It is estimated that over 70% of large organizations make use of an ERP or a comparable business management solution. Regardless of the size of the company, it is essential to have an ERP system in place. The ERP market is expected to reach a size of $117.09 billion by 2030.

What is an ERP system, how does it work, and why should you invest in it? Here, we explain what ERP stands for and reveal why the solution benefits your business.

What Is ERP in Brief

Enterprise resource planning software is a comprehensive system utilized by organizations to oversee various aspects of their operations.

ERP usually includes such modules as:

-

Accounting

-

Project management

-

HR & Payroll

ERP systems serve as comprehensive, fully integrated platforms, available either on-site or in the cloud, overseeing all facets of production-oriented or distribution-based enterprises. Moreover, ERP systems facilitate every aspect of financial management, human resources, and manufacturing, customizing them to meet your industry’s specific needs alongside your fundamental accounting tasks.

ERP systems offer visibility into your entire business operation by monitoring all stages of production, logistics, and finances. These cohesive systems function as the central nexus for a business's complete workflow and data, enabling various departments to access crucial information.

History of ERP Systems

Now that we have understood what an ERP system means, let us delve into its evolution.

The first generation of ERP systems was based on mainframe computers and was introduced in the 1960s. These early systems were designed to handle inventory control and order processing but lacked flexibility and scalability. Moreover, since they were so expensive, only large companies with significant resources invested in them.

The second generation of ERP systems emerged in the 1980s and early 1990s and was built on minicomputers and workstations. These systems could support multiple users and applications, but they were still expensive and not accessible to smaller companies.

The third (and the latest) generation of ERP systems uses cloud technology, which allows multiple users to access information stored on a server over a network connection. This makes it possible for businesses of all sizes to own an ERP system without investing thousands of dollars in infrastructure.

How Does a Modern ERP System Work?

ERP systems use a centralized database to equip everyone with the latest information on business processes. When someone enters or updates the data into the system, it gets immediately available to authorized users across the organization.

Switching to the cloud, especially with the software-as-a-service (SaaS) model for ERP, means that the cloud based ERP system is hosted on remote servers rather than on-site. The cloud provider handles software updates regularly, saving companies from costly upgrades every 5 to 10 years. This shift reduces both operational and capital expenses because companies no longer need to buy software or hardware or hire extra IT staff. Instead, they can invest these resources in new business ventures.

Plus, staying on the cloud ensures that the organization always has access to the latest ERP software. With IT management taken care of, employees can focus on more productive tasks like innovation and expansion.

Business Value of ERP

By streamlining their operations, ERP applications help businesses become more efficient and profitable. The program helps companies keep track of sales orders and inventory levels and manage finances and human resources.

As you enter critical business data into an ERP system, you can align different departments across locations to streamline your business workflows, leading to significant savings.

Here are the key values that an ERP system brings to your business every day:

-

Improves efficiency by automating manual processes and synchronizing data from multiple sources

-

Increases visibility and transparency into business operations by integrating all your departments

-

Ensures compliance with local laws and regulations by highlighting the best practices

-

Improves supply chain management by tracking the movement of goods from manufacturer to consumer

-

Upgrades collaboration across departments to increase conversion and retention rates

-

Helps leverage the latest technologies without driving a fundamental change in your work processes

Note: When you pick an industry-specific ERP system or customize it according to your business needs, you’ll enjoy more benefits and a higher ROI.

Stay on track with your goals

Monitor KPIs with FirstBit ERP

Request a demo

Types of ERP

Various types of ERP systems vary in terms of their core characteristics and usage.

-

Custom ERP systems are developed from scratch based on your unique business requirements to meet your specific needs.

-

Ready-made ERPs are pre-built software solutions that are immediately deployable after purchase, without customization or additional programming.

-

Hybrid ERP enables businesses to customize a pre-built solution to their needs.

Here are the hosting types:

-

Cloud-based systems are hosted on remote servers and provide access online.

-

On-premises ERPs are software systems installed and managed on servers within your business premises.

Also, you can group ERPs into different types depending on what they can do for each industry:

-

Generic ERP systems are designed to meet the needs of a broad range of businesses and industries.

