays, and keeps projects on track financially.

Types of Invoices in Construction

In the construction industry, invoicing can take several forms depending on the nature of the project and the agreements made between contractors and clients. Understanding these different types of invoices is crucial for ensuring that you, as a business owner, get paid for the work done while maintaining clear communication with clients.

1. Standard Invoice

A Standard Invoice is the most basic type of invoice used in construction. This is issued when a project or a portion of the project is completed, and it includes the details of the work done, materials used, and the total amount owed. This type of invoice is typically used for smaller projects where the job is completed in a short timeframe and can be billed in a single payment.

Key Elements:

-

Clear description of work completed

-

List of materials used (if applicable)

-

Total cost, including any taxes or fees

A standard invoice is straightforward and is ideal for business owners managing smaller projects with clear start and end dates.

2. Progress Billing Invoice

A Progress Billing Invoice is used when a construction project is large and spans a longer period. In these cases, it’s common to bill clients in stages based on the percentage of work completed at different points in the project.

For example, if 30% of the project is complete, the contractor sends a Progress Billing Invoice for 30% of the total agreed-upon price. This allows both the contractor and the client to manage cash flow more effectively. The client isn't faced with one large payment at the end, and the contractor receives regular payments to cover ongoing costs.

Key Elements:

-

A clear indication of the percentage of work completed

-

Milestone descriptions (what specific work has been finished)

-

The total amount owed is based on the percentage completed

Progress billing invoices are vital for maintaining cash flow during lengthy or complex projects and are often negotiated in the contract before work begins.

3. Time and Materials (T&M) Invoice

The Time and Materials (T&M) Invoice is used when it’s hard to predict the exact cost of a project upfront. Instead of setting a fixed price for the whole project, the client is billed for the actual hours worked (time) and the materials used.

This type of invoice is particularly useful for projects where the scope may change as the work progresses or for tasks where it’s difficult to estimate the time required.

Key Elements:

-

Breakdown of labor costs (hours worked and the rate per hour)

-

Detailed list of materials used, including their cost

-

Any markup on materials (if applicable)

-

Detailed list of materials used, including their cost

-

Subtotals and final total

For business owners dealing with projects where costs can fluctuate, a T&M Invoice ensures that you’re paid fairly for the actual work and materials, avoiding losses when unexpected challenges arise.

4. Cost Plus Invoice

A Cost Plus Invoice is similar to a T&M Invoice but with an added twist: the contractor charges for the actual cost of the project (labor and materials), plus an additional percentage for profit, often referred to as a markup or overhead.

This is commonly used in projects where clients want to ensure transparency in costs and are willing to pay an extra fee on top of the direct costs for managing the project.

Key Elements:

-

Breakdown of actual costs (labor and materials)

-

Agreed-upon percentage added for profit (e.g., a 10% markup on the total costs)

-

Clear calculation of the final amount owed

This type of invoicing allows for more flexibility, and business owners can feel confident that they are covering all their costs while still making a profit.

5. Fixed Price Invoice

A Fixed Price Invoice is issued when the price of the project has been agreed upon upfront. Regardless of how much time or materials the project requires, the client pays the same set amount, which was predetermined in the contract.

Key Elements:

-

A fixed total amount based on the project scope

-

Clear description of the work agreed upon

-

Payment terms (such as installments or payment upon completion)

Fixed Price Invoices are useful when the scope of the project is well-defined from the start, offering the client peace of mind that there won’t be surprise costs along the way.

However, as a business owner, it’s essential to ensure that your pricing accurately reflects the potential cost of labor and materials, as unexpected expenses can’t be passed on to the client.

6. Retainage Invoice

In construction, clients often withhold a percentage of the total payment until the project is fully completed and they are satisfied with the work. This withheld amount is known as retainage, and a Retainage Invoice is used to bill for this remaining amount once the project is finished.

For example, if a client withholds 10% of the total project cost, you’ll issue a Retainage Invoice for that final 10% after completing the job and meeting any final inspections or conditions.

Key Elements:

-

The withheld amount (usually 5–10% of the total contract value)

-

A statement indicating that all project work has been completed to satisfaction

-

Final amount due

Retainage protects clients but can delay full payment for contractors, so issuing a Retainage Invoice promptly after project completion is important for business owners looking to close out the job financially.

