Construction projects are time-sensitive and require the completion of interdependent tasks. Materials cannot be installed until inspections are completed, subcontractors cannot begin work until the previous project is finished, and large expenses must often be paid before client funds are received. This constant flow of money in and out makes cash flow a crucial factor in keeping projects on schedule and profitable.

If cash flow falters, schedules can slip, suppliers can delay deliveries, and crew members can go unpaid - each disruption increases the risk of delays and disputes. In contrast, a steady stream of funds allows managers to procure materials early, pay subcontractors on time, and plan future work with certainty.

This article will cover how maintaining a positive cash flow enhances every aspect of a construction project, from payment processes and cost management to forecasting and technology usage. It provides practical strategies for maintaining financial stability while meeting deadlines.

What Is Cash Flow in Construction

In construction, cash flow is the real-time movement of money into and out of a project. Picture it as a timeline: client payments arrive according to contract milestones (inflows), while wages, materials, equipment rentals, permits, and subcontractor bills go out (outflows). If the inflows lag behind the outflows, the project can stall even when it’s technically profitable on paper.

Good cash flow management means planning this sequence so that there’s always enough money available to pay for labor, materials, and overhead without taking on costly short-term debt. Contractors do this by forecasting each month’s inflows and outflows, setting up clear payment schedules with clients and subs, keeping working capital reserves for unexpected costs, and adjusting procurement or phasing so spending matches income. In practice, that might mean delaying a bulk order until a milestone payment clears, or negotiating faster approval of invoices to keep crews paid.

Importance of Cash Flow in the Construction Industry

Construction timelines depend on a series of interdependent tasks. For instance, the installation of drywall cannot commence until the electrical work is finished, and the finishing work cannot begin until the inspections have been passed.

At the same time, substantial expenses such as materials, equipment rentals, and wages must be paid regularly throughout the timeline, often before the contractor receives payment from the client. Without a steady and positive cash flow to cover these upfront costs, even meticulously planned projects can come to a halt. Payments to subcontractors may be delayed, workers may be left idle, and crucial milestones may be missed, resulting in cost overruns and squeezing profit margins.

Prevent cost overruns

Register expenses in FirstBit ERP

Request a demo

Impact on Project Timelines and Dependencies

Construction projects rely on a chain of dependent tasks. When cash flow is steady, materials, labor, and services can be paid for and scheduled on time. This keeps each phase moving without interruptions.

Research shows that delayed payments and lack of finance are among the top reasons for project slowdowns or even abandonment, so keeping funds available is essential for meeting milestones[?].

Covering Upfront Costs and Managing Payments

Contractors often have to pay for materials and subcontractor work before receiving full payment from the client. Reliable cash flow enables them to cover these upfront costs without incurring expensive short-term borrowing, which helps stabilize their budgets.

Preventing Project Delays and Cost Overruns

Negative cash flow quickly leads to delays, higher costs, and squeezed profit margins. Payments to suppliers or workers get postponed, creating bottlenecks that ripple through the schedule.

Poor cash flow management directly causes capital lock-up, extended timelines, and cost escalation. Managing cash flow as a risk-control tool helps keep schedules realistic and budgets stable.

Supports Long-Term Growth

A consistent record of positive cash flow strengthens a contractor’s reputation with banks and clients, making it easier to qualify for tenders or secure financing for new work. This financial stability gives firms the capacity to manage multiple projects and scale operations sustainably.

Early Signs of Cash Flow Problems

Cash flow problems in construction often show up long before bills go unpaid. Here, we discuss the warning signs that can help you act early and avoid major problems.

Delayed Payments from Clients

When clients take longer than expected to pay, it creates gaps in cash flow. Often, this is not just about the client; outdated billing practices, incomplete paperwork, or unclear schedules can slow your own invoicing cycle and delay funds coming in.

Shortages in Materials and Equipment

Shortages or delivery delays push back work, which means you cannot invoice for completed stages on time. Costs may also rise as you pay premiums for faster shipping or purchase substitutes to keep crews busy, further straining cash reserves.

Rising Overhead Expenses

Indirect costs such as rent, utilities, insurance, and multiple equipment rentals can quietly drain available cash. Because these expenses are not tied to a single project, they can erode margins across all jobs if not monitored and allocated carefully.

