On February 22, 2024, the Federal Tax Authority (FTA) issued Decision No. 3 of 2024 with regard to the timeline for registration of taxable entities for Corporate Tax (CT) in the UAE.[?]

As per Article 51 of the UAE CT Law, all taxable entities must register for corporate tax (CT) with the Federal Tax Authority (FTA) within a specified timeline and obtain a tax registration number. This law applies to any business (including construction) entity that meets the taxable threshold of AED 375,000 per year.

The registration process involves:

-

Submitting an application form and supporting documents to the FTA

-

Reviewing and approving the application

The recent FTA Decision No. 3 of 2024 outlines the deadlines for different categories of taxable entities based on their turnover.

All UAE taxable entities must register for CT with the FTA within the time limit set by FTA Decision No. 3 of 2024 to avoid any legal consequences. It is crucial to comply with this requirement to avoid any penalties or legal issues.

If your company is acknowledged as a Resident Person and was founded or registered before March 1, 2024, you must adhere to specific deadlines for submitting your Tax Registration application. Below are the outlined timelines for your reference:

The timeframe for tax registration is directly related to the date of license issuance by the Federal Tax Authority (FTA). As per the UAE CT Law, a license is a crucial document issued by a licensing authority that permits a business or business activity, such as trade and/or commercial licenses, to be conducted in the UAE. It is worth noting that if a juridical person holds multiple permits, the one with the earliest issuance date must be used.

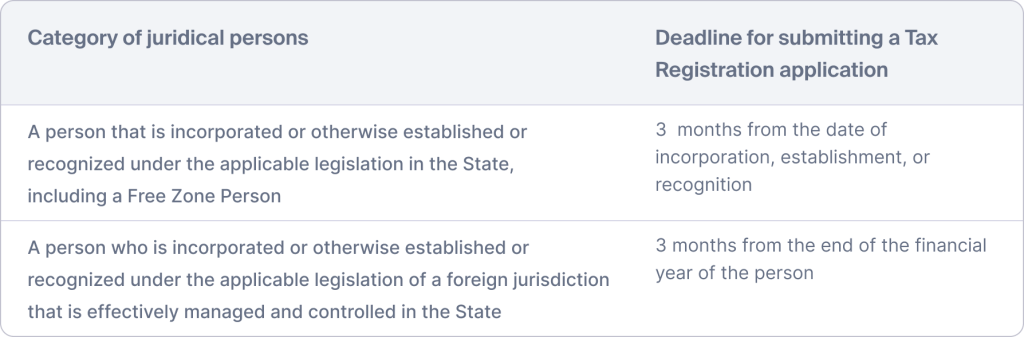

For resident juridical persons that are incorporated, established, or recognized on or after 1 March 2024, the following timelines will apply:

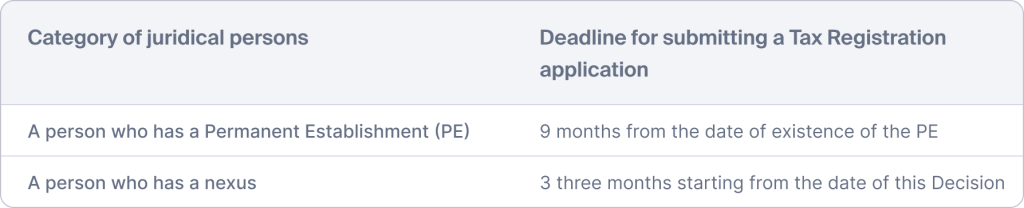

Timeline for Non-Resident Juridical Persons

Before the effective date of this Decision, non-residents must apply for Tax Registration as per the table below.

On or after the effective date of this Decision:

Automate all financial operations within one ERP software

Request a demo

Timeline for Natural Persons

It has been recently decided that if an individual conducts a business or any business activity within the UAE and their annual turnover exceeds AED 1 million, they must submit a tax registration application within specific deadlines.

-

For Resident Persons, the deadline is 31st March of the subsequent Gregorian calendar year in which the business or activities occur.

-

Non-resident persons must apply within three months after meeting the tax requirements.

Note that failure to submit the tax registration application within the given timeframe will result in a penalty of AED 10,000 for each taxable person.

Anna Fischer

Construction Content Writer

See FirstBit ERP solutions in action

Discover how our system solves the unique challenges of contractors in a personalized demo.

After the demo you will get a quotation for your company.

After the demo you will get a quotation for your company.