7. Change Order Invoice

Construction projects often involve changes along the way — whether it’s adding new tasks, upgrading materials, or addressing unforeseen issues. When the scope of the project changes, a Change Order Invoice is used to charge for these additional costs.

Key Elements:

-

A description of the changes made to the original scope

-

Costs associated with the additional work (labor, materials)

-

Adjusted total amount due (including or excluding previously agreed-upon amounts)

A Change Order Invoice helps maintain clarity and avoids disputes when modifications are necessary, ensuring that business owners are compensated for any extra work.

Essential Components of a Construction Invoice

Every construction invoice should include key components to ensure that it contains all the necessary details for both the business owner and the client. Here are the essential components every construction invoice should include:

1. Header Information

The top part of your invoice should contain Header Information, which includes the following:

-

Company details. This refers to the name, address, phone number, email, and any other relevant contact information for your business. This makes it easy for your client to know exactly who is billing them and how to contact you if they have questions.

-

Client details. This is the information of the company or individual you're invoicing. It should include their name, address, and any other relevant details. Make sure this is correct to avoid delays or confusion.

-

Invoice number and date. Each invoice you send should have a unique invoice number. This makes it easy to track and reference invoices, especially when dealing with multiple clients or projects. The invoice date indicates when the invoice was issued, which is important for payment tracking.

2. Itemized List of Services and Materials

The itemized list is the core of your invoice. It should clearly break down all the services provided and materials used. This transparency helps clients understand what they are paying for and reduces the chances of disputes.

-

Description of work completed. Be as specific as possible here. For example, instead of just saying "labor," describe the tasks performed, such as "installation of electrical wiring" or "concrete foundation work."

-

Quantity and unit price. If you’re charging for materials or labor, list the quantity used and the price per unit (e.g., hours worked or items installed). This way, the client can see exactly how the total is calculated.

-

Subtotal and taxes. At the bottom of the itemized list, you should have a subtotal (the sum of all the listed items before taxes). Then, include any taxes applicable, such as VAT or sales tax, to give the final total.

3. Payment Terms

The payment terms section tells the client how and when to pay.

-

Due date. This is the date by which you expect to receive payment. Be clear about the deadline, as this will help avoid any delays in payment.

-

Accepted payment methods. List all the methods your business accepts, such as bank transfers, checks, or online payments. If there are any preferred methods, mention them here.

Clearly stating these terms helps prevent late payments and ensures both parties know what’s expected.

4. Notes or Additional Information

In this section, you can add any other relevant details or instructions that might help the client when making a payment.

-

Client instructions. If you need the client to take a specific action (e.g., reference a purchase order number when paying), include this here.

-

References to contracts or agreements. If your invoice is based on a contract or prior agreement, include the reference to that document. For example, you could mention, “As per Contract #12345,” so the client can easily connect the invoice to the work agreement.

The Invoicing Process

Understanding the invoicing process helps you manage your cash flow more efficiently and reduce errors that could lead to delays. Here’s a step-by-step guide:

1. Preparing the Invoice

Preparation is the first and crucial step in the invoicing process. It involves gathering all necessary information and accurately documenting the work completed.

Steps:

-

Collect project details. Gather information about the project, including the scope of work, materials used, labor hours, and any additional expenses.

-

Review contracts and agreements. Ensure that all billing aligns with the terms outlined in the contract, including payment schedules and agreed-upon rates.

-

Calculate costs. Accurately calculate the costs associated with labor, materials, equipment, and any other expenses. Apply any markups or discounts as per the agreement.

-

Organize information. Structure the invoice in a clear and logical manner, making it easy for the client to understand the charges.

2. Sending the Invoice

Once the invoice is prepared, you’ll need to send it to the client. Depending on the client’s preference, you may:

-

Send by email. This is the most common method. It’s quick and allows for easy record-keeping.

-

Use postal mail. For clients who prefer paper invoices, sending a physical copy may be necessary. Be sure to track its delivery to confirm the client received it.

