Getting paid on time is one of the biggest challenges in the construction industry, often leading to cash flow shortages, project delays, and strained relationships with suppliers and crews.

70% of contractors say payment delays threaten their business and the industry as a whole.[?]

While billing methods can’t solve every payment problem, choosing the wrong approach can make things worse. For example, lump sum invoices may leave contractors waiting until the end for most of their payment, while progress billing provides a steady flow of funds as work advances but requires more administration.

This article breaks down both methods, explains how they work, and shows where each is best suited, so you can choose the option that supports your cash flow and reduces stress on your projects.

How Construction Billing Methods Impact Your Business

Accurate billing is crucial for building trust with clients, ensuring consistent cash flow, and maintaining smooth business operations.

Here’s why it matters:

-

Building client confidence. Trust is the cornerstone of strong client relationships. Clear and correct invoices from the start establish your company’s credibility and reliability, showing clients you’re organized and committed to delivering value.

-

Ensuring smooth cash flow. For any business, cash flow is essential. Timely and accurate invoices help you receive payments quickly, while errors in billing can lead to delays and unnecessary complications, disrupting your financial stability.

-

Staying compliant and credible. Navigating the complex landscape of financial regulations is vital. Adherence to standards such as GAAP and ASC 606 for revenue recognition is critical for precise reporting. Complying with local and international regulations safeguards your company from potential fines and reinforces your reputation with clients.

-

Boosting your bottom line. Accurate billing provides valuable insights into project timelines and costs, allowing you to refine your forecasts. This understanding helps optimize future projects and enhances overall profitability.

Choosing Construction Billing Method: What to Consider

Choosing how to bill for a project is not just an accounting decision — it directly affects cash flow, risk, and client relationships.

The right approach depends on three main factors:

-

Project scope. Is the work straightforward or complex?

-

Project duration. Will it be finished quickly or span months?

-

Client preference. How comfortable are they with risk and payment timing?

Discussing these points early ensures everyone understands how and when payments will happen, setting clear expectations from day one.

Lump Sum Billing: Best for Smaller Projects

For smaller jobs, like residential remodeling or roofing, lump sum billing is often the simplest choice. A single fixed price covers the entire job, giving clients cost certainty and reducing paperwork for contractors.

Payments are either made:

-

As one payment at the end of the project

-

In milestones, tied to completed phases

This method works best when the scope is clearly defined and unlikely to change.

However, it shifts most cost risk onto the contractor, who is responsible for covering unexpected price increases.

Progress Billing: Ideal for Large or Complex Projects

When projects are larger — such as commercial builds or government contracts—progress billing becomes more practical. Payments are issued as work is completed, which keeps funds flowing steadily and shares risk more evenly between contractor and client.

Because payments are tied to progress, contractors must track completed work carefully and provide supporting documentation. This extra effort brings flexibility as the project evolves and helps maintain trust throughout long timelines.

Other Billing Methods to Know

Not every project fits neatly into one of the two main approaches. Depending on circumstances, you might also consider:

-

Cost-plus billing. Reimburses the contractor for all their expenses, plus a predetermined fee — ideal when the project’s scope is difficult to estimate upfront. Specify the fee structure in the contract and keep expense records organized.

-

Unit price billing. Charges are based on the quantity of work completed (like per square foot of flooring). Agree on unit rates in advance and document quantities as work progresses.

-

Time & materials. Bills based on actual labor hours and materials used, suitable for unpredictable work. Track hours and materials closely and share records with the client.

-

Retention. Withholds a percentage of each payment until completion, adding a layer of security for the client. Include the retention rate and release conditions in the contract upfront.

No matter which method you choose, keeping billing records accurate and organized is essential to avoid disputes and keep cash flow steady. Tools like FirstBit ERP centralize all billing documents in one place, saving time and reducing paperwork for busy teams.

Keep every project on budget

Track expenses in FirstBit ERP

Request a demo

Lump Sum Invoice

Here’s how this billing approach works in real project settings.

What it is

A lump sum invoice is a billing method where the contractor and client agree on a single, fixed price for the entire project. This price is determined before work begins and remains unchanged unless both parties formally approve modifications to the contract. It is straightforward: one agreed figure covers all labor, materials, and other project costs outlined in the scope of work.

