Understanding direct and indirect cost in construction is one of the most reliable ways to create accurate budgets and predictable financial performance. These two cost categories shape how contractors estimate work, manage cash flow, and protect project margins.

Clear classification helps teams understand which costs belong to a specific job and which support the wider business. When this structure is consistent, cost overruns become easier to detect, and profit forecasts become far more dependable across the project lifecycle.

This guide explains how direct cost and indirect cost in construction projects work, why they behave differently, and how contractors can use both categories to build more realistic budgets and competitive bids.

Direct Cost in Construction

Direct cost in construction include the expenses tied to a single project’s physical delivery. These costs rise or fall with project scope, which is why they form the foundation of any estimate or bill of quantities.

Because direct costs sit closest to the job site, they carry the most visibility during tendering and client negotiations. They also influence cash flow timing, since most payments under construction contracts align with progress on direct cost items.

Construction input prices remained almost 39 percent higher than pre-2020 levels, according to an analysis by Associated Builders and Contractors. This trend increases the volatility of material-heavy direct costs.

What Are Direct Costs in Construction?

Direct costs are expenses that can be traced to a single construction project without any allocation method. If the project is removed, these costs do not remain in the business.

They typically include physical work items such as labor, materials, and equipment used on a specific site. Subcontractor packages also fall into this category because they deliver a defined scope for that particular job.

This classification is essential because errors in direct cost estimates directly affect the profitability of a single project, whereas mistakes in indirect costs can distort the entire portfolio’s financial picture.

Typical Direct Cost Categories

To keep estimates consistent, most contractors group direct cost in construction under several standard categories:

-

Materials. Concrete, steel, lumber, MEP components, finishes, and consumables were purchased for that job.

-

Labor. On-site workers, skilled trades, project-based supervisors, and statutory labor expenses are tied to hours worked on the project.

-

Equipment. Rented machinery or internally owned assets assigned to the job for a defined period.

-

Subcontractors. Packages such as HVAC, plumbing, electrical, or façade installation priced for a single project.

-

Project-specific overhead. Temporary utilities, site trailers, waste disposal, project-dedicated safety, and any support that does not serve other jobs.

This structure makes it easier to compare bids, track performance, and prevent the mixing of direct and indirect costs in construction project reports.

How to Estimate and Calculate Direct Cost in Construction

Estimating direct cost in construction begins with a detailed quantity takeoff. Drawings and specifications are measured and converted into units such as cubic meters of concrete or square meters of formwork.

Unit rates combine material prices, labor productivity, equipment usage, and subcontractor quotes. When these elements are added together, the result becomes the project’s direct cost baseline.

A simple structure used in most construction accounting systems follows this format:

Direct Costs = Labor + Materials + Equipment + Subcontractors + Project-Specific Costs

The U.S. Bureau of Labor Statistics reports a 3.5 percent year-over-year increase in total compensation for private industry workers, steadily raising the baseline for direct construction wages.

Indirect Cost in Construction

Indirect cost in construction include the expenses that support the organization behind every project. These costs do not belong to a single job but enable teams to manage, supervise, and deliver work across multiple sites. Because they sit outside of day-to-day site activity, they are often underestimated during bidding.

Clear visibility of indirect costs helps contractors protect margins even when direct cost and indirect cost in construction projects fluctuate. When overhead is tracked as consistently as direct costs, companies gain a far more accurate view of profitability across their entire project portfolio.

What Are Indirect Costs in Construction?

Indirect costs are expenses that remain in the business whether one project ends or another begins. They support operations, administration, compliance, and long-term capability.

These costs include management salaries, office rent, insurance, technology systems, and shared resources. Although they do not show up directly on the job site, they influence pricing decisions and markup strategies across every tender.

A contractor that consistently monitors indirect costs often maintains better financial stability. Overhead clarity ensures that pricing reflects the true cost of operating the business, not just the cost of building one project.

Common Indirect Cost Categories

To maintain structure across budgets, indirect cost in construction is often grouped into several categories:

-

Administrative and office costs. Office rent, utilities, administrative salaries, communication, and corporate supplies.

-

Insurance and compliance. General liability, bonding, workers’ compensation, licenses, permits, legal fees, and safety programs.

