Payroll in construction is complex, with large crews, multiple sites, and subcontractors, making it easy for payments to be delayed or disputed. When wages don’t arrive on time, projects face compliance risks, and companies may lose the trust of their workforce.

To address this, the UAE government introduced the Wage Protection System (WPS). By channeling salaries through approved banks and exchange houses, the system creates a verified record of payments that matches employment contracts and labor laws.

This guide explains how WPS applies to construction, who must comply, and how the process works step by step. It also covers Salary Information Files (SIFs), coordination with banks, and the practical measures finance and HR teams need to stay audit-ready.

What Is WPS in Construction

WPS is an electronic salary transfer framework that routes employee wages through banks, exchange houses, and other approved financial institutions. Built and overseen by the

Ministry of Human Resources and Emiratisation (MoHRE) together with the Central Bank of the UAE, it creates a verified record of every payroll run.

For construction companies, WPS aligns salary payments with contract terms and project

payroll cycles. Each transfer is logged, traceable, and reconcilable, which supports wage transparency, reduces processing errors, and helps prevent delays.

Why WPS Was Introduced

Before WPS, late or incomplete wage payments and unregulated cash payrolls were common pain points, especially for migrant and blue-collar workers. The system was launched in July 2009 under

Ministerial Resolution No. 788 to ensure salaries are paid in full and on time, and to give authorities clear oversight of wage flows. As adoption expanded, wage disputes declined, compliance checks became faster, and confidence in payroll processes improved across the labor market.

Who Must Comply With the Wage Protection System in the UAE

WPS covers the UAE’s private sector. Construction contractors, specialty trades, and subcontractors are expected to register and run payroll through approved banks or exchange houses. Compliance applies on the mainland and across most free zones. Major zones operate WPS-aligned schemes, including DIFC, JAFZA, ADGM, DMCC, and SAIF.

[?] (DMCC began enforcing WPS wage payments in January 2024.)

Exemptions

Certain categories fall outside WPS or follow separate arrangements:

-

Domestic workers

-

Small firms with fewer than five employees (subject to conditions)

-

Fishing boats owned by nationals

-

Public taxis owned by nationals

-

Banks

-

Houses of worship

-

Government and semi-government entities

Free-zone and sector rules can add specifics, so construction firms should confirm the applicable framework for each license and site.

How WPS in Construction Works – Step-by-Step

At a high level, employers register with WPS, prepare and submit a SIF each pay period, and route salary payments through an approved agent. MoHRE and the Central Bank verify the data and confirm that payments have been made as per contract terms.

1. Employer Registration

Once you confirm your company falls under WPS, you need to register with MoHRE and choose a WPS-approved bank or exchange house. Open (or validate) your corporate account with that agent and complete their WPS onboarding. Prepare the core documents: valid trade license, company registration details, authorized signatory papers, and an employee list with bank or wage-card details.

Pro tip: Create a single, audited “WPS pack” (PDF folder) with these items and keep it updated. Assign one owner in HR to maintain the employee bank list and one owner in Finance to manage the agent relationship—then document both roles in your payroll SOP.

2. Preparing and Submitting the Salary Information File

Once your agent is set up, you need to build the monthly SIF. Include the company header (name/ID and payroll period) and a line for each employee with bank or wage-card number, basic salary, allowances, overtime, deductions, days worked, and net pay — exactly as per the employment contract. Submit the file in the required format through your bank/exchange portal.

Pro tip: Lock contract terms and bank details in your payroll master data and generate the SIF from payroll software to avoid manual errors.

If you use project management software such as FirstBit ERP, enable the UAE-compliant payroll rules and export the WPS file directly.

3. Salary Verification and Payment Processing

Once the SIF is uploaded, you need to track validation and fund the payroll. MoHRE and the Central Bank will cross-check the file. After it clears, issue a payment order for the total payroll amount to your WPS agent so they can disburse individual salaries to employee accounts or wage cards.

Pro tip: Fund the payroll one business day before your internal cutoff. Reconcile three figures every cycle — SIF total, payment order, and bank debit — and resolve any rejects the same day. Capture approvals (HR, Finance) in a short checklist attached to the SIF for audit readiness.

4. Real-Time Government Oversight and Employee Access

Once salaries are disbursed, you need to confirm it and close the cycle. MoHRE receives automated payment data, and employees can see wages in their accounts and check status via available portals and apps.

Pro tip: Share payslips the same day and send a one-page “How to check your WPS payment” guide to site teams. Track three compliance KPIs on a monthly dashboard: share of workforce paid (target ≥ 90%), minimum wage portion paid to each employee (target ≥ 80%), and “days to pay” versus contract due date. Log exceptions (missing bank details, rejected transfers) and close them within 48 hours.

