We are thrilled to unveil our new localized version of FirstBit ERP specifically tailored for businesses operating within the Kingdom of Saudi Arabia. The system is now completely fitted to meet regulations of Saudi authorities.

E-Invoicing Integration with Fatoora Portal

FirstBit ERP users will be able to generate and send electronic invoices (e-invoicing) directly to the Fatoora portal, meeting Saudi Arabian authorities' mandate.

Fatoora is the e-invoicing system started by Saudi Arabia's tax authority, ZATCA. It was created to improve and update the country's tax system. Fatoora requires all businesses to create, keep, and send e-invoices for their transactions.

E-Invoicing integration with Fatoora Portal is developed for entities that are residents of the KSA. It ensures that your business stays ahead of regulatory requirements while optimizing invoicing processes.

VAT Return Functionality

VAT returns can now be generated by the requirements of Saudi Arabian legislation. With the FirstBit ERP system you can:

-

Change the VAT rate within the system by the country legislation

-

Assign multiple country-specific VAT rates to each inventory item or service

ERP that saves your money

Adopt FirstBit ERP to cut costs, boost ROI, and effectively plan future cash flows

Request a demo

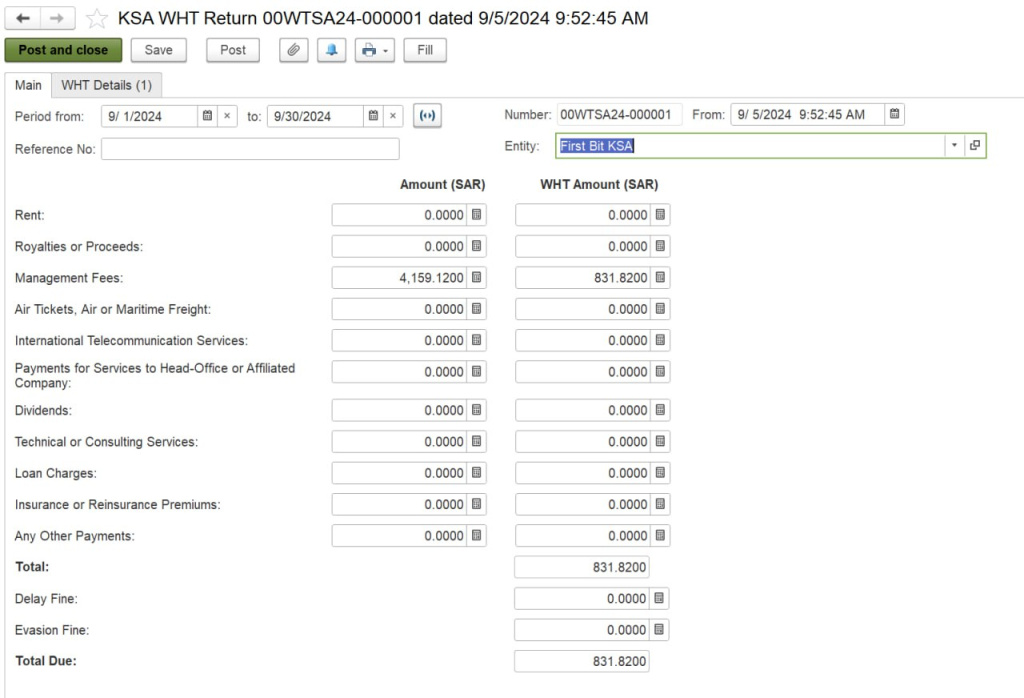

Withholding Tax Service

Other KSA regulations involve withholding tax (WHT). In FirstBit ERP, you can now recognize the withholding tax amount from non-resident services as receivable. This deduction is applicable when making payments for the following types of transactions:

-

From a customer

-

Repayment of loan issued

-

And others

Also, you can analyze the withholding tax from non-resident services for deduction by creating a report in the FirstBit ERP system.

For company contracts it’s possible to select parameters for calculating withholding tax on services from nonresidents:

-

You can now choose an option to indicate if withholding tax is necessary for contract payments

-

It's also possible to specify the type of service, which determines the tax rate

Another feature is the manual accrual of accounts receivable and accounts payable for the withholding tax from non-resident services.

Finally, the system can automatically generate the KSA WHT Return. This update lets you create a tax report for the income from services given by companies or people not based in Saudi Arabia.

Other Innovations

Among other features we've added new General Ledger (GL) accounts to streamline the recording of taxes withheld from payments made to non-residents. Here's what's new:

-

These GL accounts are categorized by Tax Type and Payment Type, and you'll see them included in the Current Assets and Current Liabilities sections of the Statement of Financial Position report.

-

You can now use these accounts by default to record the taxes withheld from payments to non-residents, which are owed to tax authorities.

-

You can use these GL accounts in your Bank Payment and Bank Receipt documents.

We've also rolled out new bilingual (English and Arabic) templates for printing key financial documents. This update includes templates for:

-

Quotations

-

Customer Orders

-

Proforma Invoices

-

Invoices

-

Tax Invoices

-

Credit Notes

-

Tax Credit Notes

-

Purchase Orders

Complementing these enhancements, we've developed the automatic import of exchange rates for various currencies directly from the Central Bank of Saudi Arabia. All your financial transactions are always aligned with the latest currency values, simplifying international dealings.

Everything you need for success in one powerful ERP solution

Request a demo

Anna Fischer

Construction Content Writer

See FirstBit ERP solutions in action

Discover how our system solves the unique challenges of contractors in a personalized demo.

After the demo you will get a quotation for your company.

After the demo you will get a quotation for your company.