-

Industry-specific ERP systems are pre-configured with functionalities tailored to meet the unique requirements of a particular industry or sector.

ERP Features

ERP systems can efficiently impact your business with the following features.

Finance & Accounting

The finance and accounting module of ERP simplifies financial tracking, budgeting, billing, and reporting for businesses. Key features include:

-

Bank reconciliation. Reconciles bank statements with account balances to identify discrepancies.

-

Accounts receivable management. Manages customer accounts, credit limits, and overdue invoices.

-

Profit & loss statement. Tracks profits and losses across all areas for strategic planning.

-

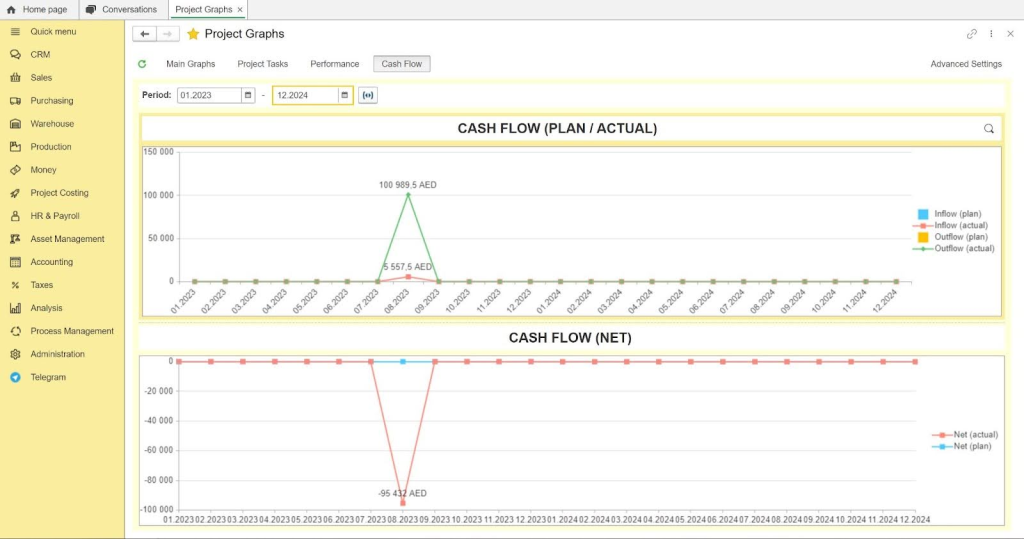

Cash flow management. Tracks real-time cash flow and generates reports for analysis.

-

Compliance. ERP software assumes a pivotal role in tracking regulatory updates, ensuring that all project management procedures align with the most recent legal requirements.

Among other things, the ERP allows you to calculate the retention that is crucial for maintaining financial stability throughout the project process. It encourages accountability, ensures adherence to quality standards, and provides a financial buffer for dispute resolution in cases of non-payment or late payment.

Supply Chain & Procurement

The ERP Supply Chain Module serves as the backbone of the system, streamlining the entire supply chain process to reduce lead times from raw material acquisition to product distribution.

Key features include:

-

Inventory management. Ensures optimal stock levels to meet demand.

-

Material requirement planning (MRP). Plans material needs based on customer orders.

-

Shipping or distribution. Calculates shipping rates, manages transportation, generates documents, and handles tax calculations.

-

Procurement management. Manages the purchasing process from a single platform.

The module benefits businesses by managing inventory, improving customer service, ensuring compliance, and providing process visibility.

Project Management

Project management in ERP systems is crucial to oversee the different stages of ERP implementation projects, which include:

-

Planning

-

Testing

-

Deployment

-

Post-launch analysis

Efficient project management ensures the successful integration of new ERPs by coordinating tasks, resources, timelines, and stakeholder engagement throughout the project lifecycle.

Project management in ERP systems often includes a risk management option, which involves evaluating and mitigating the potential risks associated with projects and their surrounding factors. By proactively identifying these scenarios prior to project commencement, you can:

-

Take steps to prevent their occurrence.

-

Respond effectively to risks if they arise.

This proactive approach aids in minimizing the financial ramifications and project delays resulting from such events.

