Handling transactions in multiple currencies brings a level of complexity many businesses underestimate. It’s not just about applying exchange rates; it’s about keeping financial records accurate when rates fluctuate, regulations vary, and reporting deadlines don’t wait.

Small issues like inconsistent conversions or delayed revaluations can lead to much bigger problems: distorted financials, compliance gaps, and missed insights. As operations expand across countries and currencies, the risk only grows.

In this article, we look at the practical challenges finance teams face when managing multi-currency accounting and share proven methods to improve accuracy, reduce manual work, and maintain compliance across jurisdictions.

What Is Multi-Currency Accounting?

Multi-currency accounting is the practice of recording financial transactions in more than one currency and accurately reflecting their value in financial reports. This includes:

-

Converting foreign transactions into the company’s base currency

-

Recording exchange rate gains or losses

-

Revaluing balances held in foreign currencies

-

Preparing consolidated reports for entities across currency zones

A UAE-based construction firm billing in euros for a project in Italy must convert that revenue into dirhams (AED) for internal reporting. If the euro weakens before payment is received, the firm may record a foreign exchange loss. Without proper processes, such discrepancies can distort financial performance and complicate tax reporting.

Key Terms and Concepts in Multi-Currency Accounting

Getting the basics right is essential before dealing with more complex reporting or compliance tasks. Below are core terms and concepts every finance team should understand:

-

Functional Currency: The currency of the primary economic environment in which a company operates. All financial reporting is typically done in this currency.

-

Presentation Currency: The currency used to present financial statements. It may differ from the functional currency in group reporting.

-

Foreign Currency Transaction: Any transaction denominated in a currency other than the functional one, e.g., purchases, sales, or loans in foreign currency.

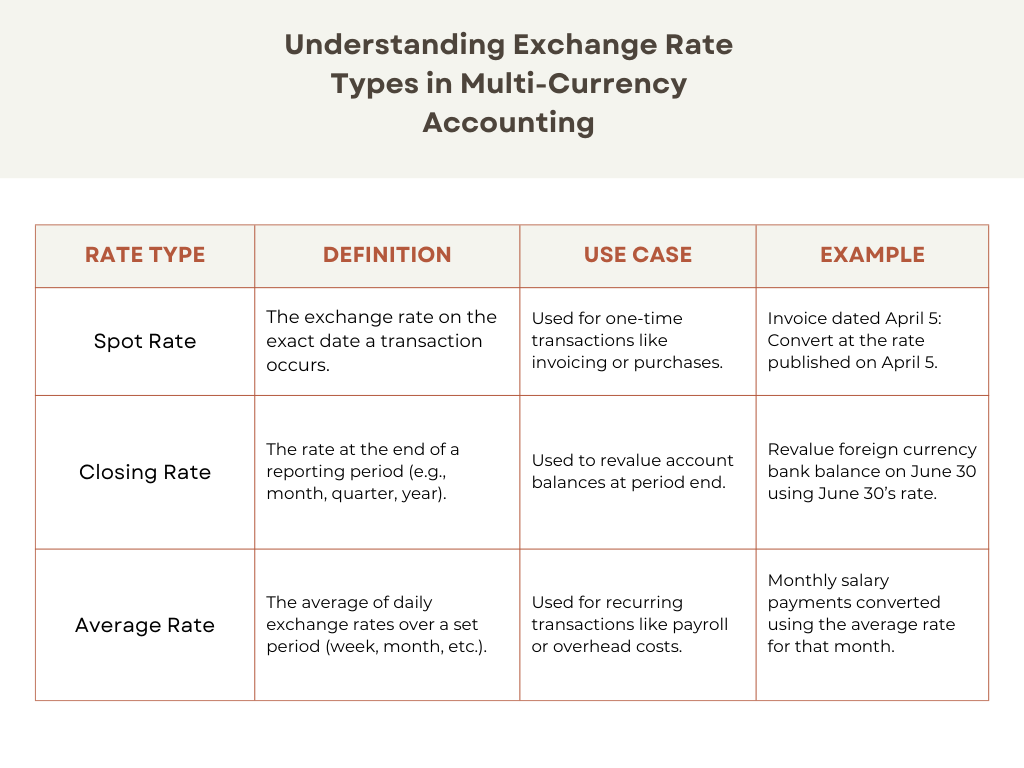

Exchange Rate Types:

-

Spot Rate: The rate on the date of the transaction

-

Closing Rate: The rate at the balance sheet date (used for revaluation)

-

Average Rate: Commonly used for income and expenses over a period

-

Exchange Gain/Loss: Happens when exchange rates change between the transaction date and the settlement or balance sheet date. Can be realized or unrealized.

-

Revaluation: Adjusting the value of foreign currency-denominated accounts to reflect the current exchange rate at period-end.