Poor Budgeting and Cost Projections

Underestimating costs or leaving out contingencies leads to unexpected expenses. Even profitable companies can run into cash flow gaps if their payment schedules do not match when debts fall due. Accurate budgets with built-in buffers help absorb surprises without wiping out working capital.

Manage your cash flow with confidence

Request a demo

Benefits of Maintaining Positive Cash Flow

Consistent cash flow is not just about paying bills. It gives a construction company the leverage to plan, negotiate, and deliver projects without constant financial stress.

1. Secure Labor and Materials When You Need Them

Consistent cash flow gives a contractor the ability to pay deposits, order materials early, and settle invoices promptly. On a busy site, this might mean booking crane time weeks in advance or paying suppliers upfront to guarantee steel delivery before a price spike. The result is a project schedule that moves without costly stoppages or last-minute premiums.

2. Plan and Expand with Confidence

Stable inflows make it possible to forecast costs accurately and allocate funds without borrowing from one job to cover another. A contractor can, for instance, mobilize a new team on a school build while still finishing a housing project, confident the payroll and suppliers on both are covered. This keeps operations scalable and reduces the risk of a cash crunch.

3. Build a Reputation for Reliability

Paying workers, vendors, and subcontractors on time builds trust across the supply chain. A firm that consistently releases wages on schedule or clears supplier invoices promptly will stand out in a labor-short market. Over time, that reputation makes it easier to attract and retain skilled staff and preferred partners.

4. Strengthen Your Standing with Lenders and Investors

Financial institutions favor contractors who demonstrate predictable cash flow. When a company can show steady statements over several quarters, banks are more inclined to extend credit lines for equipment or bridging finance on large projects. This financial credibility opens the door to better rates and more ambitious bids.

5. Invest in Efficiency Improvements

A healthy cash position allows a business to fund training, digital systems, or equipment upgrades that cut waste and improve coordination. For instance, implementing an integrated scheduling tool across multiple sites becomes feasible when cash is available. Such investments translate into tighter deadlines, lower overhead, and stronger project margins.

Strategies to Improve Cash Flow in Construction

The primary problems with cash flow frequently arise from delayed payments, withheld funds, discrepancies in payment timelines, inadequate tracking, and unexpected expenses.

Research on construction cash flow shows that “financial management,” at 27.72%, plays the most important role in cash flow forecasting, underlining how much impact strong controls have on a project’s stability[?].

The following tips turn those risk factors into clear actions that contractors can apply to keep funds moving, cover costs when they’re due, and protect project timelines.

1. Strengthening Payment Processes

Clear payment processes keep cash moving and disputes low. Start by defining milestones, deadlines, and penalties in every contract so clients know exactly when and how to pay. Combine this with disciplined billing: send invoices as soon as work or milestones are complete and consider small discounts for early payments to prompt faster cash inflows.

For larger jobs, break invoices into stages so you’re not waiting for a lump sum at the end. Together these practices create a predictable income stream instead of peaks and troughs.

2. Managing Accounts Receivable Effectively

Good receivables management turns billed work into cash on time. Monitor overdue payments weekly and follow up promptly so late accounts don’t build up. At the same time, make it easy for clients to pay by offering online transfers, credit cards, or other quick options.

Keeping invoices aligned with actual progress prevents overbilling or underbilling, which can both create cash gaps. This approach keeps money flowing steadily from completed work to your bank account.

3. Controlling Costs and Overheads

Healthy cash flow also depends on spending control. Regularly review rent, utility bills, insurance premiums, and equipment rental fees to identify areas for cost savings without compromising on quality. Negotiate with suppliers for extended payment terms or bulk discounts to alleviate financial strain.

Additionally, update your budgets frequently to ensure you can adjust your spending before minor overruns escalate into more significant issues. By reducing overhead expenses, you create a buffer to handle project costs and unexpected events.

4. Building Financial Resilience

Resilience means you can handle surprises without pausing work. Save part of your profits during peak periods to build an emergency fund for unexpected costs like equipment breakdowns. Set aside a fixed percentage of each payment as profit before covering expenses so you’re always building reserves.

Finally, forecast cash inflows and outflows to plan for slow periods and avoid reactive decisions. A resilient cash position lets you take on new work and handle setbacks with confidence.