ERP tailored to UAE legislation

Navigate UAE construction laws effortlessly

Request a demo

WPS: Compliance Expectations for Construction Companies

-

On-time coverage. Pay at least 90% of the workforce on schedule.

-

Due-date rule. Credit salaries no later than one day after the date stated in each contract.

-

Minimum payout. Ensure at least 80% of each employee’s wage is paid for the month.

These indicators keep payroll aligned with contract terms and give auditors a clear view of timely, sufficient payments.

Why Construction Is a High-Risk Sector for Wage Disputes

In construction, payroll risk is higher because of how teams are formed and how work is delivered. Here’s what drives the exposure:

-

Workforce composition. Large migrant teams with frequent onboarding and exits create constant change. Bank accounts, IDs, and contract details are frequently updated, which raises the risk of missing or outdated data.

-

Operational spread. Multiple project sites, layered subcontractors, and labor camps mean that timesheets and approvals are handled by many individuals. Fragmented data flows lead to inconsistencies in hours, allowances, or deductions.

-

Demand variability. High turnover and seasonal peaks cause late roster changes, overtime adjustments, and partial months — common triggers for delays or short payments.

These conditions raise the likelihood of late or incomplete wages unless controls are tight and data is validated before each payroll cycle.

Common Pitfalls

With these risk drivers in view, most compliance slips trace back to a few recurring issues:

-

Timing and cash flow. Project receipts arrive late, approvals stall, and the SIF goes in after the cutoff — pushing payments past due dates. Build a fixed payroll calendar with a T-1 funding rule and stick to it even when projects are tight.

-

Manual data errors. Bulk uploads with hand edits create mismatches in bank numbers, net pay, or totals. Lock master data, generate the SIF from payroll software, and run a 5-employee test export each cycle.

-

Free-zone variations. Free-zone variations. Each free zone has its own WPS portal and procedures, which may differ in format, submission process, and deadlines. For every license you hold (DIFC, JAFZA, ADGM, DMCC, SAIF), document the exact rules in your SOP and assign one owner to keep them updated.

Key Benefits of WPS in Construction

WPS reduces wage-related disputes and improves visibility across contractors and subcontractors. The benefits surface on both sides of the payroll ledger.

For employers, WPS helps you:

-

Avoid fines and work-permit restrictions by meeting clear payment thresholds.

-

Strengthen compliance with labor law through auditable payment records.

-

Boost reputation and employee retention with predictable, on-time pay.

-

Streamline payroll operations with digital tools and standardized SIF workflows.

The employer side holds only if the worker's experience is reliable and verifiable. WPS is built to support that outcome.

For workers, WPS provides:

-

Timely and secure wage access through approved banks or wage cards.

-

Transparent salary records that reflect contract terms and actual payouts.

-

Easier dispute resolution and legal protection backed by verified data.

-

Financial inclusion via access to formal banking and related services.

Together, these effects stabilize project delivery, reduce payroll escalations, and make audits a predictable checkpoint rather than a disruption.

Meet all of the UAE legal requirements with FirstBit ERP

Request a demo

Penalties and Enforcement for Non-Compliance in the UAE

If payroll timelines slip or payouts fall short, enforcement escalates in defined steps. Start by mapping the immediate sanctions, then account for the day-to-day controls that keep you visible to regulators.

MoHRE sanctions for violations:

-

Delays of more than 10 days lead to work-permit blocks for the company.

-

Delays of more than 15 days result in business downgrades and license restrictions.

-

Repeated violations can trigger an AED 5,000 fine per unpaid worker and potential court referral.

These sanctions focus on the outcome — late or missing wages. The operational pressure comes from how the system monitors you between cycles.

Other enforcement mechanisms:

-

Real-time monitoring and automated alerts on payment status.

-

Blacklisting for unresolved violations or persistent non-payment.

-

Free zones tightening WPS application (e.g., DMCC enforcement since Jan 2024).

Taken together, sanctions and monitoring set the guardrails for payroll operations. You can use them to design your funding calendar, SIF checks, and approvals so you never approach the thresholds in the first place.

Best Practices for WPS Compliance in Construction

To keep each payroll run predictable and audit-ready, anchor your process in three habits such as the right tools, trained people, and continuous monitoring.

Best practices for WPS compliance

1. Invest in WPS-compatible payroll systems.

Once your payroll calendar and cutoffs are defined, move the heavy lifting into software that is built for WPS. The goal is simple: generate clean SIF files every month, push them to your bank/exchange portal without hand edits, and leave an audit trail that matches what employees actually receive.

