In the construction law in UAE jurisdiction, construction contracts are regulated by the Civil and Commercial Code. These provisions include default clauses that must be explicitly stated in contracts and non-negotiable standards that apply even if parties choose foreign law or dispute resolution mechanisms. Opting for foreign law or a different dispute resolution venue does not exempt parties from complying with UAE construction laws and regulations.

Every year in the UAE, the government adjusts existing construction laws. This article defines the UAE regulatory framework's intricacies, the construction law in the UAE, the participants, and the risks.

The information provided in this blog article is for informational purposes only and is not intended as legal advice. For any legal concerns or advice, please consult with a qualified attorney.

The UAE Construction Legal Framework

The legal system in the UAE has three main sources of law:

-

Federal laws and decrees. These apply across all Emirates.

-

Local laws. Each Emirate enacts its own laws but must align with federal laws.

-

Shari'ah. A legal system based on Islamic principles.

Each Emirate passes its laws, and you can monitor them on the Municipalities' websites:

For example, The Abu Dhabi Municipality mandates using Abu Dhabi Government Conditions of Contract for construction project procurement, introduced in 2007 and based on the 1999 FIDIC Red and Yellow books.

As for the Dubai Municipality, it has Administrative Decision No 125 of 2001, which offers an in-depth technical discussion on building regulations and standards.

There are two main financial free zones — the Dubai International Financial Centre (DIFC) in Dubai and the Abu Dhabi Global Market (ADGM) in Abu Dhabi. They have their own legal system based on common law, with their own English language courts.

-

DIFC. Its laws are developed by the DIFC Authority, based on international standards and common law principles tailored to the region's needs. The DIFC Courts operate within a common law framework and have a specialized Technology and Construction Division.

-

ADGM. It has its own set of commercial regulations and rules, a financial services regulator, and its own Courts. ADGM's legal system is based on English common law, English statutes, and ADGM enactments. These are primarily drafted from English statutory precedents and partly from other respected common law jurisdictions.

Furthermore, the free zones in the UAE have distinct rules ensuring compliance with building standards, environmental considerations, health and safety guidelines, and other technical requirements.

Laws concerning employment matters, such as labor laws, are also crucial in the construction law in the UAE. Federal public tenders conducted by the UAE government adhere to the Federal Public Tenders Law outlined in Financial Order No. 16 of 1975.

Civil Code

The main law governing construction projects in the UAE is the Civil Transactions Law, commonly known as the Civil Code.[?] This law is foundational for civil transactions and incorporates general principles derived from Islamic ideals. It covers various aspects of contracts, including their formation, interpretation, and execution. The Civil Code also outlines remedies for breaches and circumstances like force majeure and addresses harm and tort liability issues.

-

A crucial provision in construction contracts often cited is Article 246 of the Civil Code. This article emphasizes that parties must perform contracts in good faith and adhere not only to express contract terms but also to other requirements in line with the transaction's law, customs, and nature. Additionally, the Civil Code includes specific provisions for Muqawala contracts, encompassing construction contracts. These provisions serve as defaults when parties have yet to agree on specific terms.

-

An example of a mandatory provision in the Civil Code is Article 880, which addresses decennial liability. This provision holds contractors and architects liable for any destruction or defect in buildings they have constructed.

Another relevant law is the Commercial Transactions Law, also known as the Commercial Code. This UAE’s law applies to construction and engineering projects, emphasizing that commercial parties are bound by the agreements they enter unless those agreements contradict a mandatory provision of law.

In summary, these laws shape the legal framework for construction projects in the UAE, providing guidelines for contract formation, performance, and legal remedies.

Standard Contracts

The International Federation of Consulting Engineers (FIDIC) provides a suite of construction contracts common in the industry. Each type of contract consists of special conditions and has its own specific (for example, duration of work). The suite includes:

-

Green Book (1999). The Short Form of Contract is for small projects under $500,000. An authorized person from the employer handles Engineer duties. It's good for simple projects without needing specialist subcontracts and includes Rules for Adjudication, which is unique for international contracts.

