It is no easy task to finance a construction project. Navigating this capital-intensive industry requires a solid grasp of project financing, a tailored funding method where loans hinge on a project’s future cash flows rather than personal assets.

In fact, nearly a third of construction projects fail, underperform, or face budget and time shortcomings every year. This occurs due to changing customer requirements, inadequate cost/time evaluation, labor inefficiency, and subpar materials.[?]

While project financing can be complex and resource-intensive, it provides a crucial path forward by limiting liability and enabling high-value, capital-heavy developments. From energy facilities to major infrastructure, project financing underpins some of the world’s most ambitious construction efforts.

In this guide, we break down its mechanics, highlight its applications, and provide practical steps to secure funds while avoiding common pitfalls. Whether you’re a seasoned contractor or just starting out, understanding how to finance a construction project can transform challenges into opportunities for growth.

What Is Contractor Project Financing?

Put simply, project finance refers to the money borrowed specifically to fund a particular project. Just as home loans are used to finance a house and car loans are used to purchase vehicles, project finance involves borrowing funds from lenders to support the development or execution of a defined project.

Project finance differs from traditional financing in terms of risk and repayment. With conventional loans, borrowers assume full responsibility for repayment, and lenders can claim their personal or business assets in the event of default. In contrast, project finance typically operates on a non-recourse or limited-recourse basis.

This means lenders primarily rely on the project's future cash flows and assets for repayment. If the project fails or the borrower defaults, lenders generally cannot seize the project owner's personal assets. Consequently, project finance limits the borrower’s liability, making it a preferred structure for large-scale, capital-intensive ventures with defined revenue streams.

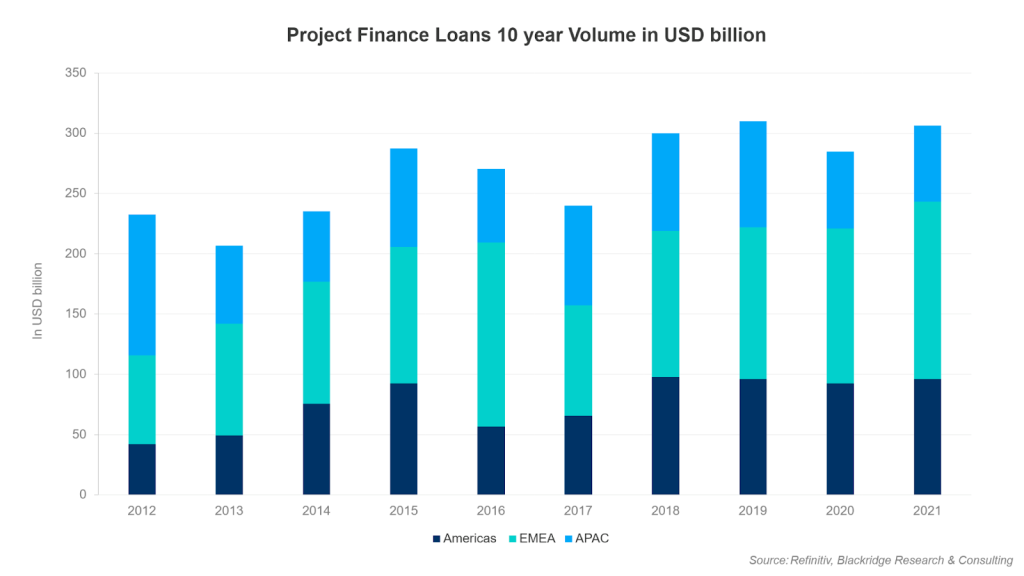

These statistics reveal that the number and value of project finance transactions have been on the rise each passing year. In the fiscal year 2021 alone, the project finance value reached USD 97.3 billion in the United States and the South and North America region, USD 148.8 billion in the EMEA region, and USD 63 billion in the Asia Pacific & Japan region.