What to set up:

-

Native SIF generation (company header + per-employee lines) with checks for missing fields, IBAN/wage-card formats, duplicates, and totals.

-

Maker–checker controls on contract terms, bank details, earnings/allowances, and net-pay changes.

-

A no-edit-after-export rule — if something changes, regenerate and re-approve.

-

Bank/agent handoff with acceptance/rejection status and reason codes for quick re-runs.

-

Time & attendance integration so overtime and partial months land before payroll lock.

-

Export guardrails that block SIF release if on-time coverage (<90%) or minimum payout (<80%) would be breached.

-

A versioned audit pack for each cycle (SIF, approvals, payment order, bank debit proof).

Standardize one payroll platform across licenses and projects, enable validation/guardrails, and run a small test export before the first full cycle to catch formatting and banking issues early.

2. Train HR teams and site managers

Once the system pieces are in place, set your people up to run it the same way every month. Focus training on the roles that touch data and deadlines like HR payroll, site managers, timekeepers, and subcontractor coordinators. By this, payroll stays aligned with contract terms and WPS thresholds.

What to cover:

-

Payroll calendar and cutoffs — including payday, payment due no later than one day after the contract date, funding one day before payday, and monthly targets such as at least ninety percent of employees paid on time and at least eighty percent of each employee’s wage paid.

-

SIF essentials — required fields, contract-matched net pay, maker–checker approvals, and a no-edit-after-export rule.

-

Onboarding hygiene — collect and verify IDs plus IBAN or wage-card details before first payroll; track gaps early.

-

Time & attendance integrity — overtime approvals by cutoff, partial months, and LWOP handling.

-

Changes and exceptions — visa status updates, rejected transfers, and a 48-hour closeout for short pays.

-

Zone specifics — the exact WPS steps for each free zone you operate in, documented in a simple SOP.

-

Employee communication — same-day payslips and a short guide on how to verify WPS payments.

Run a 60-minute induction for new site leads and HR coordinators covering the items above, then issue a one-page “pre-payroll week” checklist they use before every cycle.

3. Monitor compliance regularly

With the system and team in place, keep compliance steady by measuring it every cycle — and catching issues before the SIF goes out. Build a simple dashboard that your HR and Finance leads review together.

What to track:

-

On-time coverage (target ≥ 90%) — share of employees paid within the pay period.

-

Due-date adherence (pay by +1 day) — percent credited no later than one day after the contract due date.

-

Minimum payout (target ≥ 80%) — percent of employees meeting the monthly payout threshold.

-

Exception log — rejected transfers, short pays, and missing bank details; each closed within 48 hours.

-

Readiness checks — new-hire registration within 30 days, overtime approvals before cutoff, and LWOP recorded.

-

Reconciliations — SIF total = payment order = bank debit; sample-check payslips against contract terms.

Schedule a 20-minute end-of-month “readiness review” with HR, Finance, and one site lead to confirm the three KPIs, clear exceptions, and sign off on the audit pack before release.

Save time and reduce costly errors

Automate payroll calculations with FirstBit

Request a demo

How FirstBit ERP Helps Construction Companies Comply with WPS

Once your calendar and SOPs are set, the system should carry them out every month without extra effort. In

FirstBit ERP, WPS compliance is a by-product of how payroll, employee records, and off-boarding work together — data moves cleanly into a validated SIF and back out to employees.