-

Red Book (1999). The Red Book is for construction projects where the employer does the design. It's not limited to civil engineering and focuses on procurement type. Suitable for projects with Employer design but allows some Contractor design. An Engineer employed by the employer does administration and supervision. Example forms for Tender, Contract Agreement, and Dispute Adjudication Agreement are provided.

-

Yellow Book (1999). The Yellow Book governs construction contracts where the contractor handles design. The Yellow Book includes example Tender, Contract Agreement, and Dispute Adjudication Agreement forms. It focuses on procurement type rather than the nature of specific work.

-

Orange Book (1995). Initially focused on project type, current FIDIC contracts emphasize various procurement strategies. The Orange Book assigns total design liability to the contractor, offering single-point responsibility for the employer. It is suitable for turnkey projects where the contractor provides a fully-equipped facility.

-

Silver Book (1999). The Silver Book is for experienced Contractors in process, power, and private infrastructure projects, where they take full responsibility for design and execution. It ensures cost certainty by transferring risks, like ground conditions, to the contractor. The employer retains some risks. Limited control is given, and there's no Engineer reference, emphasizing reduced Employer influence.

-

Public-Private Partnerships (PPPs). PPPs are a mutually beneficial cooperation between government agencies and entrepreneurs in sectors traditionally under the state's responsibility on the balanced distribution of risks, benefits and costs, rights and obligations defined in the relevant contracts.

-

Design-build. It's a method of delivering construction projects in which the designer and builder work together under a single contract from the beginning of the project to ensure unity and cooperation throughout the process.

FIDIC forms heavily influence the UAE construction law practices, often as a foundation for adjusting individual contractual provisions. There is a shift towards increased design responsibility for contractors, particularly in planning and building projects, and a growing preference for bespoke contracts, including PPPs.

Taxation

For legal construction entities, the following types of taxation apply in the UAE construction law:

-

VAT. The standard rate is 5% and is charged when the company's profit exceeds AED 375,000 or $100,000 annually. The amount must be repaid 28 days after the end of the reporting period for the quarter. Before doing so, you must register the business as a taxpayer on the FTA website. The 0% VAT rate in Dubai applies to businesses specializing in certain types of activities, and construction is not on that list.

-

Income tax. From June 1st, 2023, for other businesses (including construction), it is 9% — this applies to companies whose yearly profits come out to more than 375,000 AED.

-

Corporate tax. Corporate tax (CT) is a direct tax imposed on the net income or profits of corporations and other entities arising from their business activities. The UAE has the GCC region's lowest corporate income tax rate, set at a standard rate of 9%.

First Bit takes into account the regulatory framework in the UAE both in terms of taxes and other legal regulations.

The Parties

Traditionally, the employer, the contractor, and the financier negotiate a contract. UAE construction law also allows for subcontractors, architects of record and others. The participants will vary depending on the arrangements prescribed in the contract.

The Employer Identity

The Contractor Identity

The Subcontractor

The Financier

The Architect of the Record

Construction Execution

Construction Execution consists of a range of procedures.

-

Scope of work. The employer or contractor will explain what needs to be done in a project — the scope of work. If the employer plans the project, they'll give details like specifications, drawings, schedule, and more.

They can share those ideas if the contractor suggests changes to save money or improve things. If the employer doesn't plan the project, they'll tell the contractors what they need, and the contractors will share their plans. -

Procedure of variations. The contract typically governs the process and includes a price for variations. Either the employer or the contractor can request variations, leading to potential entitlements for additional time and compensation if accepted. If variations are necessary due to a party's failure, delay, or default, that party is not entitled to extra time or compensation under the contract.

Generally, works are completed by the contract's specified date, subject to potential amendments. Variations causing time extensions may trigger claims for prolongation costs, an extension of time, and additional work. -

Design. Employers typically hire design consultants, and contractors focus on executing the employer's provided plan. However, there's a recent trend toward design and build contracts, where contractors take responsibility for projecting specified works. Contractors engaging usually obtain professional indemnity insurance.

If the contractor doesn't handle the design, the UAE's mandatory decennial liability holds both the contractor and designer jointly liable for building collapse. This liability persists even if a third party performed the design. Additionally, contractors are always accountable for planning temporary works like scaffolding. -

Construction. The contract establishes the responsibilities of each party in construction projects. Typically, the employer is responsible for site access and payments to fund the project costs.

