In construction projects, managing costs efficiently can make the difference between a profitable venture and one that goes over budget. One of the biggest challenges for project managers and contractors is properly allocating overhead costs, which can often be complex and hard to track.

Many project managers and accountants seek guidance on this topic because they’re grappling with questions like: "How do I allocate labor costs fairly?" or "Why does mismanaging labor costs inflate my project budget?" This challenge is even more critical when maintaining project profitability and avoiding cost overruns.

This article aims to bridge that knowledge gap. We'll break down what overhead costs are and why accurate allocation is crucial, as well as explore the various methods you can use to distribute them.

What is Overhead in Construction?

In construction, overhead refers to the indirect costs required to run a project but are not directly tied to specific construction activities or physical work. These include costs like administration, office expenses, insurance, equipment maintenance, and utilities.

While direct costs like labor and materials are easily assigned to a project, overhead costs are more complex because they support the entire operation rather than a single task.

For example, imagine you’re building a house. The costs for materials like bricks, wood, and concrete, along with paying the workers building the house, are direct costs. These are easy to assign to the project because they’re directly tied to the physical work being done.

However, while you’re building that house, there are other costs that aren’t as obvious but are still necessary to complete the project. For instance:

-

You need an office to manage all the paperwork and logistics of the project.

-

You pay office staff who aren’t at the construction site but are handling contracts, payments, and scheduling.

-

You have to pay for business insurance that covers you in case of accidents or damage.

-

The equipment you use on-site needs regular maintenance to stay in working condition.

None of these costs are directly part of building the house itself, but they’re essential to the project’s success. These are overhead costs. Even though you can’t point to them on the construction site, they’re happening in the background and need to be factored into the project’s total cost.

If you forget to account for these overhead costs when planning or pricing the project, you might find yourself losing money because the indirect costs are eating into your profits.

Why Overhead Costs Matter for Construction Budgets

Understanding the importance of overhead costs in construction is crucial for maintaining the financial health of your projects. Here is why they matter:

-

Accurate budgeting. Understanding and allocating overhead costs properly helps create more accurate budgets. Without including overhead, project costs can appear lower than they actually are, leading to unexpected expenses during project execution.

-

Assessing project profitability. Overhead allocation plays a vital role in determining project profitability. By accurately accounting for all indirect costs, project managers can better evaluate whether a project is generating a profit or loss.

-

Improving bid accuracy. A major challenge in construction is preparing accurate bids. Including overhead in your bids ensures that you account for all necessary costs, which improves the likelihood of submitting competitive and profitable bids.

-

Allocate resources effectively. Allocating overhead costs helps construction managers better understand resource usage across different projects. This insight allows for more strategic resource allocation, avoiding waste, and maximizing efficiency.

-

Identify cost-saving opportunities. Breaking down overhead costs allows you to identify potential areas for cost savings. Reviewing recurring expenses may allow you to cut unnecessary costs or renegotiate contracts with vendors.

-

Client transparency. Allocating overhead costs clearly and accurately improves transparency with clients. By explaining where their money is going, you build trust and avoid potential disputes over unexpected charges.

Protect your profit margins

Use FirstBit to compare planned vs. actual costs

Request a demo

Calculating Overhead Costs: A Step-by-Step Guide for Construction Budgets

Allocating overhead costs can seem complex if you’re just getting started, but following a structured process will make it much easier.

1. Gather Your Costs

Start by listing all the indirect costs associated with your business and construction projects. You’ll need to separate them into two categories:

I. Fixed overhead costs

These are consistent, predictable expenses that don’t change much from month to month. Examples include:

-

Office rent

-

Utilities (electricity, water, internet)

-

Salaries for administrative staff

-

Insurance premiums

II. Variable overhead costs

These costs fluctuate depending on the specifics of the project. Examples include:

-

Maintenance costs for construction equipment

-

Temporary site office expenses

-

Fuel for machinery or vehicles

-

Project-specific legal or consulting fees

Tip: If you’re unsure where to find these costs, start by looking at your business’s financial statements, invoices, and receipts. Collect as much data as possible to avoid overlooking important expenses.

