What is Retention in Construction?

There is a nuanced distinction between “retention” and “retainage”. In specific contexts, “retainage” denotes the money being withheld, whereas “retention” refers to the action of withholding the money.

The UAE Practice

Step-by-Step Process of Retention in Construction

Establish Contract

-

Detailing payment schedules

-

Addressing subcontractor provisions

-

Outlining dispute resolution options

Thoughtful contract drafting ensures mutual protection and sets expectations for timeline, cost, and quality, fostering trust and confidence in the project's progress.

Point Retention Clause

-

Understanding laws

-

Regulations comprehension

-

Industry practices

-

Understanding whether the payment encompasses both labor and materials

-

Establishing the particular time of payment

-

Defining when the project’s completion is

-

Recognizing the significance of belated payments — when, how much, and determining the forefront during disputes

Before committing to any specific terms, you must navigate through the intricacies with precision, ensuring that the contract is carefully compiled and understandable to the sides.

Run Retention Funds

-

Adhere to legal and contractual obligations. When handling retention money, you must consider both parties’ legal requirements and contractual obligations. Adherence to specific release timelines in contractual agreements is crucial for maintaining project progress. Timely resolution of disputes is essential to prevent any adverse impact on the release of retention money.

-

Engage third-party administrators. You may also opt for third-party administrators to manage projects and oversee retention money releases. These administrators assure compliance with contractual terms, legal regulations, and relevant laws. Their expertise can help you navigate the potential risks of holding substantial funds for extended periods, aligning with contract specifications.

-

Utilize financial software for compliance. Implementing financial software aids you in ensuring compliance with contractual obligations. The software provides alerts for timely payments, facilitating the tracking of payment changes due to factors like price fluctuations. Automation of retention money release processes reduces manual errors, enhancing overall efficiency in financial management.

Manage Prepayment

-

Plan. Prepayment plans empower you to receive funds before project or service completion, enabling coverage of costs related to materials, labor, taxes, and other ongoing expenses. This proactive approach aids in financial flexibility during project execution.

-

Advance. Payment advances offer an immediate infusion of cash, providing you with timely access to funds before project completion and inspection. This option facilitates financial liquidity and flexibility, mitigating potential challenges associated with delayed payments.

-

Schedule. Payment scheduling allows you to plan and ensure timely submission of necessary documents. It also provides an opportunity to negotiate favorable early payment terms. Strategic planning enables you to capitalize on discounts offered for prompt invoice payments, creating incentives for subcontractors and suppliers as well. Early payments expedite reimbursement, allowing stakeholders to transition smoothly to the next project or procure additional resources.

Keep Records

-

Store paperwork securely, electronically or physically, organized by project phases for quick retrieval. Regular backups prevent potential data loss.

-

Maintain two copies of contract-related documents, ensuring both parties sign off on changes. Thoroughly document proposed revisions during negotiations. Consider creating a spreadsheet for efficient progress tracking.

Adhere to Regulatory Compliance

Security Measures

-

Familiarize yourself with all contractual terms related to retention management.

-

Comply with inspections regulations, ensuring certified personnel perform required inspections before payment release.

-

Maintain up-to-date documentation for subcontractor services throughout each contract period.

Dispute Handling and Industry Practices

-

Establish strict criteria for handling disputes related to retaining funds.

-

Be aware of industry standards regarding withholding percentages until project completion in specific areas or regions.

Continuous Compliance Monitoring

-

Review and stay updated on changing construction regulations regularly.

-

Conduct periodic reviews to maintain accurate records and ensure proper remittance of withheld funds upon satisfactory completion of contracted services.

-

Keep informed and compliant for contracting businesses of all sizes to avoid fines and legal issues associated with non-compliance errors.

Turn to Insurers and Bondsmen

Mind the claims process for insurers and bondsmen in case of unforeseen issues during the project.

Release the Retention Funds

-

Establish clear agreements on payment terms and clauses for withholding retention funds.

-

Include details like waiting periods, withheld portions until project completion, and milestones for full release.

-

Comprehend relevant regulations and laws governing retention fund release during negotiations with clients.

-

Define expectations and timelines in contracts, documenting progress throughout the project to preempt disputes.

-

Mediate disagreements between you and your clients, aligning with industry standards.