The engineer/consultant supervises project execution and may contribute to the design. The contractor carries out the construction works according to contract specifications. -

Site access. The employer is tasked with providing the contractor timely site access and information on its status, including pollution and ground conditions. Once the contractor assumes site custody, responsibilities include site maintenance, health, and safety measures, and managing on-site noise and pollution.

In case of archaeological discoveries, the responsible party must report to authorities, leading to work suspension until an investigation occurs. -

Permits. UAE construction projects necessitate a building permit from the relevant municipality. The engineer obtains initial design approval, and subsequent permits for execution, such as "No Objection Certificates" (NOC), are the contractor's responsibility, involving agencies like environmental or utility bodies.

-

Maintenance. During the defect liability period, corrective works are conducted based on the division of responsibilities outlined in the main contract and subcontract. Once this period concludes, employers commonly engage specialized companies through contracts for ongoing maintenance services, especially for systems like elevators and air-conditioning.

-

Tests. In construction projects, the specified tests on completion are typically conducted by either the main contractor or specialized third parties, depending on the nature of the work. Under the Red Book, these tests, overseen by the engineer/consultant, must occur within 14 days of notification. The contractor is obligated to address any defects before the issuance of the taking-over certificate by the engineer/consultant.

-

Completion, takeover, delivery. Upon satisfactory completion of tests and issuance of the taking over certificate by the engineer/consultant, the contractor invites the employer to take over the work. Without a certificate, if the employer uses any part of the work, it is considered taken over, transferring related liabilities to the employer.

Post-takeover, the contractor typically receives a portion of retention money and a reduction in the value of performance bonds, as stipulated in the contract. -

Defects and defects liability. Once the work is handed over, the liability period for defects begins, typically lasting one to two years (extendable for specific aspects). The contractor must promptly address defects or outstanding works identified during this period. Failure to meet obligations may trigger the calling of performance bonds.

Additionally, the UAE construction law’s mandatory decennial liability provision holds both the contractor and designer jointly liable for building collapse during this period.

Payment

There are several types of payment. In the UAE construction law the party selects each type depending on the arrangements.

-

Negotiated price. Contracts typically involve fixed lump sum payments or remeasurements, where the work value is determined by a pre-set price schedule or BOQ (bill of quantities). The usual payment method is based on the contract administrator's certification of completed work, occurring either periodically (like monthly) or at agreed-upon milestones or stages.

-

Advance payments and interim payments. These types of payments are widely used in construction contract law in UAE. For example, in government contracts, as per Circular No. 1 of 2019 from the Executive Council of the Emirate of Abu Dhabi, payments should be settled within 30 days from the invoice date. The circular also mandates that undisputed amounts must be paid within 30 days in case of a dispute.