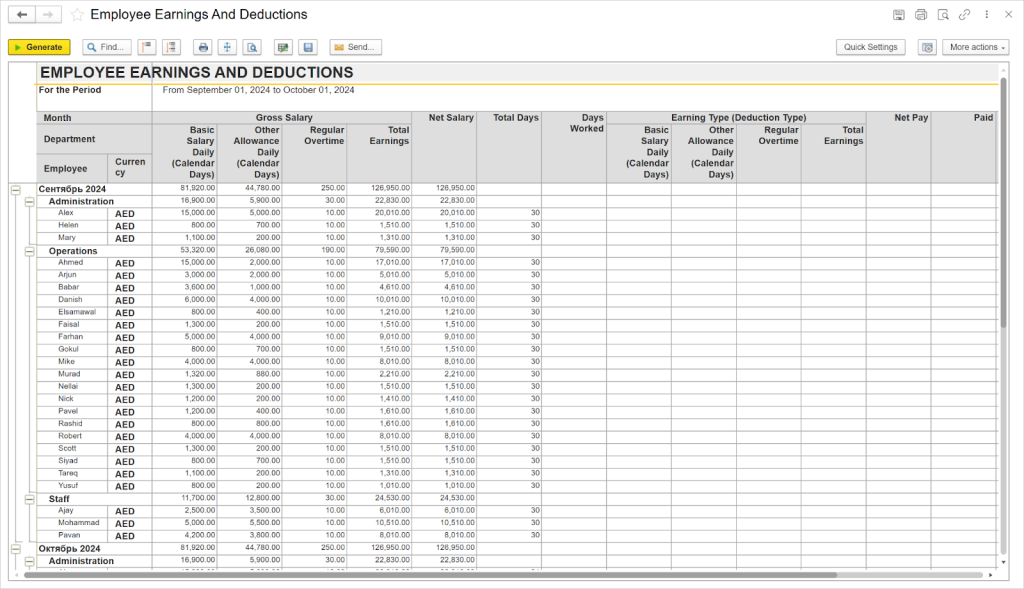

First, automated payroll calculation converts

overtime, timesheets, leave, and deductions into accurate net pay. With contract terms built in, values meet WPS thresholds, and the need for hand edits falls, along with the rejections that follow.

Payroll run: earnings, overtime, deductions, and net salary in FirstBit ERP

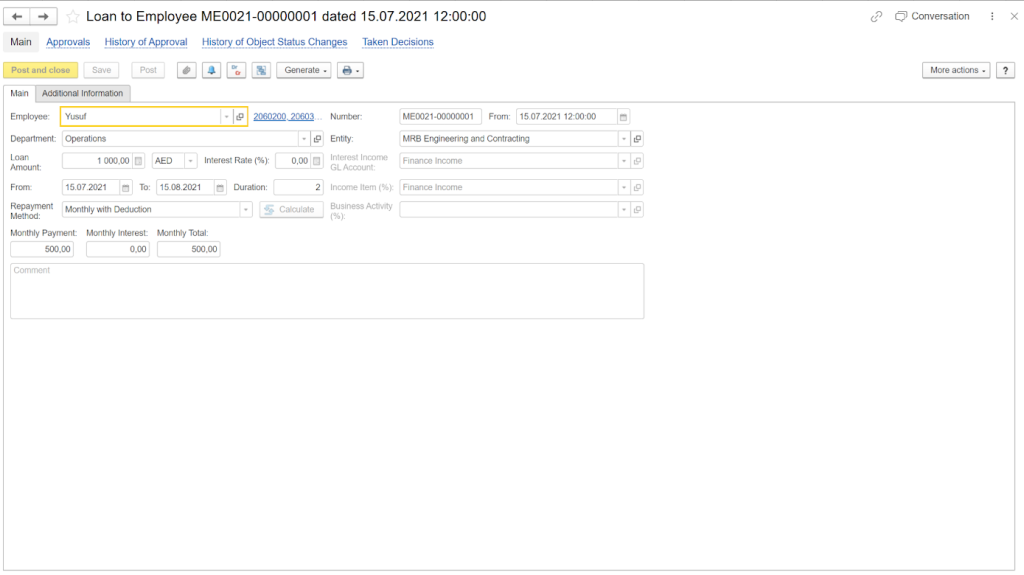

Next, employee expenses (such as loans, fines, and other recoveries) are handled within payroll rather than in separate spreadsheets. Deductions flow into the SIF with the right codes and amounts, which helps prevent short payments that could drop an employee below the monthly minimum.