-

Maintain detailed records, including digital copies of hours worked and invoices, safeguarding against disputes over compensation rates or time frames.

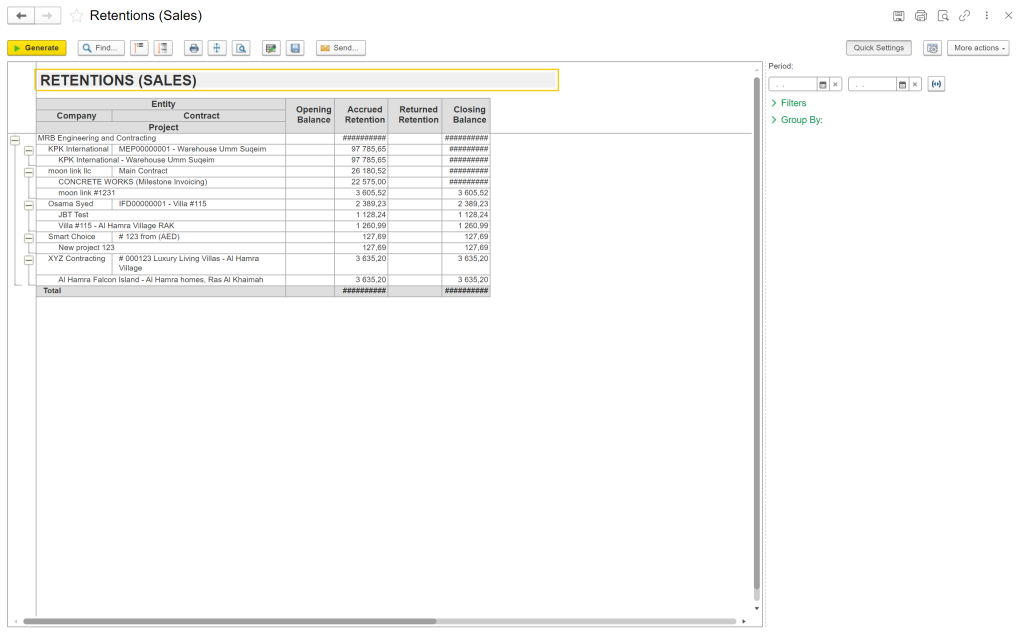

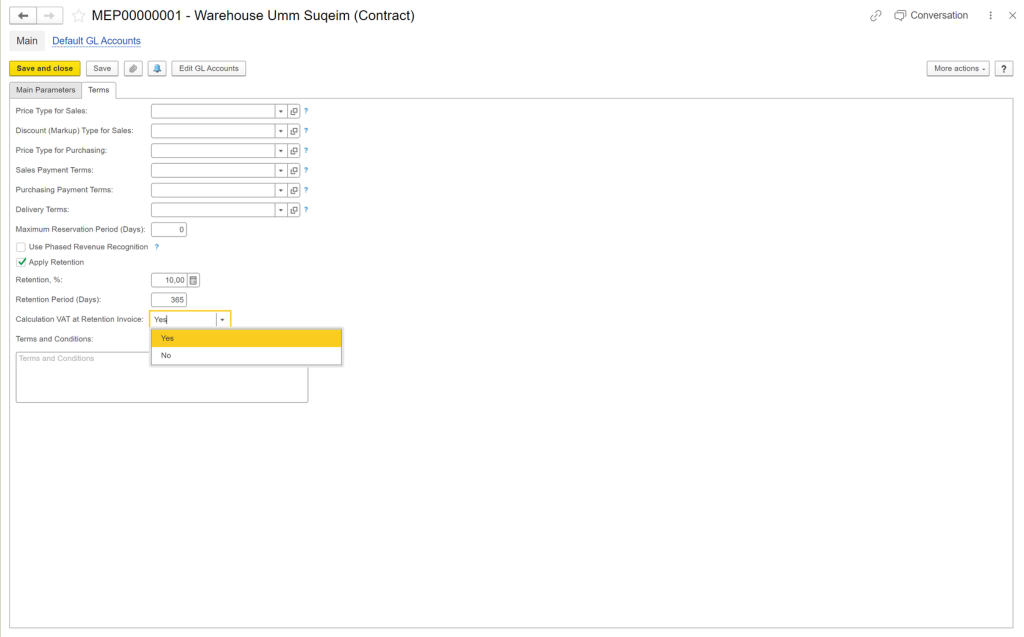

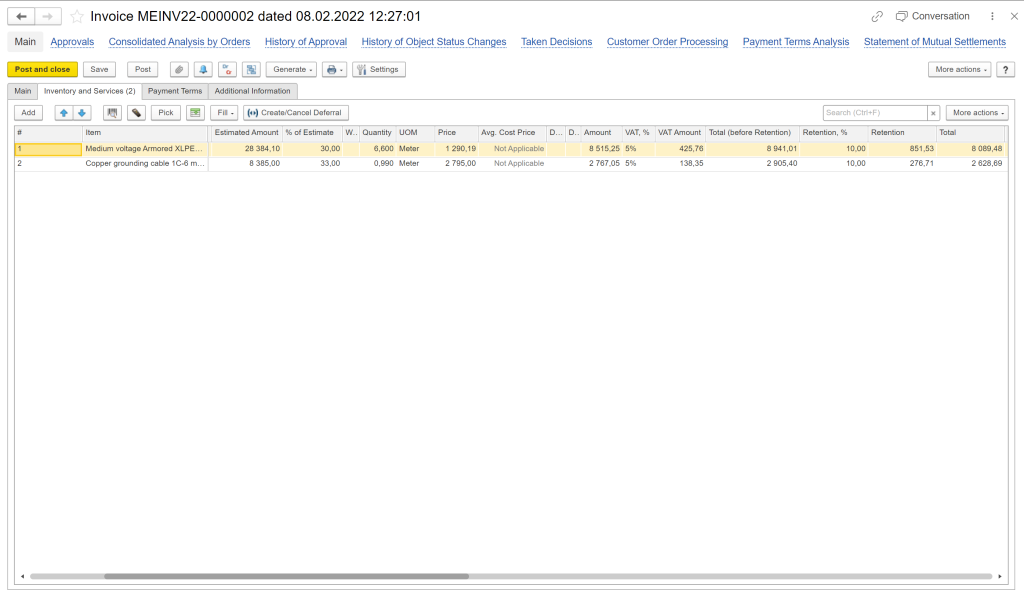

Register expenses in FirstBit ERP

Risk Management Techniques

-

Identify contractual risks. Be vigilant about contractual obligations, especially regarding timely completion and quality standards. Proactively identify potential areas of risk before entering into agreements.

-

Ensure project security. Safeguard investments by providing sufficient funds for unexpected costs. Assess the impact of changes on budget, timeline, and legal obligations related to the job site.

-

Mitigate retention risk. Protect against lost payments by seeking strong financial guarantees or securing bond insurance coverage for high-value projects. Minimize the risk of financial losses due to unpaid debts or failed projects.

-

Proactive risk management. Address external risks such as weather conditions and safety hazards early on. Proactively manage retention issues throughout the project life cycle, minimizing delays and unforeseen expenses.

Benefits of Early Release

-

Quicker turnaround time. Early release significantly accelerates construction project timelines, ensuring timely completion. This expedites payments for all parties involved and prevents costly delays and overruns, fostering a more efficient construction process.

-

Cost savings opportunities. Potential cost savings arise from purchasing materials at lower prices and optimizing labor hours. The extent of savings depends on the size and complexity of the project, providing an avenue for better financial management.

-

Incentives for early completion. You can enhance motivation by offering various incentives such as bonuses, gift cards, or vouchers. The choice of incentives should align with the target demographic and project specifics, fostering a positive and motivated workforce.

-

Personnel resource management. Efficiently deploying and managing personnel resources throughout the job site minimizes idle time. Preventing excess staff during inactive periods results in substantial savings over the contract's duration, optimizing resource utilization.

-

Customer Satisfaction. Providing adequate time for necessary changes or updates before the final inspection boosts customer satisfaction. Consistently meeting expected timelines and budgets establishes trust and reliability.

-

Business Advantages. With effective early release strategies, you can build a reputation for timely completion and superior craftsmanship. This positive reputation accelerates contract acquisition, leading to increased profits and higher margins per project, contributing to sustained business success.

First Bit Assistance

Automated Tracking

Contract Compliance

FAQ

Use FirstBit to compare planned vs. actual costs

See FirstBit ERP solutions in action

After the demo you will get a quotation for your company.