-

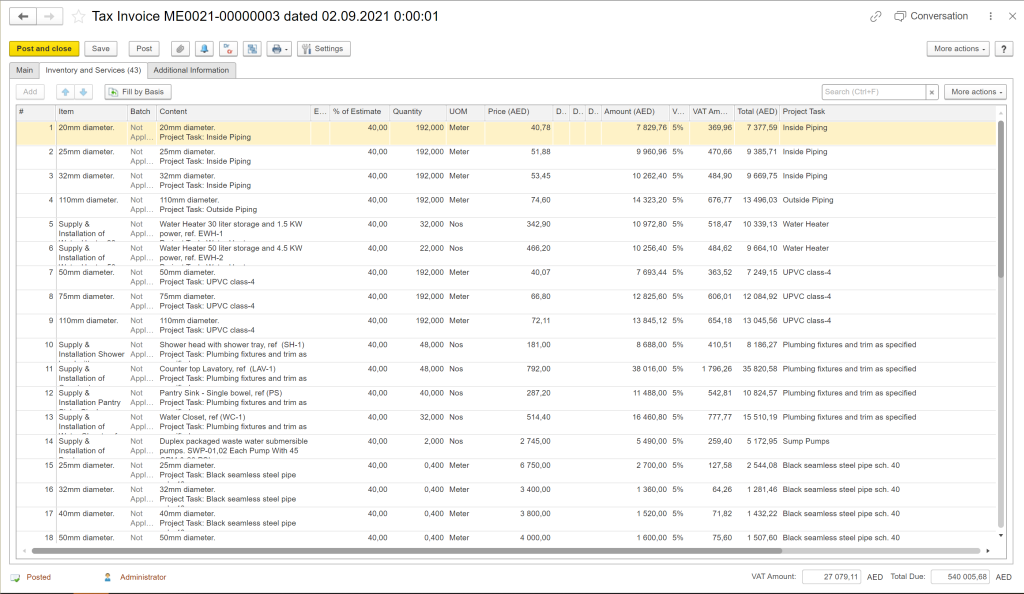

Invoices. Contractors usually give paper invoices to the employer, although some contracts use programs for easier document exchange, including invoices. For such needs, you can try the FirstBit ERP system, which helps our clients track contracts and documents more comfortably.

Timeframe

The construction contract law in the UAE directs contractors in planning and updating projects efficiently. Focused on the UAE context, we provide the info about how delays, remedies, extensions of time, force majeure, and unforeseen circumstances are handled within the contractual framework. Navigating these nuances is crucial for successful construction projects in the UAE.

Planning

The contract outlines how the contractor should plan the project. It specifies the method for developing strategies and regularly updating the project plan. Often, contracts require the use of project management tools like FirstBit Contracting ERP. The tool makes the process smoother by allowing the contractor to input updates of construction contract law in the UAE and generate an updated plan shared with the employer.

When something happens that might cause delays, the contractor usually has to tell the employer about it. The notice includes details about how much the delay might cost and how long it might take.

Delay Issues

The contract rules determine how to handle delays, distinguishing between excusable and non-excusable delays. For costs related to time, the agreement decides the specific rates. According to the UAE construction law, contracts usually say that if delays happen over and over again, the contractor can get more time but not extra payment for it.

Remedies for Delays

If the employer causes delays that the contractor can't excuse, the contractor gets more time and can ask for extra money to cover the time-related costs. If the delays are the contractor's fault and can't be excused, the employer can ask for compensation, use the performance bond, or end the contract.

The party affected by the delays can also seek compensation for any contract breach caused by the delays.

Extension of Time

UAE construction law states that the documents usually contain terms about how contractors can ask for EoT (extension of time). The contractor must send a notice within a set time after the event causing the delay.

The contract often says this notice is a must for getting more time, but UAE courts sometimes allow extensions even if the notice rules aren't followed, especially when the delay is the employer's fault.

Typical reasons for EoT include:

-

Bad weather

-

Changes by the employer

-

Challenges on the site

Force Majeure

Force majeure is like a shield in contracts. It lets someone off the hook when they can't fulfill their arrangements because of unexpected events. In the UAE, it's covered by Article 273 of the Civil Code.

To claim force majeure, you usually have to show:

-

The event was unpredictable

-

Performance is impossible (not just too expensive)

-

The event was beyond your control

Force majeure often happens due to a temporary problem, so you're not off the hook forever. You pause your duties until the issue is fixed. But if it's impossible, the contract ends automatically.

UAE construction law doesn't list all the force majeure events, so people can define them in their contracts. Article 249 of the Civil Code says that if something unexpected and public happens, such as a big disaster, courts can change a tough obligation to something more reasonable. You can even end the contract if the unexpected event makes your duty too hard.

Unexpected Circumstances and Disruption

The contract usually determines who bears the risk of unforeseen circumstances. While the FIDIC Red Book assigns this risk to the employer, UAE construction contracts often transfer it to the contractor.

Even though construction law in UAE doesn't explicitly recognize the concept of disruption, stakeholders can use general provisions to claim extensions of time, often framing these claims as breach of contract. To establish such claims, a fundamental case for damages is required.

For this point the contractor involves proving that the employer breached its contractual obligations and that a disruption caused the damage. The contractor must demonstrate the right to claim damages and quantify the claim, ensuring a direct link between the disruption and the suffered damage.