-

Technology and systems. ERP software, IT infrastructure, cloud tools, cybersecurity, hardware, and staff training.

-

Shared equipment and vehicles. The company fleet is used across multiple jobs, fuel, maintenance, and tools supporting several sites.

-

General overhead. HR, accounting, marketing, and executive leadership.

This structure helps avoid mixing direct and indirect cost in construction project reports, improving forecasting accuracy and internal accountability.

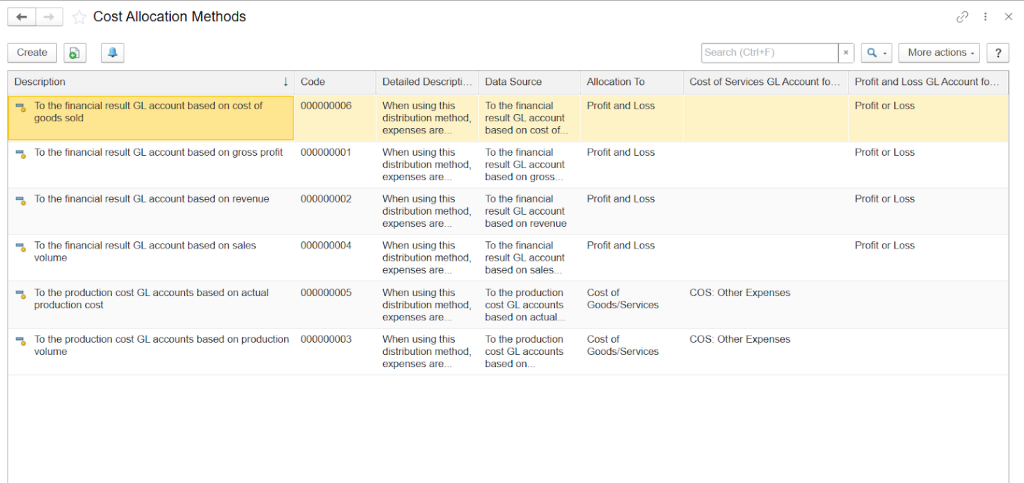

Methods for Estimating and Allocating Indirect Costs

Estimating indirect costs begins with identifying all overhead expenses for the year and grouping them into an overhead pool. Since these costs support every project, a method is needed to distribute them fairly.

Common allocation approaches include:

-

Percentage of direct costs. Overhead rate = Total Indirect Costs ÷ Total Direct Costs.

-

Labor-based allocation. Overhead is applied according to project labor hours or labor cost.

-

Revenue-based allocation. Used when project sizes vary significantly, and labor is not the main driver.

Choosing a method depends on the project mix and business structure. The key is consistency so that direct and indirect cost in construction remain aligned with how the company actually operates. When allocation is stable, contractors gain clearer visibility of margins and can detect overhead drift earlier.

Prevent cost overruns

Register expenses in FirstBit ERP

Request a demo

Direct and Indirect Cost in Construction: Key Differences

Direct and indirect cost in construction serve different purposes, yet both shape the accuracy of a project budget. Understanding these differences helps contractors create stronger bids and predict profitability more reliably. When teams confuse the two, costs fall into the wrong buckets, and project performance becomes harder to measure.

Clear separation also improves internal reporting. Direct costs provide a view of site-level performance, while indirect costs reveal the true cost of running the business. This split allows decision-makers to understand whether margin issues come from execution or from overhead pressure.

Traceability, Allocation, Variability

Direct costs are traceable to a single job. They appear only because that project exists. Labor for a specific installation, materials delivered to the site, and subcontractor packages all fall into this category.

Indirect costs are shared across multiple jobs. They require allocation because they cannot be linked to a single activity. Office rent, administrative salaries, and insurance are all overhead costs that remain whether projects start or finish.

Variability differs as well. Direct costs change with quantities and scope, while indirect costs often stay more stable. This is why estimates must treat direct and indirect cost in construction differently during planning.

Impact on Budgeting, Bidding, and Profitability

Incorrect classification is one of the most common causes of inaccurate bids. When indirect costs are treated as direct costs, project budgets appear inflated, and bids become less competitive.

The opposite mistake is more damaging. When direct costs are misclassified as indirect, overhead pools become too large and individual projects look more profitable than they are. This can lead to underbidding, hidden losses, and margin erosion.