HR & Payroll

As your business expands, managing your workforce and payroll becomes complex. ERP systems streamline HR and payroll tasks, automating payroll calculations and other tedious processes.

Key features of the HR and payroll module include:

-

Recruitment. Post job vacancies and manage the entire recruitment process, from candidate search to onboarding.

-

Employee management. Easily manage employee details like contact info, skills, and education background for quick access.

-

Employee time cards. Track attendance with login and logout times for each employee.

-

Leave management. Manage each type of leave and allow employees to apply online, reducing email exchanges.

-

Payroll management. Keep track of salary payments, tax deductions, and employee benefits like vacation payouts and sick leave.

This module allows you to reduce costs and errors through automation, streamlines recruitment with automated submissions and follow-ups, and provides easy access to employee data for accurate record-keeping.

Gain full control of your business

Request a demo

What’s the Difference Between ERP and Financials?

ERP and financials are two different things. ERP is an enterprise resource planning system that helps manage and organize your business’s processes, data, and people so they can run efficiently.

Financials, on the other hand, is a finance management tool that helps you track your company’s performance over time (in terms of revenue). It includes the numbers behind your business’s financial performance. These include income statements (profit & loss statements) and balance sheets (assets, liabilities & equity).

Financial software usually includes compliance with the necessary reporting requirements, such as the International Financial Reporting Standards Foundation (IFRS), Financial Accounting Standards Board (FASB), and local laws.

While financials focus on one area of the business, ERP software comprises a wide range of business processes (which includes financials).

What's the Difference Between ERP and Accounting Software?

The main differences between ERP software and accounting software lie in their scope, functions, and capabilities. Accounting software is primarily used for financial management tasks like accounts payable, accounts receivable, financial reporting, and basic sales recordings.

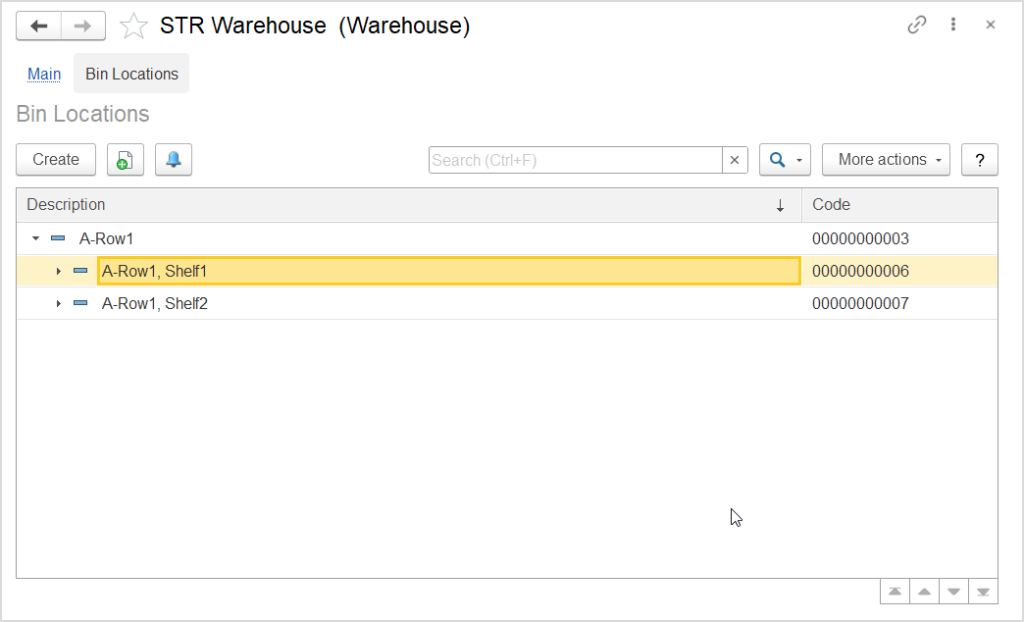

On the other hand, ERP software offers a comprehensive solution that integrates various business processes beyond finance, including supply chain management, human resources, customer relationship management, project management, inventory tracking, warehouse management, eCommerce, and more.