Security and Risks in the UAE Construction Law

Security and risks in construction law in UAE include a range of points about insurance, guarantees, and indemnities. Here, we provide the legal specifics of each of the units.

Guarantees & Indemnities

Guarantees that you can face:

-

Bid bond. Provided during the bidding process to guarantee that the bidder will honor the terms of the bid.

-

Performance bond. Generally held from the commencement of the contract until Taking Over or the end of the Defects Liability Period. Unconditional on demand bonds are almost always used.

-

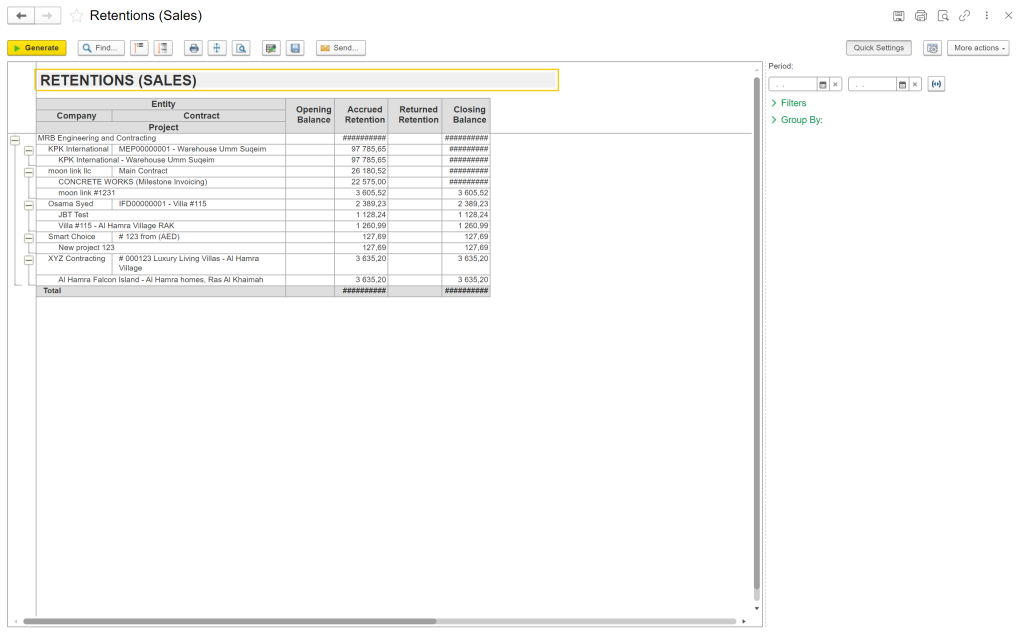

Retention or retention bonds. Employers tend to retain a percentage of each progress payment as “retention”. Sometimes, the employer will agree to an on-demand retention bond instead of a retention.

-

Advance payment bond. It is common for employers to make an advance payment to help finance the work in exchange for an on-demand bond.

For indemnity cases, lenders typically seek a range of securities, including a legal mortgage over the land or site, company assets, plant and machinery, and direct agreements and collateral warranties.

Insurance

The insurance that a party will need to hold varies depending on the Emirate or free zone where they are registered and undertaking activities. However, contractors will generally be required, as a minimum, to maintain:

-

Employer's liability insurance

-

Public liability insurance

-

Health insurance for employees

In addition, unless the contractor is covered by project insurance taken out by the employer, they will generally take out the Contractor's All Risk Insurance that covers property, personal injury, and other add-ons such as motor vehicle insurance and plant and equipment cover as appropriate.

Professional Indemnity Insurance is required for any party undertaking engineering or design and is a prerequisite to obtaining classification as an engineering consultancy. Contractors and Engineers should also consider getting decennial liability insurance to protect against liability under Article 880 of the Civil Code.

Risk Sharing

Risk sharing is common in construction contract law in UAE, with the specific allocation defined in each agreement. Economic conditions during negotiation influence risk distribution.

Employers assume the risk for the site and provide accurate information. At the same time, contractors are responsible for construction works and on-site occurrences when in possession of the site, including liability for injuries and pollution and ensuring access for other contractors.