How it Works

With lump sum invoicing, the contractor provides one predetermined price covering all project costs — labor, materials, equipment, and overhead — based on a clearly defined scope of work. This amount is typically paid according to agreed milestones or upon project completion, with no adjustments unless both parties agree to modify the contract.

The focus is on delivering the project within the agreed budget and scope, making it simple for clients to understand costs upfront and easy for contractors to manage billing.

Lump Sum Invoicing: Pros and Cons

Lump sum invoicing has clear advantages and potential drawbacks to consider.

Pros

Lump sum invoicing offers simplicity and predictability. Because the entire project cost is agreed upon upfront, clients know exactly what they will pay, making budgeting easier. The single invoice or straightforward payment schedule also reduces administrative work, as there’s no need to track multiple progress payments or itemized costs. For contractors, a clear financial framework can streamline cash flow planning and reduce disputes over individual charges.

Cons

While this simplicity benefits clients, it also shifts financial risk onto contractors. Any unexpected expenses or scope changes not covered in the original contract typically come out of their pocket.

This approach also offers less flexibility for adjusting work as conditions change, which can be challenging for projects where the scope isn’t perfectly defined at the start.

Automate all financial operations within one ERP software

Request a demo

When to Use Lump Sum Billing

Lump sum billing works best for projects with a clearly defined scope and minimal chance of change. It is well suited to straightforward jobs where both parties can agree on a fixed price from the start and stick to it, such as minor residential upgrades, roofing projects, or standard home builds with pre‑set plans.

A study of residential projects in the Kurdistan Region of Iraq found that 60% of experts saw lump sum contracts as providing clear cost structures and profit visibility, and 63% said they were easier to manage. However, 66.7% noted their inflexibility when design changes occur. Notably, 56.7% of respondents reported that these projects finished faster than unit‑price alternatives.[?]

For contractors, this means lump sum billing offers predictable profits and simpler management, but only when the project scope is locked in early.

Construction Progress Billing

In construction, progress billing links payments to actual work completed rather than waiting until the entire project is finished.

What It Is

Progress billing is a payment method where invoices are issued as work on a project advances. Instead of paying the entire project cost at the end, clients make payments tied to specific milestones or percentages of completion. This approach helps contractors cover ongoing expenses while providing clients with visibility into what work has been completed at each stage.

How It Works

With progress billing, the contractor and client agree in advance on project phases or completion percentages that trigger payments. As each phase is finished or a set percentage of the work is complete, the contractor submits an invoice reflecting the agreed value of that portion of work.

Supporting documents, such as progress reports or photos, are often included to verify completion. This approach ensures contractors have steady cash flow throughout the project while giving clients transparency into how funds align with progress.

