In construction, managing finances is key for success. Among the myriad financial processes, managing construction accounts payable (AP) stands out as a critical task for construction companies. It's not just about paying bills; it's about optimizing cash flow, maintaining solid vendor relationships, and ensuring project profitability.

So, you must be wondering how exactly construction companies can improve accounts payable management and if any software such as ERP can help you with that. Let's explore in the article.

What is Accounts Payable?

Accounts payable refers to the obligations a business has to pay its vendors and subcontractors for the procurement of goods and services essential for its operations. This encompasses a wide range of expenses, from overhead and operational costs to both direct and indirect costs associated with the business.

The term specifically applies to invoices that are pending payment, spanning the period from when a vendor issues an invoice to the moment the payment is executed. Accounts payable can change over time, similar to accounts receivable.

Accounts Payable in Construction Industry

In construction, accounts payable is like the list of bills a construction company needs to pay. This list includes owe for things like building materials, tools, and paying workers or subcontractors who do specific parts of the project.

Managing these bills is very important because construction projects have many parts and can take a long time to finish. Sometimes, a construction company might not get paid for its work right away, so it needs to be smart about paying its own bills. If it pays too early, it might run out of money before the project is done. If it pays too late, it might undermine its credibility in front of the entities it owes money to.

Improve Your Accounts Payable in 10 Steps

1. Paperless Invoices

Moving to paperless invoicing is a forward-thinking decision that can lead to substantial improvements in operational efficiency, cost savings, and even environmental responsibility. It's a smart move for any business looking to modernize and improve their financial processes.

Short rundown on why going paperless with your invoicing is a smart move:

-

Efficiency boost. Digital invoices simplify your accounts payable process, speeding up approvals and reducing the cycle time from invoice receipt to payment.

-

Cost reductions. Switching to paperless saves on the costs of paper, printing, and physical storage. Plus, you’ll see a decrease in postage costs if you previously mailed invoices.

-

Accuracy enhancement. Digital invoicing minimizes the human errors that come with manual data entry. Automated systems ensure payments are accurate and consistent, helping to avoid overpayments or duplicates.

-

Real-time tracking. Electronic invoices offer the advantage of being tracked in real-time, improving cash flow management and making financial planning easier. This also simplifies auditing and compliance, thanks to neatly organized and accessible records.

-

Vendor relations. Faster invoice processing speeds up payments, fostering better relationships with your vendors. This is key for securing better terms and prices down the line.

2. Assign a Single Email Address to Handle All Invoice Receipts

Assigning a dedicated email address to handle all incoming invoices can greatly simplify the process, both for your vendors and your team. It clears up any confusion about where to send invoices and allows you to easily check if an invoice has been received. This streamlined approach helps maintain order and efficiency in managing your accounts payable.

Additionally, it’s a good idea to encourage your vendors to send invoices via email rather than by fax or mail. Emailed invoices are not only environmentally friendly but also more convenient. They can be easily searched, stored, and retrieved whenever necessary, and can be reprinted without any hassle if needed. This shift to digital can significantly speed up your processing time and reduce the likelihood of invoices getting lost or delayed.

3. Log Invoices in Your Accounting Software upon Receipt

Recording invoices immediately upon receipt ensures that a digital trace is established. It allows easy tracking even if the physical copy is lost. By recording invoices into your system before sending them out for approval or coding, you secure a complete log of all accounts payable. Conversely, if invoices are forwarded to management for approval prior to being entered into the system, it becomes difficult to verify their receipt, potentially leading to misplaced invoices and expenses that go unrecorded.

4. Generate Regular Reports on Accounts Payable

Regularly generating accounts payable reports helps maintain accurate financial records and ensures timely payments to suppliers, which can strengthen business relationships. The reports provide a clear snapshot of your company's current liabilities, aiding in better cash flow management and financial planning. Keeping up with accounts payable reports can also help prevent fraud and errors.

5. Track Retention Properly

Be sure to keep a close eye on the retention owed to your subcontractors. Retention is typically recorded separately from regular accounts payable because it usually isn't due within the current accounting period. It is often kept in a specific account, often referred to as "retention payable" or "accounts payable - retention." Once your subcontractor submits an invoice for these retained funds, you'll move them from the retention payable account over to accounts payable.

If your chart of accounts is set up properly, your specialized construction accounting software should handle this automatically. However, if you’re using more general accounting software, you might find you need to manually manage and record these retention payments.

6. Introduce KPIs

Accounts payable KPIs are measurable values that help assess how effectively and efficiently your accounts payable process operates. They can provide crucial insights into how well your AP department manages financial commitments, maintains supplier relationships, and oversees cash flow.