Employee loan recorded inside payroll in FirstBit

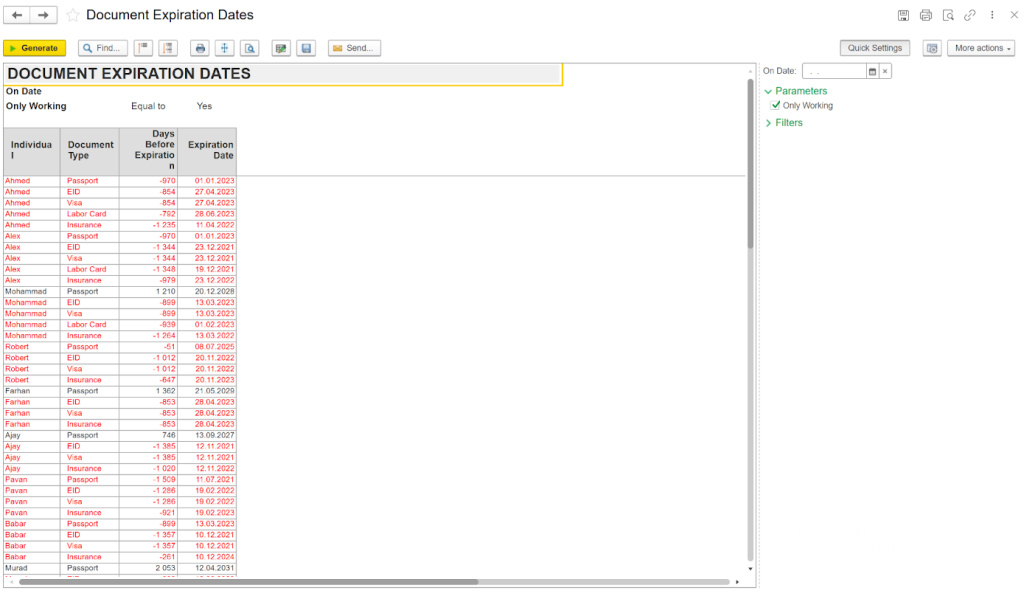

In parallel, expiry-date tracking keeps IDs, visas, and licenses current. Alerts prompt HR to close gaps before payroll lock, so eligible workers are not blocked at disbursement and the SIF is not delayed by preventable status issues.

Document expiration tracking in FirstBit ERP

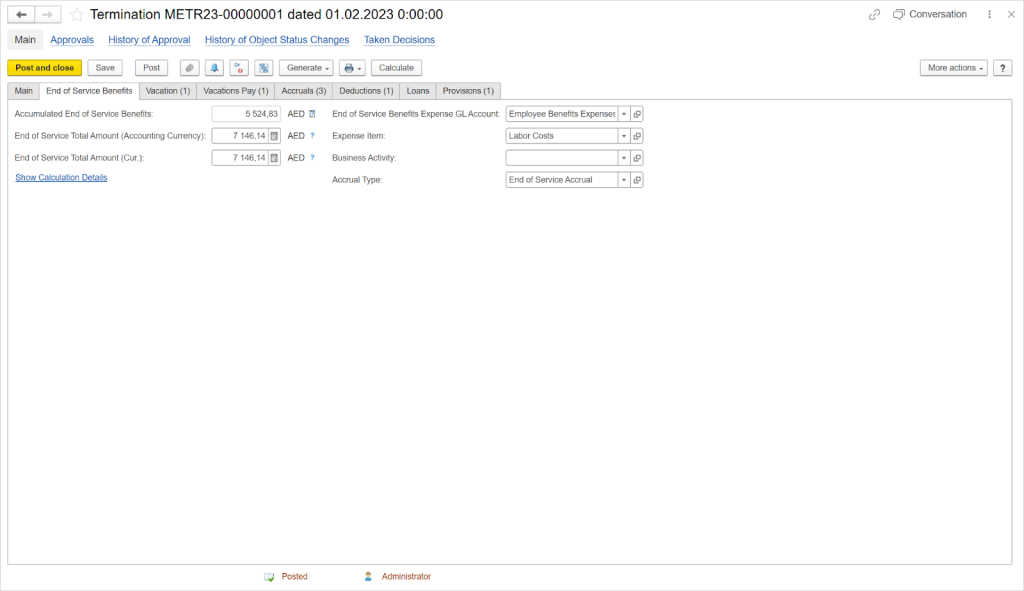

Finally, the final settlement processes pending salaries, unused leave, and benefits in a single run. Offboarding is completed in a timely manner, and the WPS record accurately reflects the amounts paid to the departing employee.

Final settlement calculation in FirstBit ERP

F.A.Q.

Why is WPS important for construction companies in the UAE?

In the UAE, WPS is a government-regulated system that construction firms must use to pay their workers. It helps businesses stay compliant with labor laws, avoid penalties, and maintain a positive reputation.

How does WPS work for construction contractors?

WPS integrates with banks and the MoHRE. Employers submit payroll data through an approved system, and payments are processed securely through authorized channels.

Can WPS help reduce labor-related disputes on construction sites?

Absolutely. By ensuring accurate and timely wage payments, WPS minimizes the risk of payment complaints, which are common in large-scale construction projects involving foreign labor.

How can construction companies integrate WPS into their existing payroll systems?

Using enterprise software, companies can automate WPS compliance through direct integration with MoHRE and UAE banks. This allows real-time reporting, error-free payroll runs, and digital recordkeeping.

Automate payroll calculation with full UAE Labor Law compliance

Request a demo

Anna Fischer

Construction Content Writer

Anna has background in IT companies and has written numerous articles on technology topics.