5. Leveraging Technology for Better Cash Flow

Manual spreadsheets cannot keep pace with today’s large, multi-site construction projects. Integrated systems such as ERP link timekeeping, procurement, and billing, so cash flow reflects actual progress on site. They let you trigger invoices as milestones are reached, see overdue payments instantly, and allocate costs accurately without double entry.

Tools like FirstBit ERP help automate invoicing, track expenses, and monitor finances in real time. By consolidating these functions, it shortens billing cycles, improves forecasting, and creates a clear audit trail of costs and payments — providing practical support for maintaining steady cash flow while meeting local compliance requirements.

Never run out of cash mid-project

Plan cash inflows and outflows to maintain liquidity

Request a demo

Maintain Positive Cash Flow with FirstBit’s Cash Flow Dashboard

Even well-run projects can suffer cash gaps if inflows and outflows aren’t tracked in one place. FirstBit ERP gives contractors a live view of their project finances, turning scattered spreadsheets into a single, actionable picture. Here’s how it helps:

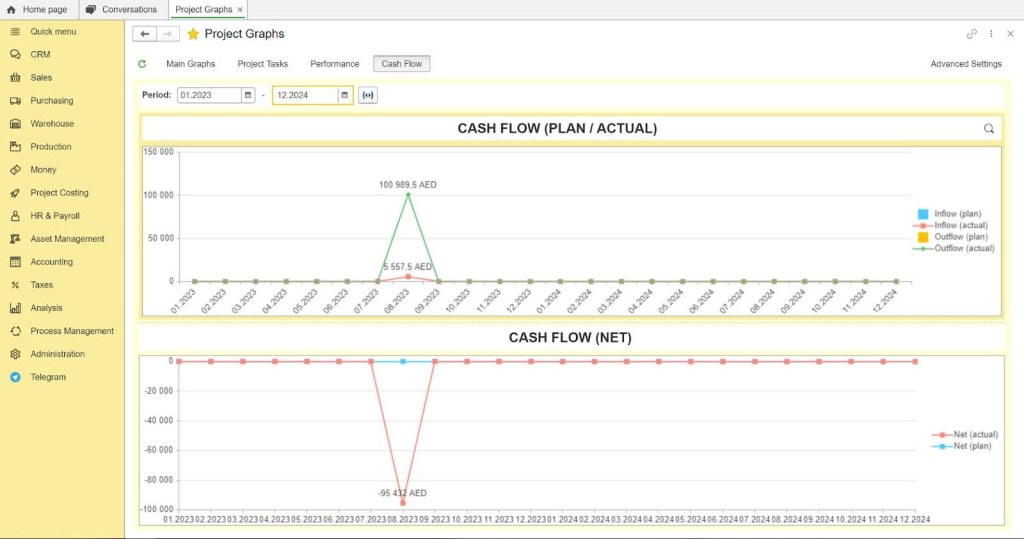

Real-Time Overview of Inflows and Outflows

A live dashboard of all incoming payments, upcoming milestones, and outgoing costs gives managers a clear picture of a project’s financial health at any moment. Instead of waiting for reports from different teams, you can instantly see what has been billed, what is due, and what expenses are coming up.

This makes it easier to anticipate cash gaps before they happen and take corrective action such as adjusting schedules, reallocating funds, or triggering faster invoicing to keep the project financially stable.