ERP that saves your money

Adopt FirstBit ERP to cut costs, boost ROI, and effectively plan future cash flows

Request a demo

Which ERP System is Best for Small Business?

The best ERP system for a small business depends on the organization's specific requirements, budget, industry, and long-term goals. Conducting a thorough evaluation of the features, scalability, customization options, integration capabilities, user-friendliness, cost-effectiveness, and support services of different ERP systems can help determine the most suitable solution for a small business.

How Does ERP Help Companies to Grow?

ERP software is essential for companies seeking to grow and adapt to changing business environments. ERP helps businesses navigate the challenges and seize the opportunities presented by growth by streamlining operations, such as:

-

Enhancing data visibility

-

Ensuring scalability

-

Enabling collaboration

-

Aligning with corporate strategy

-

Improving financial control

Explore efficient ERP solutions for your construction business

Request a demo

Get Started With FirstBit ERP System

First Bit allows you to take the business management process into your own hands and automate it.

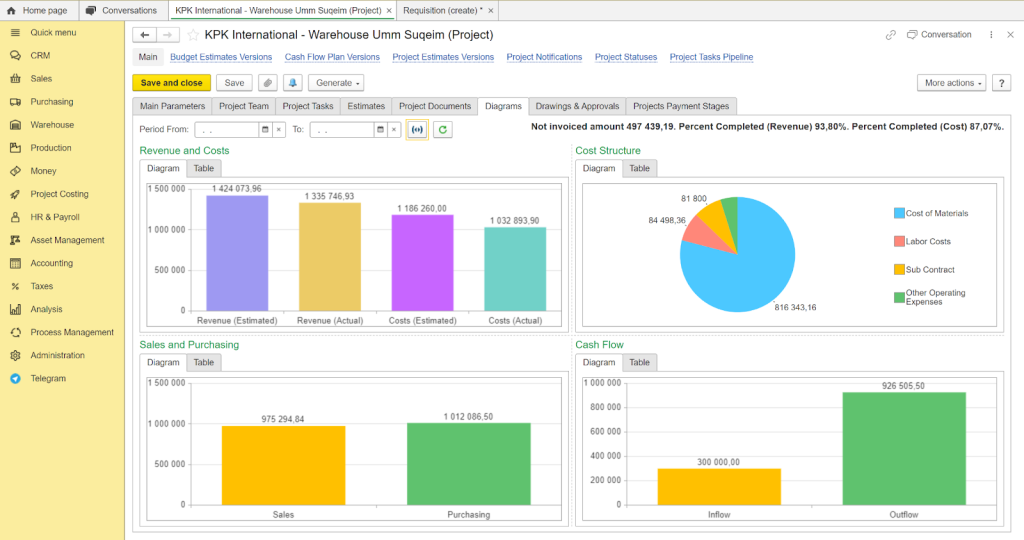

Project costs analysis. Control your project costs and avoid cost overruns.

Cash flow management. Monitor project cash-flow in real-time.

Resource allocation. Cost Structure diagram allows you better watch over the budget expenses that affect your project’s life cycle.

The biggest misconception of ERP systems is that they’re difficult to implement and are most likely to fail the first time. However, that’s not the case. And when you choose an industry leader like FirstBit, things can get even more effortless. Our experts can help you deploy the ERP system as per your requirements (on-premise or cloud).

One of the biggest benefits of the FirstBit ERP system is that it is FTA-accredited software. It also ensures full compliance with IFRS. This means that you won’t have to worry about financial or tax compliance in the UAE.

Also, you can integrate the FirstBit ERP system with front-office applications like CRM to build a holistic view of your business operations.

FAQ

1. What is an ERP?

2. Is ERP the same as SAP?

3. What is ERP vs CRM?

4. What are the 5 components of ERP?

5. What is an ERP system in accounting?

Stay on track with your goals

Monitor KPIs with FirstBit ERP

Request a demo

Anna Fischer

Construction Content Writer

See FirstBit ERP solutions in action

Discover how our system solves the unique challenges of contractors in a personalized demo.

After the demo you will get a quotation for your company.

After the demo you will get a quotation for your company.