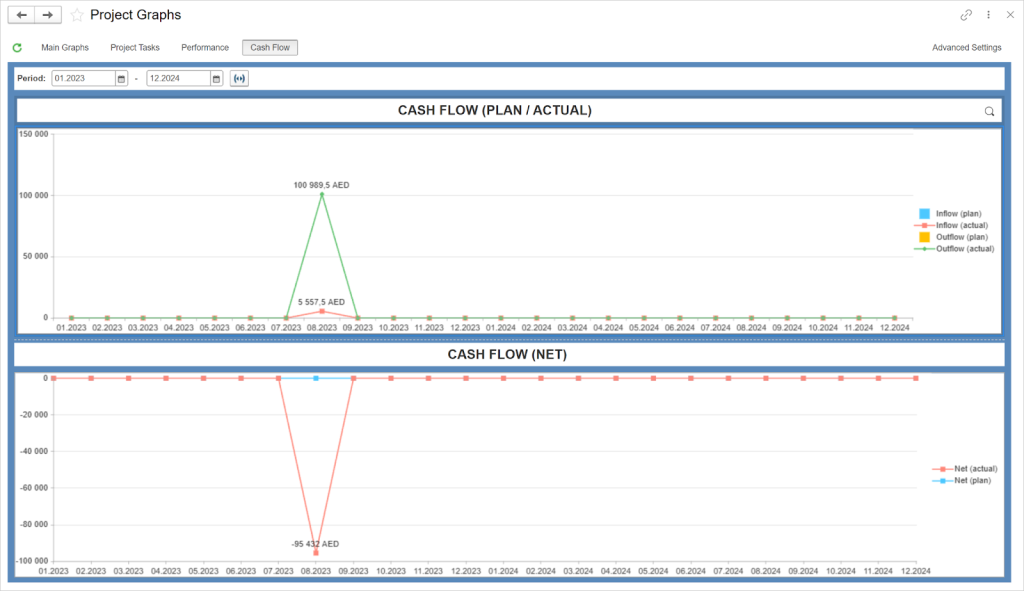

Always know where your money is going

Monitor cash flow in FirstBit ERP

Request a demo

Progress Billing: Pros and Cons – Pros

Progress billing offers advantages for cash flow and transparency, but also adds administrative complexity.

Pros

Key benefits include:

-

Improved cash flow — payments are received throughout the project, reducing the need for contractors to carry costs until completion.

-

Easier financing for large projects — regular billing helps fund labor, materials, and subcontractors without relying heavily on loans.

-

Clear client visibility — invoices are linked to specific milestones and often supported by required documentation such as progress reports or visuals, so clients can see exactly what has been completed.

These advantages make progress billing appealing for complex, multi-phase projects where predictable funding and visibility are important.

Cons

The same structure that creates transparency and cash flow benefits can also add challenges:

-

More administrative work — contractors must track progress accurately, prepare detailed reports, and maintain documentation for each billing cycle.

-

Complex accounting — progress-based invoices require careful coordination with project management and accounting systems.

-

Retention payments — a portion of payments is often withheld until project completion, which can limit available cash despite regular billing.

When to Use Progress Billing

Progress billing is best suited to large, long-term, or complex projects where work is delivered in phases and scope changes are expected. It is commonly used when multiple subcontractors are involved or when steady cash flow and detailed reporting are critical to project success.

Typical examples include:

-

Commercial construction projects

-

Government or infrastructure contracts

-

Custom home construction

-

Multi-phase developments with multiple subcontractors

This approach gives contractors the financial flexibility to manage resources over extended timelines while offering clients regular insight into project progress.

A study integrating Earned Value Analysis (EVA) and simulation models examined cash flow challenges across several construction projects. It highlighted that changes in progress payment timing, delays, inadequate financial planning, and unpredictable project changes could reduce inflows by 9.7-16.3% (average 12.4%).[?]

This demonstrates how even small shifts in billing structure can significantly impact contractor finances, especially when using progress billing.

Digital tools, such as FirstBit ERP, for tracking construction project phases give contractors a single system to handle all billing tasks accurately and on time.