Here are some commonly tracked accounts payable KPIs:

-

Days payable outstanding (DPO) shows how many days on average a company takes to pay its bills to vendors and suppliers. A high DPO means a company waits longer to pay, which might help it manage money better but could strain relationships with suppliers.

-

Cost to process each invoice measures how much money a company spends to handle a single invoice from receiving it to finishing the payment. It can help in finding ways to save money.

-

Payment process errors tracks the number of mistakes, such as overpayments, underpayments, or payments to the wrong vendor. It helps businesses understand how often errors occur, aiming to reduce these mistakes and improve the accuracy of payments.

-

Invoices processed per employee measures how many invoices each employee handles over a specific period.

These metrics can be invaluable tools for refining your business operations.

7. Set Up a Schedule for Regular Payment Intervals

Maintaining a regular payment schedule by setting specific days each month or week to pay invoices is an important step in improving accounts payable management.

Suppose you decide to set your payment schedule to the 15th and 30th of each month. On these days, you review and process all invoices that are due. This method ensures that all payments are handled consistently every two weeks, allowing your vendors to anticipate when they will receive payment.

This predictable pattern not only helps you manage your cash flow by spreading out expenses but also establishes your reputation as a dependable business partner. Over time, this reliability could lead to improved terms with suppliers, such as extended payment periods or even discounts.

8. Train Your Team

No system or software can be effective without a knowledgeable team behind it. Invest in training for your staff to ensure they understand your accounts payable process, how to use any software or systems, and the importance of accuracy and timeliness. Regular training sessions can help keep everyone up to date on best practices and any changes in your process or technology.

9. Embrace Construction Accounts Payable Software

Implementing construction accounts payable software can be a game-changer for your business.

This specialized software is designed to handle the unique needs of construction companies, offering features like automated invoice processing, electronic payments, and real-time financial reporting. It not only saves time but also reduces errors, ensuring that your accounts payable process is as efficient as possible.

10. Integrate an ERP System

If you're looking for a more holistic approach, consider integrating an Enterprise Resource Planning (ERP) system like First Bit ERP into your operations. It acts as the backbone of your business, connecting all aspects of your company, including accounts payable, project management, HR, and more.

For construction companies, an ERP system can provide invaluable insights into your financial health, streamline processes, and improve decision-making. Plus, with everything housed in one system, you'll enjoy a level of organization and efficiency that's hard to beat.

FirstBit ERP System for Accounts Payable in Construction

First Bit provides an industry-specific ERP system that can significantly enhance profitability of contracting and construction companies. It includes features for managing accounts payable:

-

Automate tasks such as invoice processing and data entry to increase operational efficiency and reduce labor costs

-

Reduce costly errors like duplicate payments

-

Enhance real-time visibility into financials for better decision-making and financial planning