-

Translation: The process of converting the financial statements of foreign operations into the reporting currency during consolidation.

-

Cumulative Translation Adjustment (CTA): An equity account used to capture gains/losses from translating foreign subsidiaries during consolidation.

-

Hedge Accounting: A method of managing volatility in financial statements due to exchange rate movements. Applies to forward contracts and other hedging instruments.

Understanding and applying these concepts is the foundation for accurate financial reporting in multi-currency environments.

The Hidden Complexity of Managing Multiple Currencies

Handling transactions in more than one currency introduces a layer of risk and complexity that isn’t always obvious at the start. For a company processing a few invoices in euros or dollars, managing rates manually might seem feasible. But as operations scale across suppliers, clients, banks, and locations, the margin for error grows fast.

The complexity increases with every new jurisdiction, subsidiary, or change in regulations. Without the right tools and processes, teams can spend hours reconciling accounts, chasing down rate discrepancies, or trying to understand why group-level numbers don’t add up.

Let’s explore the four most common challenges companies face when managing multi-currency accounting and why ignoring them can have serious consequences.

1. Currency Conversion Complexity

Currency conversion is not a mechanical task. It involves judgment — which exchange rate to use, when to revalue accounts, and how to consistently apply policies across departments or entities.

The accounting treatment for currency differences varies based on timing and purpose. For example, revenue transactions are usually recorded using the spot rate on the invoice date, while month-end revaluation of foreign bank balances uses the closing rate.

If this isn’t done consistently, discrepancies can emerge, leading to distorted financials. A mismatch in rate usage across departments is one of the most common sources of internal audit findings in international companies.

A 2023 Kyriba study found that 80% of CFOs in multinational organizations experienced negative earnings impacts from currency volatility, up from 68% in the previous year[?].

Without real-time visibility into exposure, businesses are left reacting instead of planning.

2. Regulatory and Compliance Issues

Multi-currency operations are governed by local and international standards. Each jurisdiction may have specific requirements for how foreign currency is treated, reported, or taxed.

Under

IFRS, foreign currency monetary items must be revalued at the reporting date, and exchange differences recognized in profit or loss. In contrast, US GAAP imposes different requirements, especially when dealing with functional currency determination and hedge accounting.

In the UAE, the Federal Tax Authority (FTA) mandates that VAT invoices in foreign currencies must be converted using the Central Bank’s published rates. Failing to do so or using outdated rates can lead to penalties during tax audits.

Companies that grow across borders often find themselves navigating multiple compliance frameworks at once. This can strain internal finance teams, especially when local rules evolve or conflict with global consolidation practices.

3. Cost of Multi-Currency Management

Handling currency-related tasks manually is resource-intensive. Finance teams may spend hours maintaining spreadsheets for revaluation, calculating exchange gains/losses, and reconciling foreign balances.

Operational costs add up, too. Payment gateways often apply unfavorable rates or high markups. Banks charge foreign transaction fees, and suppliers may add premiums for dealing in non-local currencies.

These indirect costs often go unnoticed until they begin to affect margins. Without centralized processes or automation, businesses may also overpay for compliance audits or require additional finance staff just to manage foreign currency risks, creating long-term inefficiencies.

4. Consolidation Across Entities

For companies operating multiple legal entities across countries, consolidation adds another layer of complexity. It’s not just about translating foreign financials; it's about aligning accounting standards, fiscal calendars, and eliminating intercompany transactions.

Translation differences arising during consolidation are posted to equity, not income, but tracking them accurately across periods requires robust processes.

A PwC global finance study revealed that over half of the surveyed firms cited the consolidation of multi-currency entities as one of their top three financial reporting challenges[?].

Even a small error in translation can disrupt consolidated financial statements and delay filings. Worse, it can erode investor or board confidence if discrepancies appear in quarterly reports.

Keep every project on budget

Track expenses in FirstBit ERP

Request a demo

Best Practices for Managing Multi-Currency Accounting

Effectively managing multi-currency accounting doesn’t just prevent errors; it improves financial clarity, audit readiness, and strategic decision-making. The following best practices help businesses stay in control as cross-border complexity increases.

Automate Currency Conversion

Manual conversion of transactions is one of the biggest sources of errors in multi-currency accounting. Automation ensures that currency rates are applied consistently based on date and transaction type, removing the need for manual re-entry and lookup.

Accounting systems should support:

-

Automatic retrieval of daily exchange rates from official sources (e.g., UAE Central Bank, ECB)

-

Configurable rules for rate types (spot, average, closing)

-

Automation not only improves accuracy but also reduces reconciliation time and removes discrepancies that can otherwise go undetected until audit or consolidation.