2. Calculate the Predetermined Overhead Rate

The Predetermined Overhead Rate is a calculation used to estimate overhead costs for a project before it begins. It helps businesses allocate indirect costs, like office expenses or utilities, to specific projects based on factors like labor hours, machine hours, or direct costs.

Think of it as a way to predict how much overhead you’ll need to allocate to each project, helping you budget more accurately.

The formula to calculate the predetermined overhead rate is:

Predetermined Overhead Rate = Total Estimated Overhead Costs / Total Estimated Allocation Base

-

Total Estimated Overhead Costs. This is the sum of all your expected indirect costs (e.g., rent, utilities, admin salaries) for the period.

-

Total Estimated Activity Base. This is the measure you’ll use to apply the overhead (e.g., total labor hours, machine hours, or direct costs) for the period.

Step-by-Step Example

Step 1: Estimate Your Total Indirect Costs

Start by figuring out how much indirect costs you expect to have over a certain period (like a year or a quarter). These could include:

-

Office rent: $30,000

-

Utilities: $5,000

-

Administrative salaries: $45,000

-

Equipment maintenance: $20,000

Total Estimated Overhead Costs = 30,000 + 5,000 + 45,000 + 20,000 = 100,000

Step 2: Estimate Your Total Activity Base

Next, decide what activity you’ll use to allocate overhead. The most common bases are:

Let’s say you expect your team to work 10,000 total labor hours over the period. This will be your Total Estimated Activity Base.

Step 3: Calculate the Predetermined Overhead Rate

Now, use the formula and plug in your numbers:

POHR = 100,000 / 10,000 = $10 per labor hour

This means that for every labor hour worked, you’ll allocate $10 of overhead costs to the project.

How to Use the Predetermined Overhead Rate

Once you have the predetermined overhead rate, you can apply it to specific projects as they happen.

Let’s say a new project is estimated to take 500 labor hours. To figure out how much overhead to assign to this project, multiply the POHR by the number of labor hours:

In this case:

Overhead for the Project = 10 × 500 = 5,000

So, you would allocate $5,000 in overhead to that project based on the labor hours.

3. Choose Your Allocation Method

There are several methods to allocate overhead, and the right choice depends on the nature of your projects. Here are some of the most common methods, explained simply.

I. Percentage of Direct Labor Hours

If you have multiple projects, allocate overhead costs based on the number of hours your workers spend on each project.

Best for: labor-intensive projects where the amount of time workers spend is the biggest cost factor.

II. Percentage of Direct Costs

Assign overhead as a percentage of direct costs (labor, materials, and equipment).

Best for: projects with substantial material or equipment costs.

III. Machine Hour Rate

Distribute overhead based on how many hours your equipment or machinery is used on each project.

Best for: projects that rely heavily on equipment, like large-scale construction or infrastructure work.

IV. Activity-Based Costing (ABC)

Allocate costs based on the specific activities that drive those costs. For example, if administrative tasks or equipment setup are key activities in your business, you assign overhead based on how much each project relies on these activities.

Best for: businesses that have diverse, activity-driven costs.

V. Square Footage Method

Overhead is distributed based on the size of the project.

Best for: large, spread-out projects, such as commercial or industrial buildings.

Tip: If you’re new to this, start with a simpler method like "Percentage of Direct Labor Hours" or "Percentage of Direct Costs." As you gain more experience, you can explore more advanced methods like Activity-Based Costing.

4. Implement Advanced Software

You could use basic accounting software to handle your project overhead calculations, and it will get the job done. However, if you want to be more strategic and accurate, an ERP system like FirstBit ERP is a better choice.

Unlike simple software that only does one thing, an ERP system brings everything together in one place. It connects accounting with procurement, payroll, project costs, and more. This integration helps reduce mistakes and keeps everything running smoothly. With an ERP system, you’ll have a clearer view of your projects and can make better decisions.