Consistent classification allows contractors to compare performance across jobs. It becomes easier to see whether a project is genuinely efficient or only appears efficient because overhead is being spread unevenly.

Fixed vs Variable Costs Within Both Categories

Both direct and indirect cost in construction include fixed and variable components. For example:

Fixed direct costs:

-

A project manager assigned full-time to one job

-

Long-term equipment rentals are booked for a fixed period

Variable direct costs:

-

Concrete volumes

-

Rebar quantities

-

Labor hours tied to productivity rates

Fixed indirect costs:

-

Office rent

-

Annual software licenses

-

Salaries for executive staff

Variable indirect costs:

-

Office utilities

-

Fuel for shared vehicles

-

Temporary staffing during peak seasons

Recognizing these patterns helps contractors predict how costs will behave when scope changes or when the company takes on more projects.

How to Build an Accurate Project Budget with Direct and Indirect Cost in Construction

Building an accurate budget starts with understanding how direct and indirect cost in construction behave across the project lifecycle. A clear structure helps contractors anticipate spending, plan cash flow, and set realistic expectations with clients. When teams follow a consistent budgeting process, projects benefit from stronger cost visibility and fewer surprises.

This framework is useful for companies of all sizes. Whether a contractor handles a single job at a time or manages a full pipeline of work, a repeatable approach ensures that both direct cost and indirect cost in construction project plans remain stable and comparable.

A well-built budget also supports decision-making throughout execution. As the project evolves, managers can track actuals against planned values and adjust based on the performance of both direct and indirect cost in construction.

Step 1: Detailed Direct Cost Estimation

Accurate budgets begin with direct cost in construction, which requires careful measurement of quantities and productivity. Every material, labor hour, and equipment requirement must be captured from drawings and specifications.

A structured takeoff helps convert design information into measurable units. For example, concrete, formwork, steel, wall partitions, tiles, and MEP components each receive their own quantity and unit rate. This ensures that direct cost and indirect cost in construction project estimates reflect the true scope.

Most contractors rely on a combination of supplier quotes, historical data, and productivity benchmarks to build unit rates. The clearer these assumptions are, the more reliable the final direct cost baseline becomes.

Step 2: Identification and Allocation of Indirect Costs

Once direct costs are established, the next step is calculating indirect cost in construction. Overhead includes all shared expenses that support project delivery, and it must be measured before bids are finalized.

A common approach is to gather annual overhead costs and group them into categories such as administration, insurance, technology systems, fleet, and executive oversight. These costs are then allocated to projects using a consistent method.

Contractors typically use one of three allocation bases:

-

Percentage of direct costs

-

Labor hours or labor cost

-

Revenue-based allocation

Using a consistent method ensures that direct and indirect cost in construction remain aligned and that pricing reflects the true cost of running the business.

Step 3: Incorporating Contingency and Risk Factors

After both direct and indirect cost in construction project estimates are defined, contractors add contingency to protect the budget against uncertainty. Construction work often involves risks such as material price increases, design changes, weather delays, and productivity fluctuations.

Contingency levels depend on project type and design maturity. Early-stage estimates usually require a higher allowance, while late-stage estimates can carry lower risk. It is important to apply contingency to both direct and indirect cost categories so overhead exposure is not underestimated.

A good practice is to link contingency to specific risks rather than using a flat percentage. This makes the budget more transparent and easier to defend during pricing discussions.

