Managing the payroll process in UAE can be difficult. However, it is a critical part of the business and rules must be followed to be compliant with the local laws in the UAE. Here is the guide which will help you to set up payroll processes in the UAE step by step and make sure you are compliant with all the rules.

Regulations for the Payroll Process in UAE

In the UAE, you must comply with multiple payroll regulations and ensure that these rules get followed for each employee. Payroll is the management, distribution of funds, wages, any benefits or deductions. However, the UAE has some unique regulations that you have to keep in mind when setting up payroll:

-

Adhering to UAE labor laws. The labor laws outline the rules that employers and employees must follow.

-

Processing WPS payments. Employers are obliged to pay the wages of employees through a WPS system to ensure the timely pay of these wages.

-

Free zones in the UAE. Free Zones have their own regulations and rules and often come with extra incentives to start businesses in this region.

-

Gratuity payments. The employees who have worked one or more years, are entitled to End-of-Service gratuity payments. The employer must calculate and distribute these payments accurately.

-

No income tax. There is no income tax charged on wages in the UAE, however companies must still check if they’re required to pay Value Added Tax (VAT) or corporate tax.

Payroll Challenges in UAE

As an employer you must make sure that the payment of the salary of each employee is made within 10 days after the due day. To ensure the timely payment of these salaries the UAE implemented the UAE Wages Protection System (UAEWPS). All employers that are registered with the MoHRE, will have to be subscribed to the UAEWPS. If an employer fails to pay the employees in time, there can be consequences for the business.

One of the biggest challenges will be keeping track of the overtime for each employee and making sure that the salaries get paid on time through the right systems. This is why having a good time tracking system in place is very important for every business and for monitoring working hours accurately.

Most Recent Changes That Have an Impact on Payroll Management

Since 2022 the MoHRE work contracts have been introduced. These contracts are for expats and nationals who want to work in the UAE, including Dubai.

-

Limited Contract. A contract with a set start and end dates in which the employer must pay the employee. The contract can be up to 3 years, after which it will cease unless both parties agree to renew it.

-

Unlimited Contract. Has no expiration date, but can be terminated by the employee with a 30 days notice. If the employee fails to give the notice, the employer can get compensation. The employer has to compensate in case they end the contract without justification.

-

Full-Time Contract. An employee with a full time contract must work 48 hours per week. If they need to work more, overtime has to be paid.

-

Part-Time Contract. The employee must work less than 48 hours, but the exact amount of hours has to be agreed on by both the employer and the employee.

Key Payroll Features

To comply with labor laws and payroll laws, you must understand how the key payroll features work in the UAE. These payroll features can be quite different from other rules in different countries. There are also some payroll features that are different in between industries within the UAE.

General Payroll Regulations

Some payroll features and requirements all employers will have to adhere to across multiple sectors in the UAE.

Paid Vacation Days / Annual Leave

After completing at least one year of work, the employer must give each employee 30 days of paid leave. These 30 days should be used within the year that they become available. Companies can also have policies that can carry these days over to the next year, ensuring proper integration into the payroll process.

Paid Sick Days

Employees get up to 90 paid sick days per year, if they can provide a note from a doctor within 48 hours of the first day of sick leave. For the first 15 days of this period, the employer must pay 100% of the base salary, while the following 30 days have to be paid with 50% of the base rate.

Maternity Leave

In the UAE women can get up to 60 days of maternity leave. From these 60 days, 45 days have to be fully paid. For the rest 15 days the women will receive 50% of their normal pay. The maternity leave can start up to 30 days before the birth of the child.

Paternal Leave

Unlike the maternity leave, men who become fathers only get 5 days of paternal leave before they have to come back to their job. These 5 days can be used however they want in the first 6 months of the child’s life.

Payroll Cycle

Employers in the UAE must pay the employee once a month. This is typically done on the last day of the month. The payments are made in the local currency: United Arab Emirates Dirham (AED).

Employer Contributions

Next to the monthly payment of the employee’s salary, the employers are obliged to withhold and submit the social security payments to the right administration. The social security contribution for the employer is 12.5% of the monthly salary of the employee. This is with a minimum salary of 1,000 AED and a maximum salary of 50,000 AED.

As an employer, you will only have to pay the 12,5% social security contribution for UAE nationals. The Government will contribute another 5%. However, in Abu Dhabi the regulations are different. In this emirate the employer must withhold and submit 15% of the employee’s salary to social security, while the Government must pay 6%. Regardless of the emirate, expats do not have to make these contributions.

Workweek

The workweek can be up to 48 hours. If employees need to work overtime, this will have to be paid at 125% of their regular salary rate. If the overtime has to be performed during night time, from 9 p.m. to 4 a.m., the overtime pay has to be 150% of the regular salary rate.

Keep labor costs under control

Track attendance and pay only for actual work hours

Request a demo

Unique Considerations for the Construction

There are some unique rules for the construction industry that slightly differ from the general payroll rules in the UAE. One of the biggest differences is the amount of hours that is counted towards the workweek and the overtime pay.

-

Workweek. Full time contracts for other sectors will have a maximum of 48 hours per week. For the construction industry however, the workweek can legally have up to 54 hours.