5. Review and Adjust

Periodically review your overhead cost calculations and make adjustments as necessary. Market conditions, project complexity, and other factors may change, requiring you to reallocate costs.

Key Tips for Allocating Overhead Costs

1. Pick the Right Measure

Choose an overhead allocation method that aligns with your project's characteristics and resource usage. For example, machine-heavy projects may benefit from using the machine hour rate method, while labor-intensive projects might prefer a labor-based allocation.

2. Group Costs Together

Keep similar costs grouped together for easier tracking and more accurate allocation. This makes it simpler to apply your chosen method and ensures that no costs are overlooked.

For example, you can put all labor-related expenses under a single category, such as "Labor Costs." This category could include various sub-costs like:

Grouping these costs under the "Labor Costs" category lets you easily track total labor expenses and allocate them accurately to different project phases or activities.

3. Stay Consistent

Consistency in your allocation method ensures that costs are distributed fairly across projects. Changing methods frequently can lead to confusion and errors.

4. Check and Update

Regularly review your overhead allocation process to ensure it remains accurate. Project conditions and cost structures change over time, so periodic adjustments are necessary.

5. Switch to Construction Management Software

Automating overhead cost tracking with construction management software can significantly improve accuracy and efficiency.

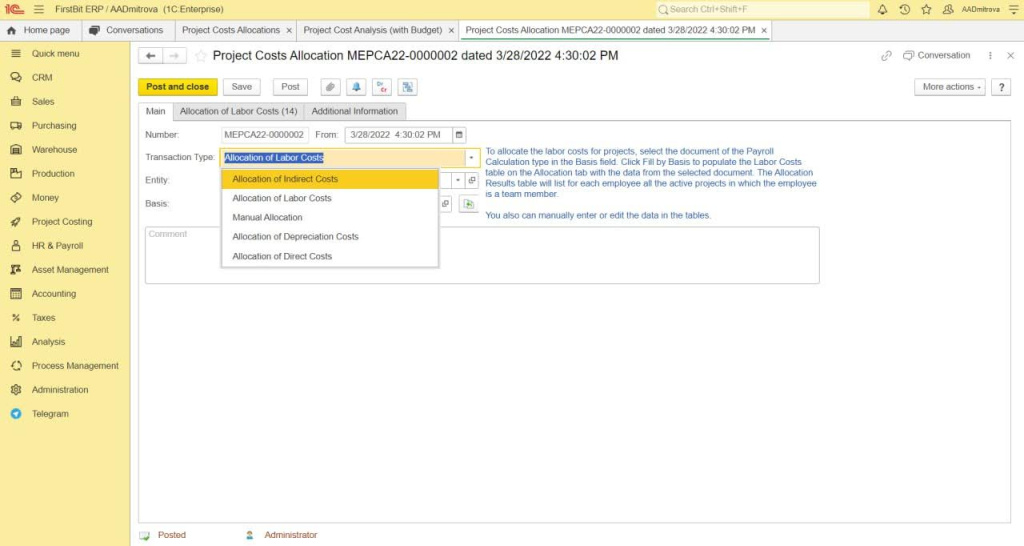

For example, FirstBit automates the allocation of overhead costs by allowing you to select the allocation of indirect costs, direct costs, and depreciation costs. It tracks actual overhead in real time, updates automatically as the project progresses, and provides customizable reports that detail cost breakdowns across different projects. You can also switch to manual allocation for more control.