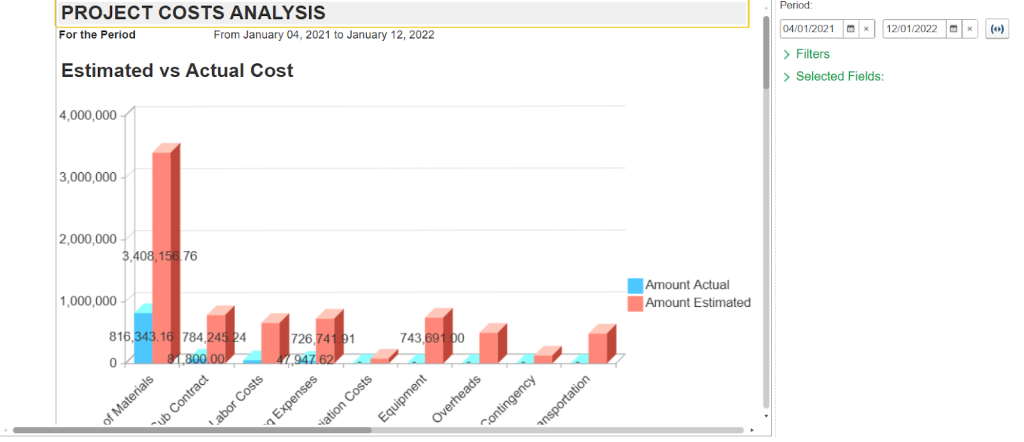

Step 4: Monitoring and Adjusting During Project Execution

Even the strongest budget needs active monitoring once construction begins. Tracking actual costs against planned values helps managers detect issues early and adjust schedules or resources where needed.

Regular reporting cycles provide visibility into trends such as labor overruns, equipment downtime, or material wastage. These insights help improve forecasting accuracy and support decisions that protect margins.

Modern ERP systems make this process easier by showing real-time data for both direct and indirect cost in construction. When variances appear, teams can act quickly to prevent small issues from becoming major cost disruptions.

Keep every project on budget

Request a demo

How FirstBit ERP Helps Track Direct and Indirect Costs in Construction

Tracking direct and indirect cost in construction requires reliable data, consistent cost codes, and a clear financial structure. When project teams work across procurement, site operations, and accounting, misclassifications can occur easily. FirstBit ERP helps maintain discipline by centralizing all cost information in one system and ensuring it follows a consistent structure.

-

Structured cost coding for all expenses. Each material purchase, labor entry, subcontractor invoice, and equipment charge can be assigned to defined cost codes, preventing mixing of direct and indirect cost in construction projects.

-

Direct cost tracking at the activity level. Project teams can link labor hours, material deliveries, and equipment usage directly to specific work items, keeping the direct cost in construction clear throughout execution.

-

Defined overhead pools for indirect costs. Administrative salaries, rent, insurance, IT, and other shared expenses can be grouped into overhead categories, creating a transparent structure for indirect cost in construction.

-

Automated allocation rules. Overhead can be distributed across active projects using percentage-of-direct-cost, labor-based, or revenue-based methods, ensuring consistent application of indirect cost and avoiding manual errors.

-

Real-time comparison of planned vs. actual costs. Variance reports show when labor, materials, or overhead deviate from the budget, allowing early correction instead of end-of-month surprises.

-

Cost-to-complete and cash flow forecasting. The system uses current spending trends to project remaining direct and indirect cost in construction, helping managers anticipate financial needs before issues escalate.

-

Unified project financial history. Every cost entry, direct or indirect, remains traceable, making internal reviews, audits, and client reporting more transparent and reliable.

By organizing project, financial, and overhead data within one platform, FirstBit ERP helps contractors maintain accurate visibility of direct and indirect cost in construction and supports more stable, informed budgeting across all projects.

Conclusion

Understanding how direct and indirect cost in construction fit into the broader financial structure of a project gives contractors a clearer foundation for planning and decision-making. When each cost has a defined place, the entire budgeting process becomes more predictable, from the initial estimate to the final stages of execution.

A well-organized cost structure also supports long-term business health. It helps contractors evaluate which projects perform reliably, where operational efficiency can improve, and how future bids should be shaped to reflect realistic financial conditions.

As the construction market continues to evolve, cost clarity will remain one of the most valuable tools available to project managers and finance teams. Companies that invest in consistent cost tracking and structured budgeting gain more confidence in their numbers and build a stronger base for sustainable growth.

Get paid faster and on time

Automate invoice creation by milestones with FirstBit

Request a demo

FAQ

What is the difference between direct and indirect construction costs?

How do you know if a cost is direct or indirect?

What are the 5 examples of indirect costs?

What is an indirect cost for a contractor?

Umme Aimon Shabbir

Editor at First Bit

See FirstBit ERP solutions in action

Discover how our system solves the unique challenges of contractors in a personalized demo.

After the demo you will get a quotation for your company.

After the demo you will get a quotation for your company.