Activity-Based Costing (ABC) is a costing method that allocates overhead and indirect costs based on the activities that generate those costs. Unlike the traditional costing method, which often uses broad averages, such as labor hours, ABC assigns costs to specific activities. This provides businesses with a more accurate understanding of their true costs.

The activity-based costing method enables better decision-making by revealing how resources are consumed across different activities. It helps optimize resources, improve profitability, and streamline cost management. For industries such as construction, where overhead costs can vary significantly between projects, ABC costing is particularly valuable.

This guide explores how the activity-based costing system works, its benefits and limitations, and how it can be applied in construction and beyond. We will also discuss how ERP systems, such as FirstBit ERP, can support the implementation of ABC for more efficient cost management.

A review of 348 firms found that ~50% reported using an activity‑based costing system, and users of ABC reported "significantly improved accuracy of overhead cost allocation and better support for decision‑making" compared to non‑users[?].

What Is Activity-Based Costing

Activity-Based Costing (ABC) is a method for assigning overhead and indirect costs to products, services, or projects based on the actual activities that generate those costs. Unlike traditional methods, which rely on broad averages, the ABC activity-based costing method links costs to specific tasks that consume resources. This provides a more accurate picture of costs.

Key Concepts of Activity-Based Costing:

- Activity. A task or event that consumes resources and generates costs. For example, activities could include machine setup, quality inspections, or material handling.

- Cost-pool. A grouping of costs related to a specific activity. For instance, all labor-related costs could be grouped into a cost pool for an activity like assembly.

- Cost-object. The item for which the cost is being measured, such as a product, service, or project.

- Cost drivers. The factors that cause the consumption of resources by an activity. Examples include labor hours, machine hours, or units produced.

By using the ABC costing system, businesses gain deeper insights into their cost structures[?]. This understanding helps identify inefficiencies, improve resource allocation, and make smarter pricing and budgeting decisions.

Activity‑Based Costing vs. Traditional Costing: Key Differences

While both the activity‑based costing (ABC) method and traditional costing allocate overhead and indirect costs, they differ significantly in how those costs are assigned. These differences affect cost accuracy, visibility, and decision‑making.

| Aspect | Traditional costing | Activity‑Based Costing (ABC) |

| Cost drivers | Uses one broad driver, such as labor hours or machine hours. | Uses multiple drivers linked to specific activities (e.g., setups, inspections). |

| Cost allocation | Spreads overhead broadly and may distort true cost relationships. | Allocates costs based on actual activity consumption, yielding tighter accuracy. |

| Cost visibility | Lacks detail on which specific tasks or processes drive cost. | Provides transparency on how different activities contribute to the cost structure. |

| accuracy | Suitable for uniform operations but weaker when operations are complex or varied. | Stronger in complex, diverse operations where cost drivers vary significantly. |

A recent study of manufacturing firms found that implementing the activity‑based costing system resulted in more accurate cost allocations and improved decision‑making compared with traditional costing[?].

By contrasting traditional costing with an activity‑based costing system, firms can gauge whether the extra complexity of ABC will deliver meaningful benefits in their context[?]. For organizations with diverse processes and high indirect costs, adopting ABC may unlock better insights and control.

Prevent cost overruns

Register expenses in FirstBit ERP

Request a demo

Benefits of Activity-Based Costing and Its Limitations

Activity-Based Costing (ABC) offers several benefits that can lead to more accurate cost allocation, better decision-making, and improved profitability. However, like any system, it comes with its own set of limitations. Understanding both the advantages and challenges of ABC is crucial for businesses considering its implementation.

Advantages of Activity-Based Costing

The primary advantage of ABC costing lies in its ability to allocate overhead costs more accurately. By providing detailed cost visibility, ABC helps businesses make better decisions and improve profitability. Key benefits include:

- More accurate job costing. ABC costing offers a clearer view of costs by linking them directly to the activities that drive them. This helps businesses understand the true cost of each product, service, or project.

- Improved estimating, bidding, and pricing decisions. With activity-based costing, firms can more accurately estimate project costs, ensuring their bids are competitive while remaining profitable.

- Better resource allocation and cost control. ABC costing helps identify inefficient or high-cost activities, such as excessive setup time or multiple change orders. This visibility enables companies to optimize processes and reduce waste.

- Strategic insights into profitability. ABC costing enables businesses to assess which projects, clients, and activities are most profitable, allowing them to focus on high-margin work.

- Flexibility in adjusting to changes. Since costs are linked to activities rather than volume, ABC allows businesses to quickly adjust cost estimates when project scopes change, ensuring accurate cost management throughout a project’s lifecycle.

Limitations of the Activity-Based Costing Method

While the benefits of activity-based costing are significant, it’s important to be aware of its limitations. Implementing and maintaining an ABC system requires considerable effort and resources. Some of the key limitations include:

- High implementation costs and complexity. Setting up an ABC system requires significant investment in data collection tools, employee training, and process changes, which can be difficult for smaller businesses.

- Challenges with data collection and measurement. ABC requires precise data on each activity, which can be difficult to gather, particularly in industries like construction, where project variables often vary.