-

Ensure compliance with UAE regulatory standards and boost data security

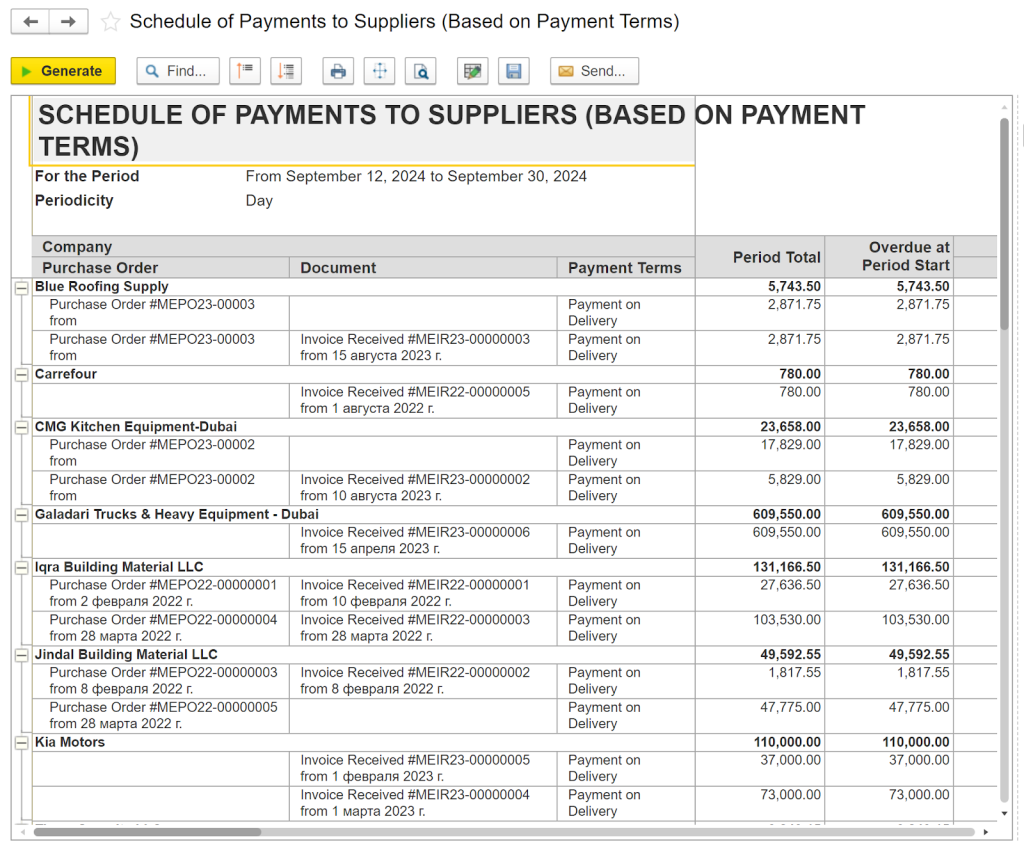

Schedule of Payments to Suppliers

First of all, FirstBit ERP system automatically generates a payment schedule to suppliers/ It is a clear plan showing when and how much money you need to pay for the goods or services you get.

With FirstBit ERP, you can make sure you pay on time, keep strong relationships with your suppliers, and manage your money well.

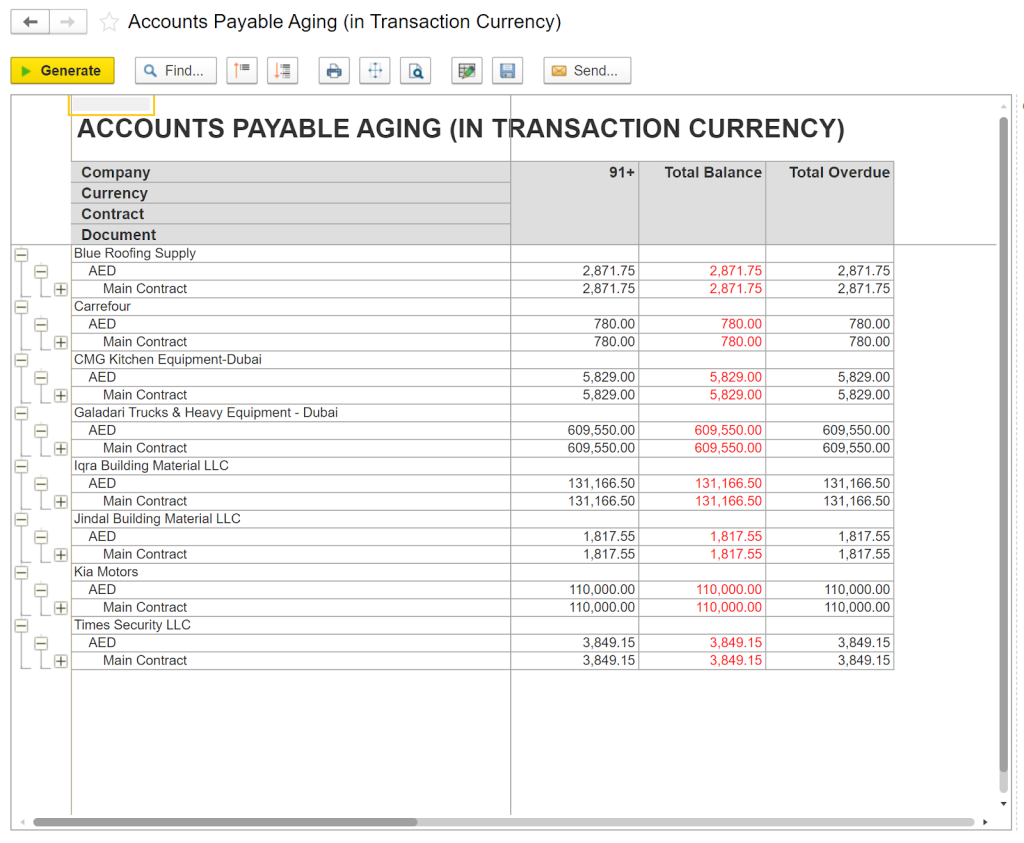

Accounts Payable Aging

Another feature is Accounts Payable Aging report. Its goal is to keep track of payments that a company makes to its suppliers or vendors and how long these payments have been due.

You can handle debts better by showing which payments need to be made first. This feature also helps you plan your project’s cash flow and pay on time. It supports strong relationships with suppliers by making sure payments aren't late, potentially leading to better payment terms and avoiding late fees.

Anna Fischer

Construction Content Writer

See FirstBit ERP solutions in action

Discover how our system solves the unique challenges of contractors in a personalized demo.

After the demo you will get a quotation for your company.

After the demo you will get a quotation for your company.