Project finance is particularly suitable for construction projects in various sectors, including:

- Energy projects (power generation and transmission)

- Public infrastructure projects (metro rail, roads, and airports)

- Manufacturing

- Construction

- Telecommunication

- Education

- Healthcare

Project Finance in the United Arab Emirates

Project financing is widely used for construction projects in the United Arab Emirates, with banks typically disbursing payments to contractors progressively until project completion.

Larger projects often employ bond issuances, while Islamic financing instruments, such as Istisna, Ijara, and Musharaka, are also commonly used. There are generally no restrictions on financing methods, except in cases involving off-plan property projects or where the bank's security or risk exposure is altered.

Security Arrangements

The most prevalent forms of security in construction project financing include mortgages, along with the assignment of rental incomes or shares in projects held by special-purpose vehicles. These mechanisms provide lenders with recourse in the event of default.

Payment Mechanisms

Payments for construction work are typically processed through monthly progress applications submitted by the contractor. The engineer or architect reviews these applications within a contractually stipulated period, usually 10 days, and issues a certificate for the employer to make payment within an agreed timeframe, often 15 days.

Subcontractors follow a similar process, with approval granted by the main contractor rather than the engineer. "Pay when paid" clauses are commonly included in contracts and have been upheld by UAE courts.

Protection Against Non-Payment

Contractors may rely on suspension clauses, such as those found in

FIDIC contracts, to secure themselves against non-payment. If the employer fails to pay certified amounts, the contractor is entitled to suspend work.

While suspension is typically a contractual right, industry customs and legal provisions may also protect contractors in the absence of explicit clauses. Subcontractors often negotiate similar terms to safeguard against non-payment by the main contractor.

Grounds for Withholding Payment

Employers may withhold payments for valid reasons, such as the absence of a valid performance bond or if the works have not been certified by the engineer. These measures ensure that payment obligations are tied to contractual compliance and project progress.

Get paid faster and on time

Automate invoice creation by milestones with FirstBit

Request a demo

10 Steps for Successful Financing of Construction Projects

Financing a construction project is about more than just securing money. It's also about aligning your vision with that of your lenders, managing risk, and proving that your project is worth the investment.

Every step of the financing process provides an opportunity to build confidence with lenders and ensure your project stays on track.

1. Develop a Comprehensive Project Plan

The foundation of successful financing lies in a well-detailed project plan. Go beyond logistics — demonstrate how the project supports the strategic goals of potential lenders. Tailor your plan to show financial viability, investor alignment, and operational readiness. A strong, lender-focused plan builds trust and sets the tone for the rest of the financing process.

2. Conduct Thorough Risk Assessment

Anticipate challenges before they arise. Identify potential risks such as

cost overruns, construction delays, or regulatory setbacks. Then, develop clear mitigation strategies and contingency plans for each. Showing that you've done your homework positions you as a prepared, responsible borrower — qualities every lender values.

3. Perform a Detailed Feasibility Study

A feasibility study is a crucial first step before seeking financing or starting construction. It assesses market demand, regulatory and technical requirements, and financial viability—helping you identify risks early and present a credible, data-backed case to investors and lenders.

Consider Wonderland, a theme park project near Beijing in the 1990s. Despite grand plans, it was abandoned due to unresolved land disputes and zoning issues — problems that a thorough feasibility study might have flagged in advance. The result: lost investment and a stalled project that never opened.[?]

4. Secure Funding from Aligned Investors

Don’t just chase capital — find the right partners. Seek out lenders or investors who understand construction financing and whose investment criteria match your project profile. The right financial partner adds value far beyond funding, offering advice, risk-sharing, and long-term stability.

5. Negotiate Favorable Terms

Once interest is secured, it’s time to shape the deal. Negotiate loan amounts, interest rates, collateral requirements, disbursement conditions, and repayment schedules. Go in with a clear understanding of what your project can realistically support, and aim to balance lender expectations with operational flexibility.