- Potential misallocation of costs. Without proper definitions for cost drivers or accurate categorization of activities, ABC may lead to misallocated costs and inaccurate data, undermining its effectiveness.

- Limited benefit in simple operations. For businesses with relatively simple, repetitive processes, traditional costing methods may suffice. In such cases, the complexity of ABC costing may be unnecessary.

- Ongoing maintenance. ABC costing requires continuous review and updates, especially as project variables and cost drivers change. This ongoing maintenance can add to the operational burden.

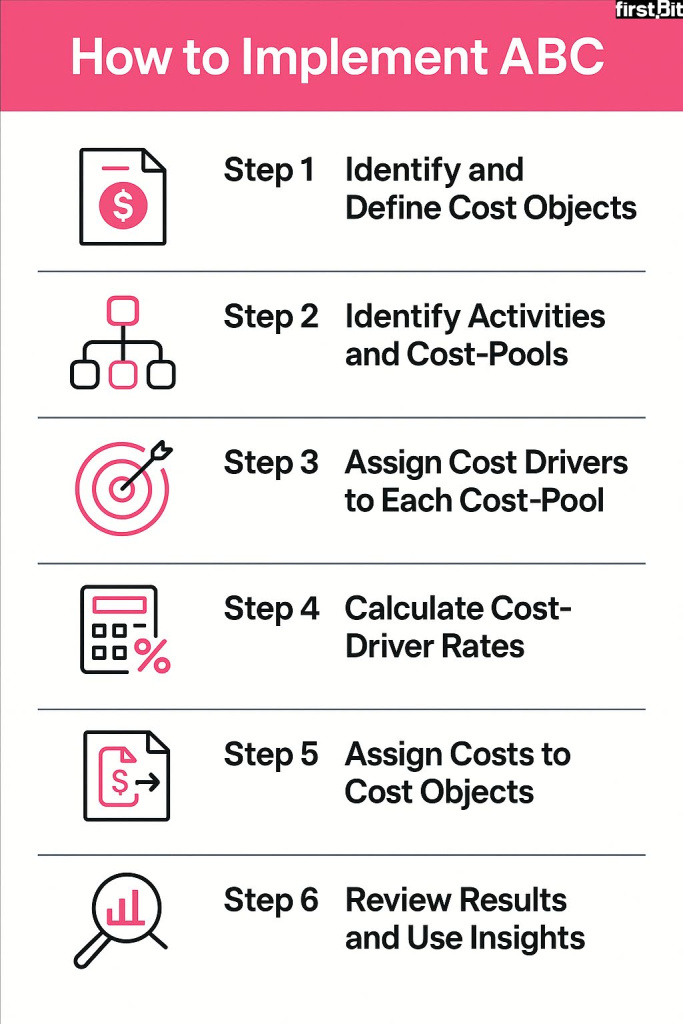

How to Implement ABC Activity-Based Costing

Implementing an Activity-Based Costing (ABC) system can significantly enhance a company’s ability to manage costs, but the process requires careful planning and execution. Below are the key steps to successfully adopt ABC within an organization.

Step 1: Identify and Define Cost Objects

The first step in implementing ABC is to identify what you will be assigning costs to. These are your cost objects, which can be products, services, projects, or even customers. Clearly defining these objects is critical, as they serve as the foundation for cost allocation.

By identifying cost objects, businesses can ensure that they track costs accurately for each key element of their operations.

Step 2: Identify Activities and Cost-Pools

Once cost objects are defined, the next step is to identify the various activities within your organization that consume resources. These are grouped into cost pools, where costs associated with a particular activity are accumulated.

For example, if you’re managing a construction project, you might have cost pools for activities such as equipment setup, labor, materials handling, and inspections. Understanding which activities drive costs is essential for effective cost allocation.

Step 3: Assign Cost Drivers to Each Cost-Pool

Each cost pool should be linked to a specific cost driver, a factor that influences the consumption of resources for that activity. For example, a cost-driver could be the number of machine hours used or the number of items produced.

Identifying and assigning appropriate cost drivers ensures that the costs are allocated accurately to the activities that actually incur them, avoiding cost distortion.

Step 4: Calculate Cost-Driver Rates

Once cost drivers are identified, the next step is to calculate the cost-driver rates. This is done by dividing the total cost of each cost-pool by the total quantity of the cost driver.

For example, if the cost pool for labor is $100,000, and the cost driver (number of labor hours) is 5,000 hours, the cost-driver rate would be $20 per labor hour. This rate will be used to allocate costs to the relevant cost objects.

Step 5: Assign Costs to Cost Objects

Using the cost-driver rate, you can now assign costs to the defined cost objects. Multiply the cost-driver rate by the number of cost drivers consumed by each cost object.

For example, if a project used 500 labor hours, and the labor cost rate is $20 per hour, then $10,000 would be allocated to that specific project as part of its overhead.

Step 6: Review Results and Use Insights

After allocating costs, it’s crucial to review the results and assess the profitability of each cost object. This analysis can provide valuable insights into which activities or products are most profitable, which processes are inefficient, and where improvements can be made.