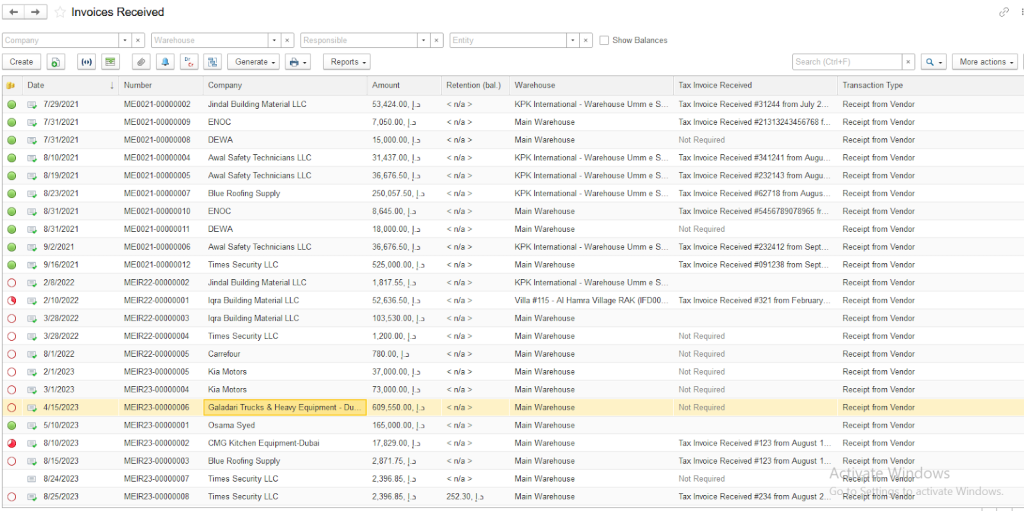

Automated Invoice Tracking

The system provides a clear, real-time overview of all outgoing invoices, showing which have been issued, which have been paid, and which remain outstanding. Finance teams can filter by client, project, or due date, enabling them to prioritize follow-ups and address overdue accounts promptly.

This visibility turns invoicing from a reactive task into a proactive process. By monitoring outstanding amounts and acting early, companies maintain a steadier cash inflow, reduce payment delays, and protect working capital across multiple projects.

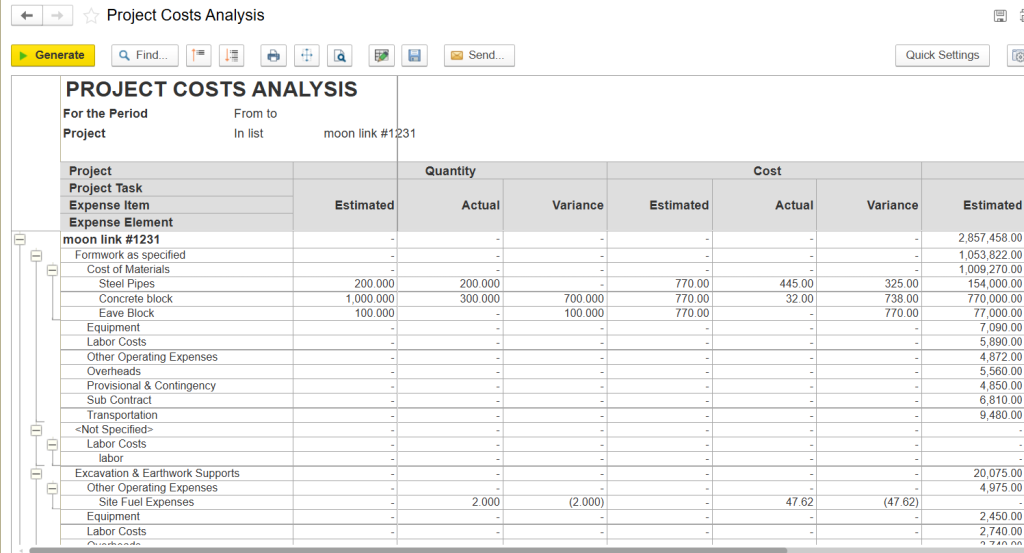

Project-Level Cost Monitoring

Track labor, materials, and overhead against budgets for each project. This visibility helps prevent overspending and keeps cash reserves aligned with actual work progress.

Forecasting and Scenario Planning

System dashboards can help project future cash flow based on scheduled work, expected payments, and known expenses, giving managers an early view of how finances will look weeks or months ahead.

By comparing different scenarios, such as delayed client payments, accelerated procurement, or adding new projects, you can test the impact on cash reserves before making decisions.

Conclusion

Strong cash flow is the foundation of a stable construction business. When inflows and outflows are monitored carefully, companies can fund labor, materials, and subcontractors without disrupting schedules or stretching credit.

Real-time dashboards and forecasting tools give managers a clear picture of where money is going, what is coming in, and what lies ahead. With that visibility, contractors can make timely decisions, prevent avoidable delays, and position themselves to take on new work with confidence.

Automate all financial operations within one ERP software

Request a demo

F.A.Q.

How can contractors tell if their cash flow practices are working?

What are the hidden costs of poor cash flow?

How do contract payment terms affect cash flow later?

Why is technology now essential for cash flow management?

Anna Fischer

Construction Content Writer

See FirstBit ERP solutions in action

Discover how our system solves the unique challenges of contractors in a personalized demo.

After the demo you will get a quotation for your company.

After the demo you will get a quotation for your company.