-

Overtime pay. Another difference in payroll in construction is, that whenever construction workers have to work overtime, they’re paid 150% of their base salary.

-

Scheduling. Since construction is hard labor and the UAE is a country with a climate that often reaches temperatures of 40º Celsius, the work schedule of construction is planned around the hottest moments in the day.

A Step-by-Step Guide to Setting Up Payroll Process in UAE

If you are looking to streamline your payroll process in the UAE or if you want to make sure that your payroll is compliant with the local laws and regulations, these steps will help you to achieve this.

1. Get a Trade License

Before you can hire employees, you must get a trade license from the right authorities. To obtain these documents, you are required to submit certain documents such as:

-

The business plan

-

Information on shareholders

-

Information on directors

-

The Memorandum of association

When all these documents have been submitted, reviewed and approved, the business will receive the trade license. This license shows that you are allowed to operate and hire employees in the UAE.

2. Register Your Business With the MoHRE

As an employer you are required to register with the Minister of Human Resources and Emiratisation. This department oversees employment matters in the UAE. The registration process involves the following:

-

Submitting the trade license

-

Sharing contact information

-

Explaining the activities of the company

As soon as you are registered with the MoHRE you will be given a registration number. This number is mandatory to obtain certain work permits. It is also necessary to be compliant with the local labor laws in the UAE.

3. Set up the Employment Contracts for Your

Now that you can legally operate and hire employees in the UAE it is time to actually hire your workers. Each worker will need their own contract with specific salaries and benefits. This is a legally binding contract which will outline the following:

-

The salary and the benefits the employee will receive

-

When the salary gets paid

-

A specific outline of the workweek

-

Details on overtime and how it gets paid

These contracts must be compliant with the local regulations and the UAE labor laws. A contract is valid when it is signed by both parties. Make sure that the contract is both in English and Arabic.

There is no predetermined minimum wage in the UAE. However, employers must cover at least the basic needs of the employees.

4. Get the Paperwork of Expat Workers in Order

If you are planning on having expats as employees, you will have to get their paperwork in order. The paperwork these expats needs are:

-

Work permits

-

Residency visas

As the employer you will be responsible for submitting all the needed documentation such as the work contract, the employee’s passport and your trade license. The costs of these processes are also for the employer. When approved, the employee will get a work permit and a residency visa. These are generally valid for 2 years.

5. Set up your Payroll System

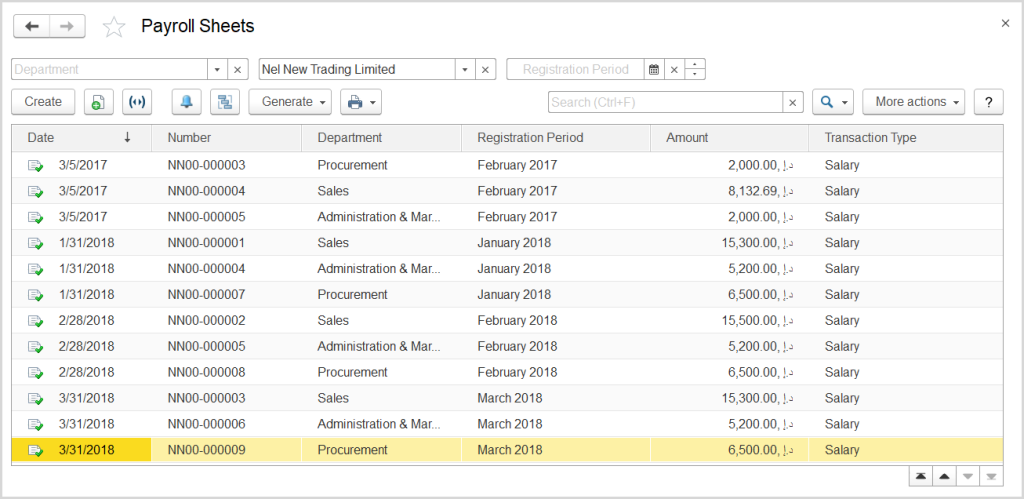

Set up a payroll system that is compliant with the regulations of the UAE. This includes keeping a record and paying the salaries in a timely manner. There are multiple payroll software options that you can choose from. If it is too much to manage, you can always outsource the payroll management to external providers. However, we suggest trying First Bit ERP to streamline your Payroll Management.

6. Process Payroll

Now that you have all the right documents and permits it is time to actually process the payroll. You must process the payroll following the agreed schedule, this includes getting the salaries of your employees in their bank accounts through direct deposits or electronic funds transfers. Other options to make payments to your employees include cheques or cash.

You must also provide detailed payslips for your employees that outline the following information:

-

The gross salary

-

The net salary

-

Any benefits

-

The deductions

-

Overtime pay

It is important to keep the payroll process as transparent as possible so your employees are less likely to be confused about the payroll systems.

When processing payroll, the business must also keep a clear record of payment details, employee information, salaries and dates of payment. This record is important for audits to showcase that you are compliant with all regulations and laws. It is mandatory to keep these records for at least 2 years and make them available to relevant authorities such as the MoHRE.