ABC allows businesses to make data-driven decisions that enhance profitability and reduce waste. It’s important to regularly update the ABC system as activities, cost drivers, and business conditions change.

Keep every project on budget

Request a demo

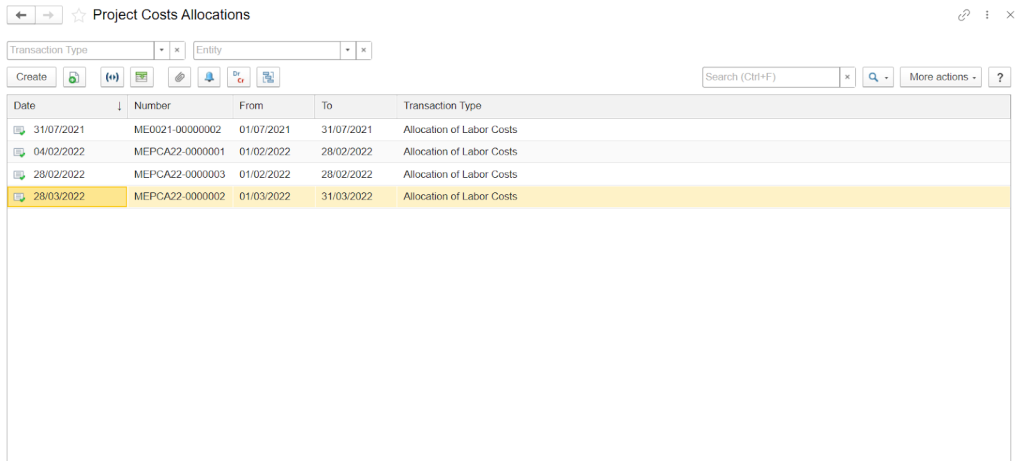

How FirstBit ERP Supports Activity‑Based Costing in Construction

In the context of implementing an activity‑based costing (ABC) system, selecting an ERP that supports detailed tracking of activities, cost‑drivers, and cost‑objects is critical. FirstBit ERP offers several modules and functions that align well with ABC principles and help contractors manage their indirect costs more precisely.

Cost Allocation and Real‑Time Visibility

FirstBit ERP provides project cost‑control features, including budgeting, cost allocation, and profitability tracking. Contractors can upload bills‑of‑quantities (BOQs), allocate materials, labour, and overheads to individual projects or cost‑objects, and monitor actuals versus budget. This supports the “cost‑object” and “cost‑pool” components of an activity‑based costing system.

Multiple Cost Drivers Integration

The system supports procurement, equipment management, warehouse management, and project management in one integrated platform. These multiple operational modules allow for identifying and tracking different cost‑drivers (for example, equipment hours, material moves, labour hours), which is key in the activity‑based costing method.

Site‑to‑Office Synchronisation and Data Accuracy

FirstBit ERP enables real‑time monitoring of site and office activities, offering dashboards for project progress, equipment utilisation, and budget status. This supports the ABC requirement for accurate data capture of activities so that allocations reflect actual resource consumption rather than estimates.

Analytics and Insight for Decision‑Making

With integrated dashboards, real‑time reporting, and analytics, FirstBit ERP helps firms identify high‑cost activities and cost drivers, thereby supporting strategic decisions on pricing, bidding, and performance improvement. For companies adopting the activity‑based costing method, this capability is a strong enabler of more granular cost visibility.

Benefits Through Integration

Because FirstBit ERP integrates multiple departments (finance, HR, project management, procurement) into a single system, a contractor can maintain one consistent cost model rather than disparate spreadsheets. This reduces the risk of misallocation of costs and supports the ongoing maintenance of an activity‑based costing system.

When adopting an activity‑based costing system, choosing an ERP that supports multiple cost drivers, real‑time tracking, and integrated departmental processes is essential. FirstBit ERP offers a robust platform for such implementation, especially for contractors with complex projects, multiple cost‑objects, and indirect overheads.

Still, the value of activity‑based costing lies not just in the software but in how clearly a firm defines its activities, cost‑pools, and cost‑drivers and maintains the system over time.

Conclusion

Activity-Based Costing (ABC) provides a more accurate and detailed method for allocating overhead costs. While it requires time and effort to implement, the benefits of ABC in terms of better cost management and decision-making are clear. For businesses in industries like construction, where indirect costs play a significant role, ABC can offer critical insights into cost structures and profitability.

Choosing the right ERP system, such as FirstBit ERP, that supports the ABC method can significantly enhance your ability to implement and maintain a robust cost management system. By embracing ABC costing, companies can optimize resources, improve profitability, and make more informed strategic decisions.

Protect your profit margins

Use FirstBit to compare planned vs. actual costs

Request a demo

FAQ

What is activity-based costing (ABC)?

Why is ABC better than traditional costing for construction companies?

What are the main benefits of using ABC?

How does ABC help with cost control on construction sites?

How does ABC support decision-making in construction?

Umme Aimon Shabbir

Editor at First Bit

See FirstBit ERP solutions in action

Discover how our system solves the unique challenges of contractors in a personalized demo.

After the demo you will get a quotation for your company.

After the demo you will get a quotation for your company.