-

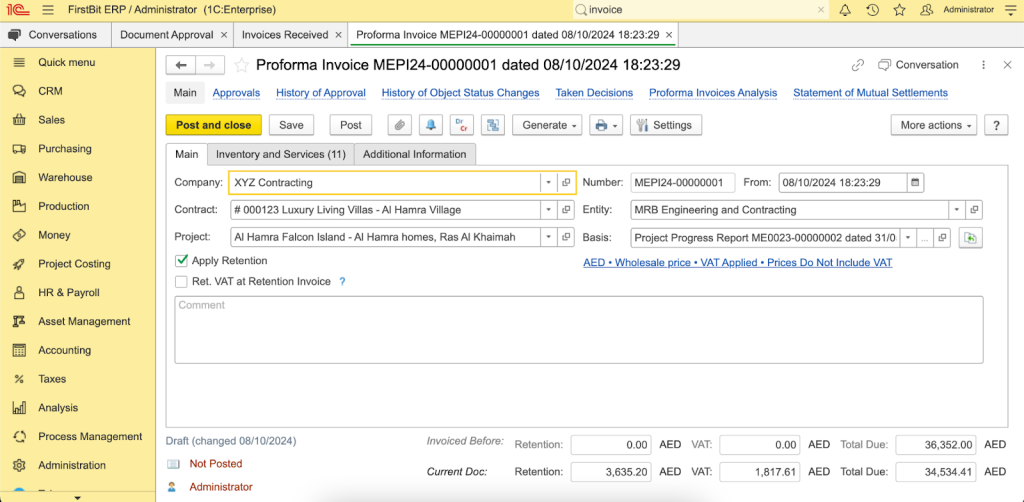

Invoicing software. Many construction companies use invoicing software (like FirstBit ERP) that automatically sends invoices to clients, tracks them, and even sends reminders if payment is late.

Make sure to send invoices promptly after the work is completed to avoid cash flow issues.

3. Managing Payments

Managing payments involves tracking incoming funds, following up on overdue invoices, and maintaining accurate financial records.

Steps:

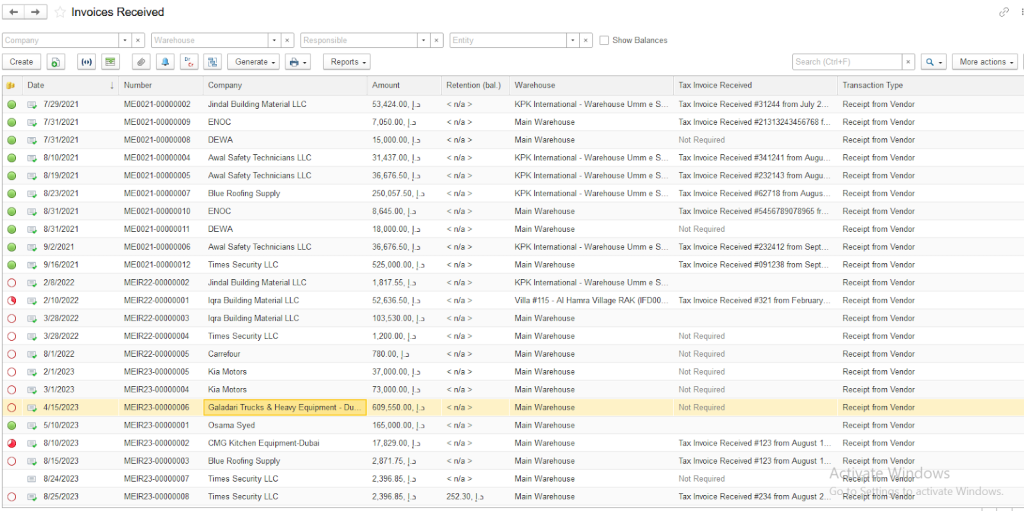

Track payments. Use a financial system or accounting software to monitor which invoices have been paid and which are outstanding.

- Track payments. Use a financial system or accounting software to monitor which invoices have been paid and which are outstanding.

- Apply payments. Once a payment is received, apply it to the corresponding invoice and update your records.

- Follow up on overdue invoices. If a payment is late, send reminders to the client. Maintain professionalism to preserve the business relationship.

- Handle discrepancies. Address any disputes or discrepancies promptly by communicating with the client to resolve issues.

- Maintain records. Keep detailed records of all invoices and payments for accounting purposes and future reference.