Where the contracting entity is a subsidiary or special purpose vehicle, the Employer will often require a parent company guarantee from the ultimate parent entity (or entities) to secure the performance of the contractor's obligations and protect the employer against the consequences of the insolvency of the subsidiary company.

Dispute Resolution in UAE

The UAE's evolving dispute resolution landscape reflects a nuanced interplay between traditional legal processes and the growing influence of arbitration and international judiciaries.

Regular Way

In the construction law in UAE disputes are adjudicated by:

-

UAE local courts (mainland)

-

Dubai International Financial Centre (DIFC)

-

Abu Dhabi Global Market (ADGM)

Parties are free to 'opt-in' by agreement to the jurisdiction of the ADGM or DIFC Courts. These Courts will also have jurisdiction in disputes involving parties or property in the relevant free zone.

Alternative Way

In construction law in UAE, the alternative way for resolving disputes is adjudicated by:

-

The Dubai International Arbitration Centre (DIAC)

-

The Abu Dhabi Commercial Conciliation and Arbitration Centre (ADCCAC)

Additionally, parties often resort to arbitration under the rules of the International Chamber of Commerce (ICC) or the London Court of International Arbitration (LCIA), both of which maintain a case management presence in the Abu Dhabi Global Market.

Trends in the Construction Law in the UAE in 2024

The UAE government is allocating more and more money to construction projects. For example, over the 2 years, the construction industry was backed by mega projects and large-scale developments, including an $820 million luxury residential development in Meydan and the Burj Binghatti Jacob & Co Residences — the world's tallest residential building and $3.5 billion island project in Abu Dhabi.

The government's initiatives indicate a remarkable surge in its construction sector, with substantial growth expected in 2024.

The most obvious difficulties in construction law in the UAE are expressed in the dispute resolution category. Construction disputes in the UAE have become increasingly intricate, involving a spectrum of legal complexities. The landscape is rich with challenges, from decennial liability and contractual breaches to issues surrounding insolvency, disruption, and force majeure.

Among them:

-

Decennial liability and contractual breaches. Construction disputes frequently navigate issues related to decennial liability and contractual breaches. Understanding the implications of these aspects is crucial for all parties involved.

-

Insolvency and bankruptcy. The financial health of construction stakeholders can significantly impact disputes. Insolvency and bankruptcy issues add layers of complexity to the resolution process.

-

Disruption, concurrent delays, and force majeure. With the surge in global supply chain challenges, disputes often involve technical legal issues related to disruption, concurrent delays, and the ambiguous contours of force majeure under UAE law.

-

Performance bonds encashment. The encashment of performance bonds is a contentious trend in the construction law in UAE. Understanding the legal dynamics among stakeholders is essential.

-

Limitation of liability. The discretionary nature of limitation of liability decisions by courts and tribunals adds a layer of complexity to construction disputes. Parties often grapple with the interpretation and application of these limitations.

-

Suspension of works and good faith obligations. Technical legal issues surrounding the suspension of works, especially concerning non-payment and the performance of contractual obligations in alignment with good faith principles, are recurrent challenges.

As construction disputes continue to rise in the UAE, stakeholders must navigate many legal intricacies. From termination and force majeure uncertainties to disputes arising from the encashment of performance bonds, the industry is witnessing a transformation in how legal issues are approached and resolved.

However, the UAE Labor Law 2024 brings about a notable transformation, particularly in resolving employment disputes. Under this amended law, all disputes between employers and employees are mandated to undergo adjudication in a newly established labor court vested with the power to issue binding judgments.