6. Ensure Proper Documentation

Protect the relationship and the project with airtight documentation. Record all terms, responsibilities, and expectations clearly and legally. This is not just a formality; it’s the blueprint for collaboration. Well-structured documentation minimizes the risk of future disputes and ensures smoother execution.

7. Manage Disbursement Efficiently

Work closely with financiers to schedule fund releases that align with project milestones. Build in buffers and maintain detailed records. Efficient disbursement management will

keep your cash flow healthy and your project moving forward without any financial setbacks.

8. Implement Effective Project Monitoring

Set up strong project controls from day one. Appoint an experienced project manager or team to track progress,

manage budgets, flag issues early, and report regularly to stakeholders.

In fact, a 2015 survey by KPMG International found that only 31% of construction projects came within 10% of their original budgets, underscoring the importance of effective project monitoring.[?]

Real-time visibility in your construction software, for example, an ERP system, ensures you can act fast to fix problems and meet lender expectations.

9. Plan for Successful Project Closure

Closure is the final proof of performance. Define clear completion criteria, and ensure that all deliverables meet the agreed-upon standards. Prepare the necessary documentation, conduct final inspections, and facilitate a smooth transition from the construction team to the operations team.

10. Strategize Loan Repayment

Don’t leave repayment as an afterthought. Build a repayment strategy into your financial plan from the start, using cash flows generated by the project to meet obligations without strain. Demonstrating a clear, reliable path to repayment reinforces lender confidence and protects your creditworthiness.

You can also set up a detailed repayment schedule to improve resource planning and financial visibility. FirstBit ERP for Construction includes built-in financial planning tools that make this process straightforward. Within the system, you can easily create a structured schedule by entering repayment dates, amounts, and the names of lending institutions into a centralized spreadsheet-style interface, ensuring clear oversight of all upcoming financial obligations.

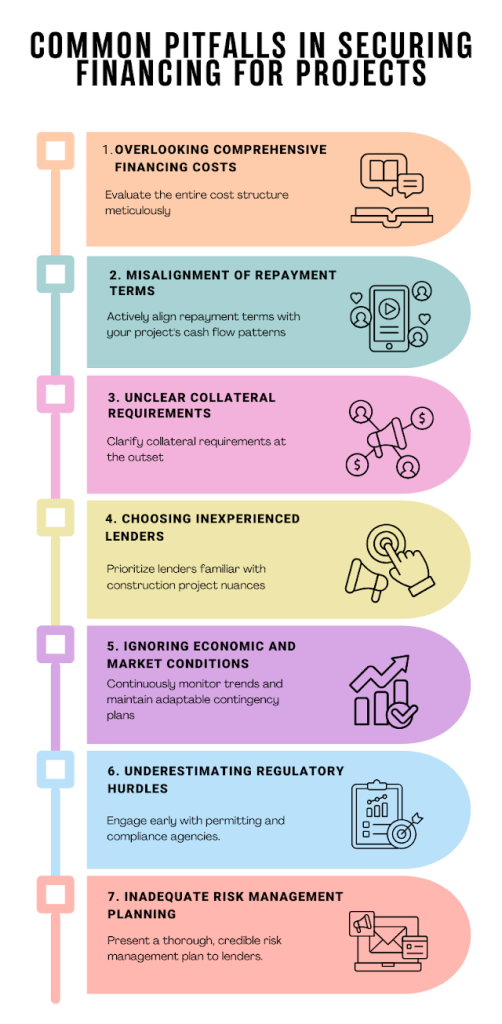

Common Pitfalls in Securing Financing for Projects

When securing construction project financing, several pitfalls commonly hinder successful outcomes.

60% of Small and Medium Enterprises (SME) developers in 2024 and 61% in 2023 said that they considered development finance to be either a major or minor barrier to housing delivery, compared to 42% in 2022 and 2021. The reasons abound, but generally, traditional lenders, such as banks, often view smaller developers as higher-risk borrowers due to their limited resources and smaller project scales.[?]