With FirstBit ERP, you can easily track client payments, automatically record when an invoice is paid, and update its status in real time. You’ll also have access to a dashboard that shows all outstanding invoices, upcoming payments, and completed transactions at a glance.

Managing Payments for Subcontract Work and Purchases

While client invoicing is essential for cash flow, managing payments to subcontractors and vendors is equally important for maintaining smooth project operations. This process has its own set of priorities, especially for tracking ongoing costs and maintaining good relationships with subcontractors.

Unlike client invoicing, where the goal is to secure timely incoming payments, managing subcontractor and supplier invoices requires careful scheduling of outgoing payments. Paying subcontractors and suppliers on agreed timelines helps prevent project delays and keeps workflows uninterrupted.

Additionally, when paying subcontractors, it’s important to track each invoice against the project’s budgeted expenses. This practice helps prevent overspending and supports real-time visibility into project costs, ensuring that subcontractor fees align with financial plans.

Unlike client invoices, which are primarily income records, subcontractor payments must be logged with detailed information on labor and material expenses. These records are crucial for project cost analysis, regulatory compliance, and future.

Common Challenges in Construction Invoicing

Construction invoicing can come with its own set of challenges. Here are some of the most common ones and how to address them:

1. Disputes over Billing

Disagreements can arise if clients believe they’ve been overcharged or if they don’t understand the charges on the invoice. To prevent disputes:

-

Ensure your invoice is detailed and transparent

-

Clearly explain the scope of work and any extra charges before sending the invoice

If disputes do occur, handle them professionally by discussing the invoice with the client and providing any necessary documentation.

2. Delayed Payments

Late payments can put a strain on your business’s cash flow. To reduce the chances of this happening:

-

Set clear payment terms upfront

-

Send invoices promptly after work is completed

-

Follow up on unpaid invoices with polite reminders

Using invoicing software like FirstBit ERP can also help by sending automatic reminders to clients.

3. Compliance and Regulatory Issues

In the UAE, construction invoicing must comply with specific regulations (e.g., withholding taxes, VAT). Not adhering to these rules can result in penalties or delays.

-

Make sure your invoices meet local legal requirements

-

Use software to ensure taxes and other compliance issues are handled correctly

Best Practices for Effective Invoicing

By following these best practices, you can streamline your invoicing process and improve your chances of getting paid on time.

1. Clear Communication with Clients

Before the project starts, ensure that your client understands the billing process, including the types of invoices they’ll receive and the payment terms. This avoids confusion and disputes down the road.

2. Maintaining Accurate Records

Keep detailed and organized records of all invoices, payments, and contracts. This will help you track unpaid invoices and handle any disputes more easily.

3. Regular Training for Staff on Invoicing Procedures

Make sure your staff understands how to create and send invoices properly. Training on invoicing software and best practices can reduce errors and save time.

4. Leveraging Technology for Automation

Invoicing software, such as FirstBit ERP, can help automate many parts of the invoicing process, from generating and sending invoices to tracking payments and sending reminders. This reduces manual errors and saves time.

How to Streamline Construction Invoicing with FirstBit ERP

Using FirstBit ERP can greatly simplify the invoicing process for your construction business. Here’s how it helps:

-

Automated invoicing. FirstBit ERP allows you to create professional invoices quickly with all the necessary details.

-

Real-time expense tracking. Track labor, materials, and project progress in real-time, ensuring your invoices are accurate.

-

Payment tracking. FirstBit ERP automatically tracks payments and sends reminders for unpaid invoices, improving cash flow.

-

Customizable templates. You can create customized invoice templates to suit different clients or types of projects.

By using FirstBit ERP, you can focus less on paperwork and more on managing your business.

Conclusion

Invoicing in construction may seem complicated, but with the right knowledge and tools, it can be a smooth and effective process. By understanding the different types of invoices, the essential components to include, and following best practices, you can reduce disputes, avoid delays, and improve your cash flow.

Additionally, using tools like FirstBit ERP can automate and streamline the process, making it easier to manage your invoicing and ensuring you get paid on time.

Umme Aimon Shabbir

Editor at First Bit

See FirstBit ERP solutions in action

Discover how our system solves the unique challenges of contractors in a personalized demo.

After the demo you will get a quotation for your company.

After the demo you will get a quotation for your company.