7. Submit the Information to WPS

In the UAE companies are required to submit WPS reports on a monthly basis. These have to be submitted to the Central Bank. As a business you have to register with an approved WPS agent. The monthly report must contain the following employee salary information:

-

Gross salary

-

Allowances

-

Deductions

-

Net salary

This information is checked by the Central Bank of the UAE, who cross-check the information with the bank account deposits of the employee to make sure the business is Compliant with the payroll rules in the UAE.

Automate payroll calculation with full UAE Labor Law compliance

Request a demo

Payroll Management: Best Practices

To have efficient payroll processing for your business there are some best practices that you can follow:

-

Make a general payroll schedule. Having multiple employees on a different payroll schedule is a recipe for mistakes in the payroll processing. This is why it is advised to categorize your employees and make sure that all the employees in the same category follow the same payroll schedule.

-

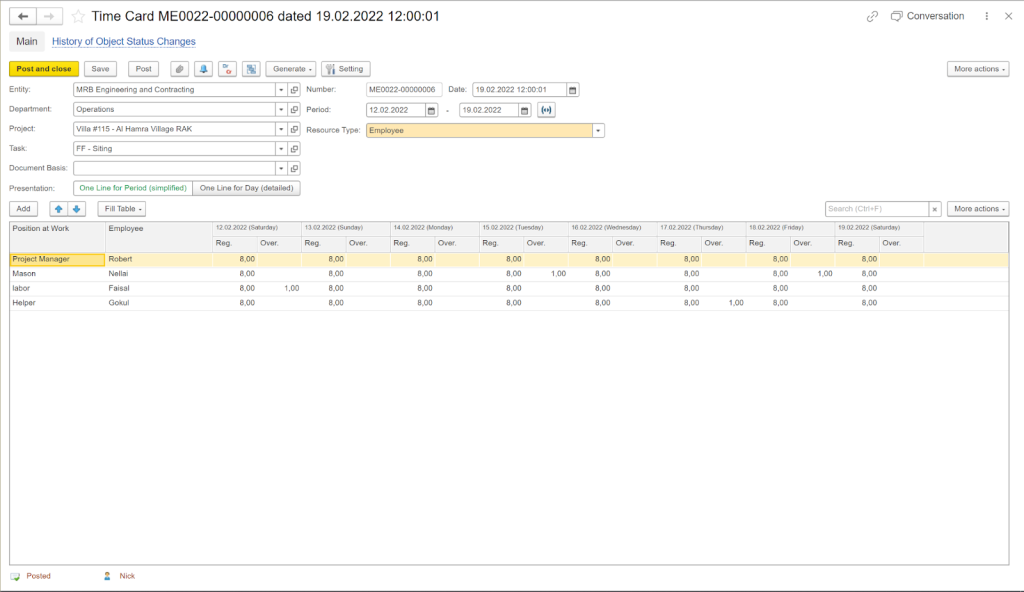

Use an employee attendance system. Implementing an attendance system is a must for efficient and good payroll management. This is to keep accurate track of employee hours and their attendance or absences to make the proper salary calculations. A good example is a time card system which is used a lot in construction projects.

-

Keep track of important deadlines and dates. All of the important deadlines are often known ahead of time. This is why it is important to also plan these deadlines so they can be handled in a timely manner. Important dates can be paydays or closing days of financial institutions.

Streamline your Payroll Management with First Bit ERP

Are you looking to efficiently manage payroll processes in the UAE, but you have no idea how you can achieve this? The First Bit ERP software can help you streamline this process and enhance the overall efficiency of the business. Here are some of the features that will help you manage the payroll process in the UAE.

Keeping Employee Records with the Personnel Record Expiry

Easily manage your employee records such as work contracts, personal documents, salary, designation and the role of the employee.

Tracking Attendance and Creating Timesheets

The First Bit ERP software supports integration with the UAE’s leading biometric attendance devices to help you manage absences automatically and track employee hours.

Time and Labor Management

The time and labor management feature of the First Bit ERP can help you make schedules and implement deadlines for certain tasks. This feature is especially beneficial for construction projects. Since construction managers often work with multiple teams that work different shifts and have tasks with dependencies.

Manage Payroll Reserves and End-of-Service Provisions

To ensure a timely payment of your employees, First Bit ERP will help you set aside funds for employee payroll and taxes to help you prevent any disruptions in the payroll process. This also includes the management of the end-of-service provisions, including gratuity, per UAE Labor Law.

Reward top talent effectively

Monitor performance with FirstBit ERP

Request a demo

FAQ about Payroll Management in the UAE

1. What are the processes of payroll?

2. What is the rule for basic salary in the UAE?

3. What is WPS payroll?

4. How do you manage payroll process?

5. How much VAT is charged on salary in the UAE?

6. Is there payroll tax in the UAE?

7. How are salaries calculated in the UAE?

Imanu Baldussu

Contributing Author

See FirstBit ERP solutions in action

Discover how our system solves the unique challenges of contractors in a personalized demo.

After the demo you will get a quotation for your company.

After the demo you will get a quotation for your company.