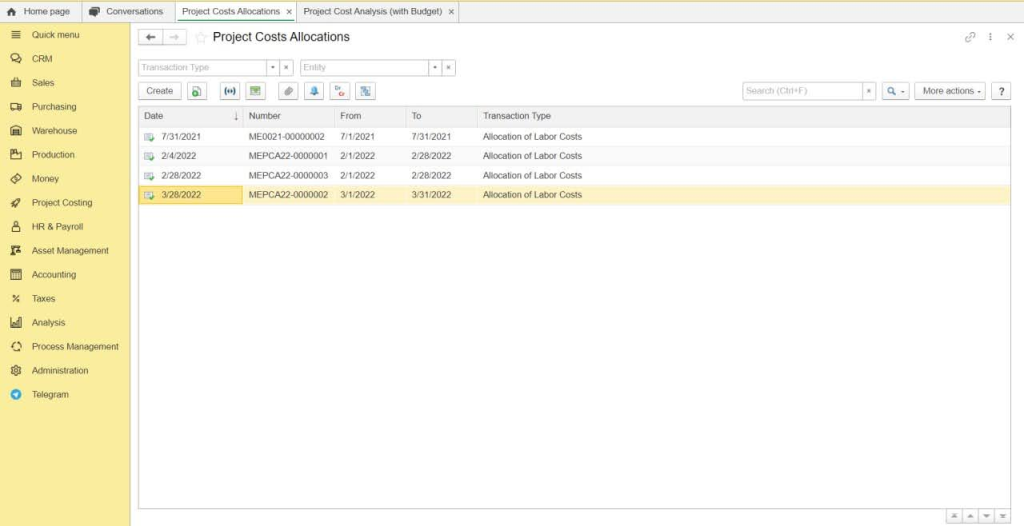

Project cost analysis in FirstBit ERP

Allocation of Indirect Costs in FirstBit ERP

6. Shop Around for Better Deals

Regularly review supplier contracts and look for opportunities to negotiate better rates, especially for recurring costs like equipment rentals or materials. This means you’ll have lower overhead costs, which makes it easier to manage your project budgets. When your overhead costs are lower, you don't have to charge as much to cover them.

For example, if you previously paid $10,000 a month for equipment rentals and managed to negotiate it down to $8,000, you've effectively lowered your overhead by $2,000.

7. Speed Up Your Payments

Faster payment cycles improve your cash flow, meaning you have more money available sooner to cover your expenses, including overhead costs. When clients or customers pay you more quickly, you don’t have to rely on other funds, like loans or reserves, to keep your business running smoothly. This can prevent financial strain on your project budgets because you can use the incoming payments to immediately handle overhead costs like salaries, utilities, or equipment rentals. It reduces the chance of having to delay payments to your suppliers, which can sometimes lead to penalties or higher costs down the road.

8. Keep Your Bills in Check

Monitoring your utility bills and other recurring expenses, like office supplies or maintenance fees, allows you to spot any unnecessary spending or sudden increases in cost. By closely monitoring these expenses, you can identify areas where you might be overspending and make adjustments, such as switching providers, reducing usage, or negotiating better rates.

Reducing these costs helps lower your overall overhead because they are part of the indirect expenses your business needs to function. The less you spend on recurring bills, the less overhead you need to allocate to your projects, making your business more cost-efficient.

Keep every project on budget

Request a demo

FAQ

1. Is it necessary to track small recurring expenses like utilities?

Absolutely! Even small recurring expenses, such as utilities, can add up and significantly impact your overhead. Monitoring these costs allows you to identify areas where savings can be made, which helps reduce overall overhead expenses.

2. How does automating overhead cost tracking with software help my business?

Automating overhead cost tracking with tools like FirstBit streamlines the process, improves accuracy, and reduces manual errors. It ensures real-time tracking and automatic overhead allocation, helping you maintain better control over your finances.

3. How does seasonal variation impact overhead allocation?

Seasonal changes can affect your overhead costs, especially for utilities and labor availability. For example, heating and electricity expenses may increase in winter, or labor costs might fluctuate with demand. It's essential to account for these variations when planning and adjusting your overhead allocation.

4. Can overhead costs include employee training or certifications?

Yes, training and certification costs for employees, especially those required for compliance with safety standards, can be considered part of your overhead. These costs indirectly benefit all projects by ensuring a skilled workforce.

Umme Aimon Shabbir

Editor at First Bit

Aimon brings a deep understanding of the modern construction business to her articles by providing practical content.