Prevent cost overruns

Request a demo

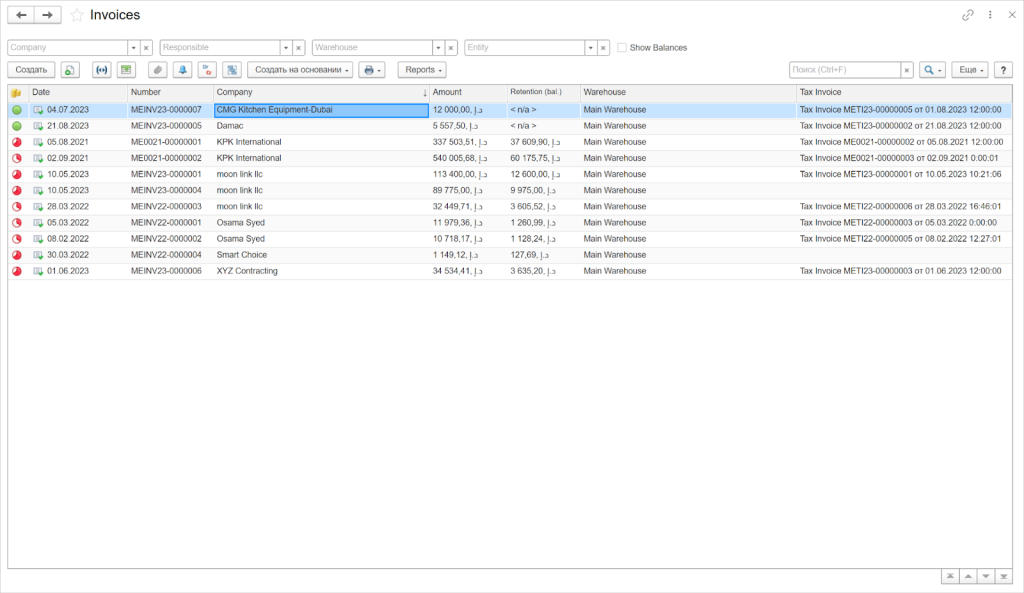

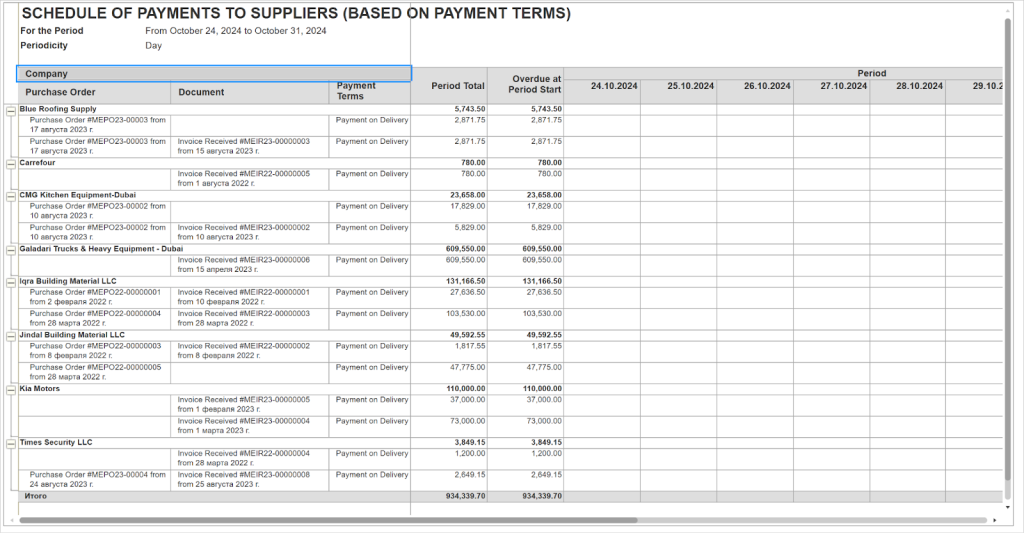

Track Your Invoices With FirstBit ERP for Better Cash Collection

Manual billing and scattered spreadsheets often cause missed deadlines, payment delays, and cash flow problems. FirstBit ERP gives contractors a single system to handle all billing tasks accurately and on time. The system will be useful for:

-

Centralized invoice management. Store and track all invoices in one place, whether lump sum or progress-based. The system links each invoice to the correct project, so nothing is lost or duplicated.

-

Payment tracking. Use built-in schedules and reminders, and status alerts to know which invoices are pending, overdue, or fully paid. This lets you follow up with clients immediately and reduce waiting time for payments.

-

Real-time financial visibility. View dashboards that show how every invoice impacts project profitability and company cash flow. See payment trends and identify risks before they affect operations.

Final Thoughts

The billing method you choose affects more than just how you get paid; it influences cash flow stability, risk exposure, and how smoothly projects run. For many contractors, delayed payments and unclear billing records create ongoing stress and financial uncertainty.

Strong internal processes for tracking invoices and collecting payments are as important as choosing between lump sum or progress billing. A well‑organized approach reduces disputes, improves cash planning, and frees time for focusing on actual project delivery. In an industry where margins are often tight, small improvements in how you manage billing can have a lasting impact on overall business health.

Keep every project on budget

Track expenses in FirstBit ERP

Request a demo

F.A.Q.

1. How do I decide billing terms with a client who has no preference?

2. How should contractors handle scope changes under lump sum contracts?

3. What risks should I be aware of with progress billing?

4. Can mixed billing methods work on one project?

Anna Fischer

Construction Content Writer

See FirstBit ERP solutions in action

Discover how our system solves the unique challenges of contractors in a personalized demo.

After the demo you will get a quotation for your company.

After the demo you will get a quotation for your company.