This upward trend underscores the growing financing challenges faced by SME developers and highlights the need for more accessible and flexible lending solutions tailored to smaller-scale construction projects.

1. Overlooking Comprehensive Financing Costs

Narrowly focusing solely on interest rates can derail budgeting accuracy and inflate hidden costs. If you neglect to evaluate the full spectrum of financing costs — including origination fees, closing expenses, and prepayment penalties — prepare to experience cost overruns.

Pro tip

Evaluate the entire cost structure meticulously, including origination fees, closing expenses, and prepayment penalties, to maintain accurate budgeting and prevent hidden costs from emerging.

2. Misalignment of Repayment Terms

Misalignment of repayment terms with project cash flow is another significant misstep. Rigid repayment schedules failing to accommodate low-revenue periods, especially in early construction phases, can severely strain financial resources.

Pro tip

Actively align repayment terms with your project's cash flow patterns. Negotiate schedules that offer flexibility during low-revenue phases, especially early construction stages, and match repayments to significant project milestones.

3. Unclear Collateral Requirements

Unclear or misunderstood collateral requirements frequently complicate financing. Neglecting to clarify lenders' asset expectations, such as property or equipment, early in negotiations can conflict with operational objectives and existing commitments, stalling progress or leading to unfavorable terms.

Pro tip

Clarify collateral requirements at the outset. Engage lenders directly to confirm asset expectations, such as property or equipment, ensuring these demands align with your operational objectives and existing obligations.

4. Choosing Inexperienced Lenders

Partnering with inexperienced lenders unfamiliar with construction complexities also poses substantial risks. Choosing lenders without relevant industry expertise can result in unrealistic financing conditions and inadequate support, jeopardizing project success.

Pro tip

Select experienced lending partners. Prioritize lenders familiar with construction project nuances who can provide strategic guidance, realistic terms, and consistent support throughout the financing journey.

5. Ignoring Economic and Market Conditions

Failing to monitor economic and market conditions represents another common oversight. Ignoring volatility or adverse market shifts leaves projects unprepared for tightened financing criteria or increased costs, causing unexpected financial burdens.

Pro tip

Stay vigilant of economic and market conditions. Continuously monitor trends and maintain adaptable contingency plans to swiftly adjust financing strategies in response to changing market dynamics and lender expectations.

6. Underestimating Regulatory Hurdles

Underestimating regulatory hurdles by not engaging early with permitting and compliance authorities can cause substantial delays, impacting financing timelines. Building buffer time into project schedules is essential to manage these regulatory risks effectively.

Pro tip

Proactively manage regulatory hurdles. Engage early with permitting and compliance agencies, and integrate buffer time into your project schedules to preempt delays that could impact financing.

7. Inadequate Risk Management Planning

Inadequate presentation of risk management strategies weakens lender confidence. Neglecting to outline clear and comprehensive plans for addressing project-specific risks, such as cost overruns, delays, or supply chain disruptions, diminishes trust and jeopardizes favorable financing terms.

Pro tip

Present a thorough, credible risk management plan to lenders. Clearly outline strategies addressing potential project-specific issues such as cost overruns, delays, and supply chain disruptions, building trust and confidence in your financial stewardship.

Automate all financial operations within one ERP software

Request a demo

The Role of FirstBit ERP in Contractor Project Financing

Enterprise Resource Planning (ERP) systems designed for the construction industry can play a vital role in improving access to project finance and managing it effectively. Here are three key ways ERP contributes to successful project financing, along with a detailed example:

1. Transparent Financial Planning and Reporting

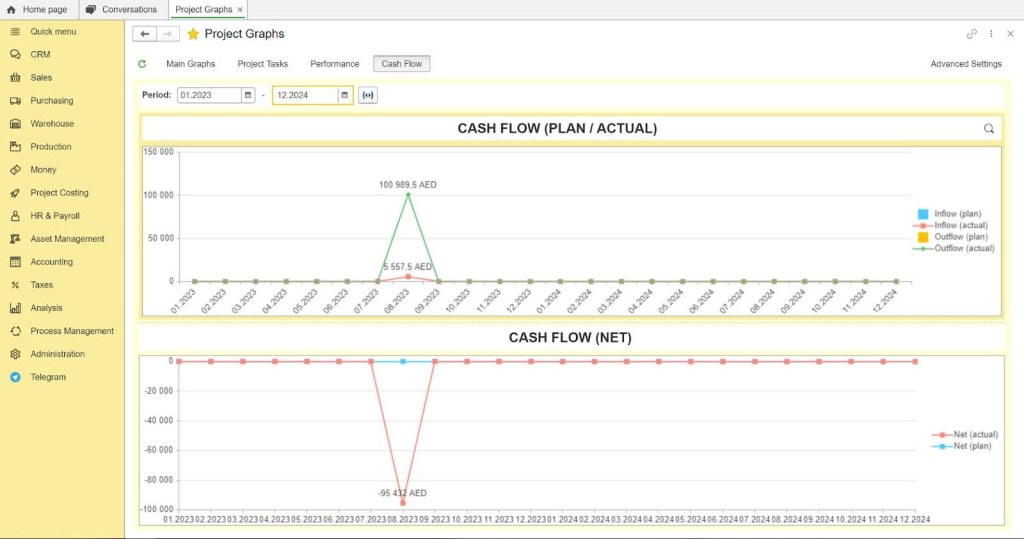

FirstBit ERP provides real-time visibility into project budgets, forecasts, and cash flow. This transparency is critical for lenders who need to evaluate the financial viability of a project before approving funding.

Cash flow project graphs in FirstBit ERP

Before applying for financing, you can use the ERP system to generate a detailed project budget, including cost breakdowns by activity (e.g., site preparation, materials, labor) and timeline-based cash flow projections. These reports are shared with potential lenders to demonstrate the project's financial structure and repayment capacity, giving the lender confidence in the borrower’s planning capability.

2. Centralized Document Management and Compliance Tracking

ERP systems streamline the management of critical documents, including contracts, permits, insurance, and regulatory approvals. This simplifies due diligence for lenders and ensures all legal and compliance documents are readily available.

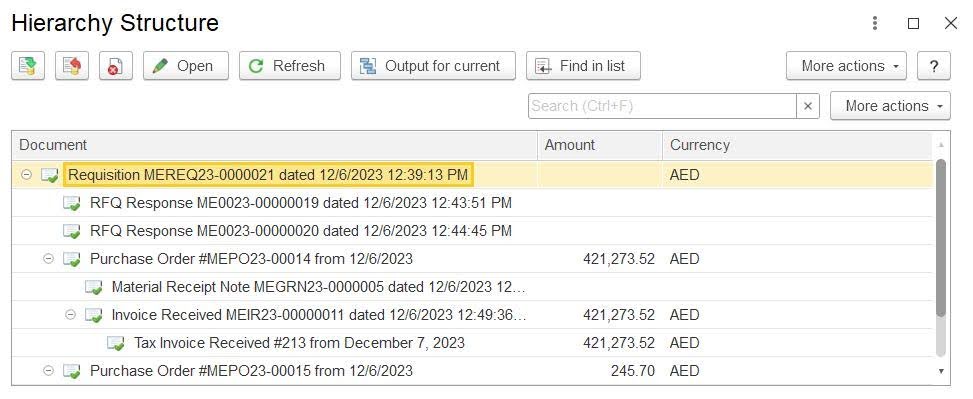

Hierarchy structure of the documents in FirstBit ERP

When undergoing financing approval, a developer is asked to submit project-related permits, subcontractor agreements, and insurance certificates. Instead of manually compiling files, the ERP’s document management module allows the team to instantly access and share verified documents from a centralized repository, accelerating the lender’s review process and reducing the risk of delays.