First Bit ERP for UAE Construction Businesses

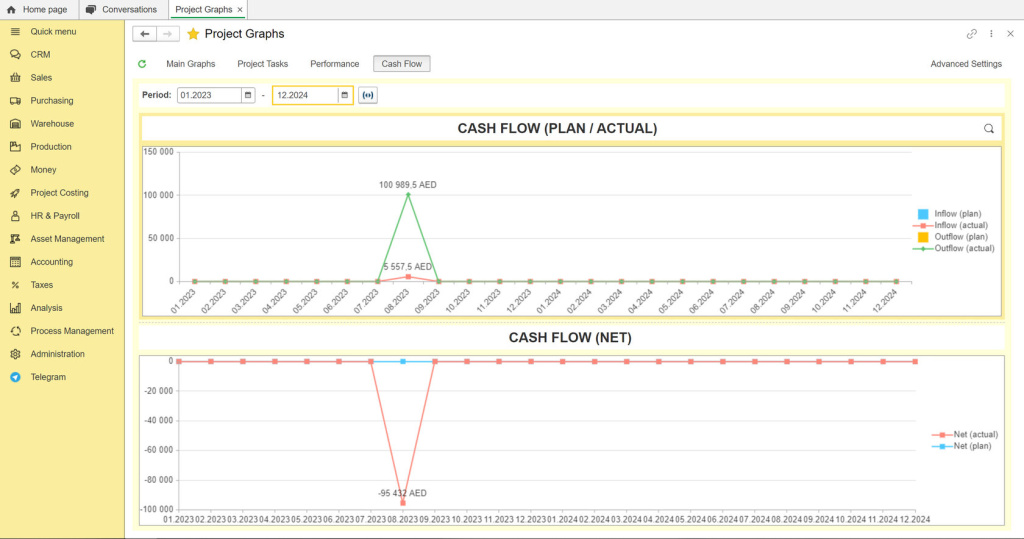

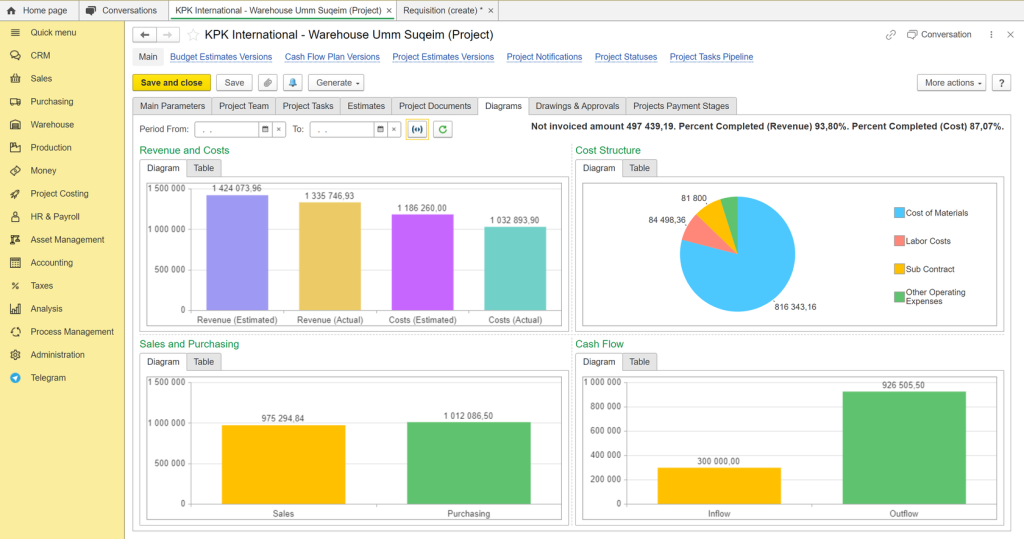

First Bit continues to build expertise in resource planning by developing functionality for our clients. An important feature of FirstBit ERP functionality is the UAE regulatory framework, namely the integration of information on taxation details. Among First Bit features are:

-

Payroll calculation in compliance with the UAE Labor Law, taking into account the specifics of construction companies

-

VAT report generated automatically as per UAE FTA's reporting standards

-

Real-time project cash-flow monitoring

-

Project P&L, cost and revenue structure, project estimates versus actuals analysis

-

Automated construction retention amount and timeline tracking

The world is changing fast, and the regulatory environment is changing even faster. First Bit strives to keep up with the trends, expand functionality, and be helpful to our clients.

Anna Fischer

Construction Content Writer

See FirstBit ERP solutions in action

Discover how our system solves the unique challenges of contractors in a personalized demo.

After the demo you will get a quotation for your company.

After the demo you will get a quotation for your company.