3. Risk Monitoring and Early Warning Systems

Modern construction ERPs come equipped with tools to monitor project KPIs, flag budget overruns, and track schedule deviations. FirstBit ERP is one of them. The system helps developers identify potential issues early and adjust accordingly, key factors that enhance lender trust and post-financing governance.

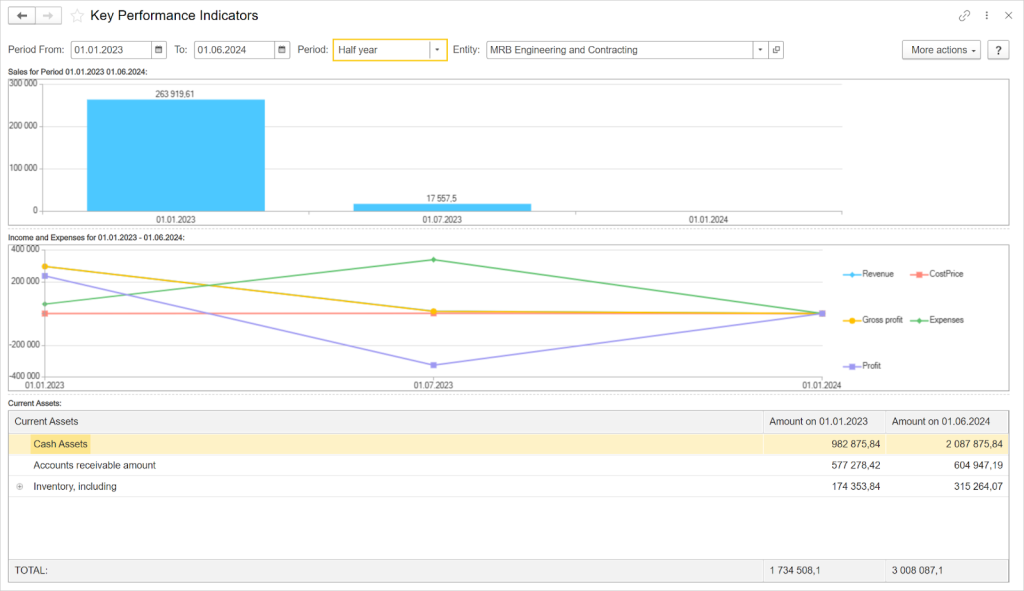

KPI graphs in FirstBit ERP

A lender funds a mixed-use development project on the condition of monthly performance updates. The ERP automatically tracks progress vs. milestones, alerting the team to any deviations in cost or schedule. These insights are compiled into structured monthly reports submitted to the lender, ensuring ongoing transparency and helping maintain compliance with loan covenants.

Final Thoughts: How to Qualify for Better Financing

Project financing, when approached strategically, can shape more than just a single build — it can influence a contractor’s trajectory. The ability to manage funding with foresight and discipline signals reliability to lenders and partners alike. Over time, this builds a foundation of trust that opens doors to larger, more ambitious opportunities. For contractors aiming to grow, strong financial planning isn’t just good practice — it’s part of the long game.

Never run out of cash mid-project

Plan cash inflows and outflows to maintain liquidity

Request a demo

FAQ

What are the most common financing options for contractor projects?

Common options include bank loans, lines of credit, equipment financing, invoice factoring, and project-based financing.

How can contractors improve their chances of securing a loan?

Contractors can improve their chances by maintaining a strong credit score, providing detailed financial records, presenting a solid business plan, and demonstrating a history of successful projects.

What are the key factors lenders consider when evaluating a contractor's financing application?

Lenders typically consider credit history, cash flow, project scope, collateral, and the contractor's experience. They may also evaluate the project's feasibility and the contractor's ability to repay the loan.

What are the risks associated with project financing, and how can they be mitigated?

Risks include cost overruns, delays, and client non-payment. Contractors can mitigate these risks by conducting thorough project planning, securing performance bonds, and including contingency clauses in contracts.

Anna Fischer

Construction Content Writer

Anna has background in IT companies and has written numerous articles on technology topics.