Ensure Compliance with International Standards

Every currency transaction has potential regulatory implications. Misalignment between local and global standards can expose businesses to audit risks or tax penalties. One common example is incorrect handling of exchange differences, which some teams wrongly post directly to retained earnings instead of profit or loss or other comprehensive income, depending on the context.

To stay compliant:

-

Clearly define policies for foreign currency treatment under applicable standards (e.g., IFRS, US GAAP)

-

Document accounting treatments for currency revaluation, translation, and gains or losses

-

Keep a record of official rates used, especially for VAT reporting

A recent report by the Controllers Council highlights that exchange rate volatility and inconsistent regulatory requirements across regions are among the most pressing challenges in multi-currency financial management[?].

These issues directly impact

revenue recognition, tax reporting, and compliance with international accounting standards, making it essential for businesses to establish robust internal processes and system controls.

Having well-documented and auditable workflows is especially important when preparing consolidated reports, managing tax obligations in different jurisdictions, or responding to audit inquiries.

Streamlined Consolidation with ERP Systems

Without an integrated system, consolidating results from multiple currency zones often involves offline spreadsheets and manual rework, increasing the risk of misstatements and delays. ERP systems with built-in multi-currency consolidation tools eliminate this dependency.

Key capabilities to look for include:

-

Automatic translation of local currency balances to the group’s presentation currency using the correct exchange rates

-

Handling of cumulative translation adjustments (CTA) in equity

-

Intercompany elimination features for multi-entity structures

-

Unified chart of accounts for cross-border comparability

ERP-based consolidation not only improves speed and accuracy but also strengthens governance by reducing fragmentation in group reporting workflows.

What to Look for in a Multi-Currency Accounting Software

Choosing the right accounting system is crucial when managing financial operations across currencies. Key evaluation factors include:

-

Currency rate flexibility: Ability to store multiple exchange rates per currency (spot, average, closing) and assign them to different transaction types

-

Automatic revaluation: End-of-period currency revaluation with proper accounting for gains and losses

-

Audit trail: Transparent documentation of all exchange rate applications, conversion logic, and revaluation entries

-

Entity-level controls: Support for separate base currencies per entity within a single group structure

-

VAT compliance: Capability to convert invoices using official rates published by authorities like the UAE Central Bank or HMRC

Multi-currency support should not be limited to conversion. It must also include downstream features such as budgeting, reporting, and tax handling across multiple currencies.

Automate all financial operations within one ERP software

Request a demo

How FirstBit Helps to Overcome the Challenges of Working with Multiple Currencies

FirstBit ERP features built-in multi-currency functionality tailored to businesses that operate across borders or deal with international suppliers and clients. From project-driven industries like construction and contracting to retail and trading businesses, FirstBit supports accurate financial handling across currency zones while remaining compliant with UAE regulations and international accounting standards.

Multiple Base Currencies Across Entities

In FirstBit, each legal entity can operate with its base currency. This is especially useful for holding companies or businesses with subsidiaries in different countries, where each unit may report and pay taxes in its local currency. The ERP allows you to configure and manage separate base currencies per entity while maintaining control and visibility at the group level. This structure simplifies consolidation and ensures that local compliance is never compromised.

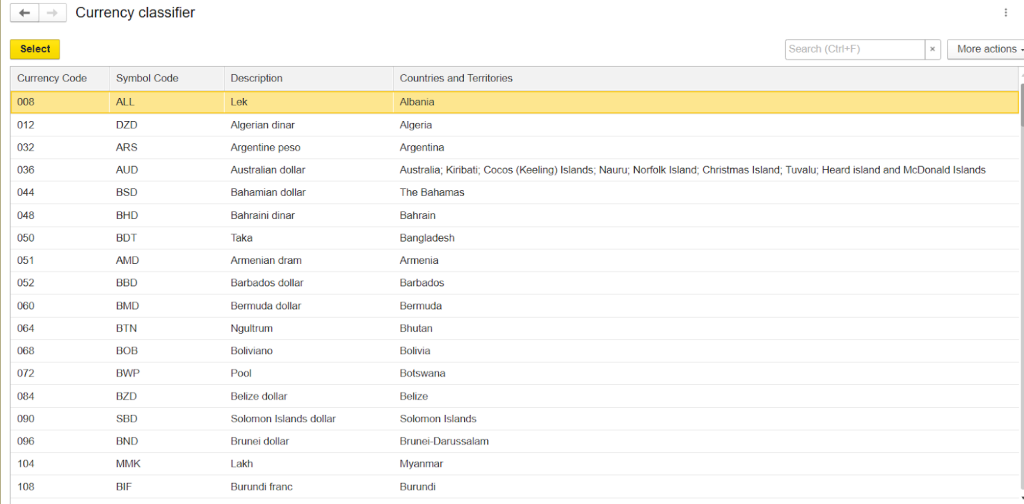

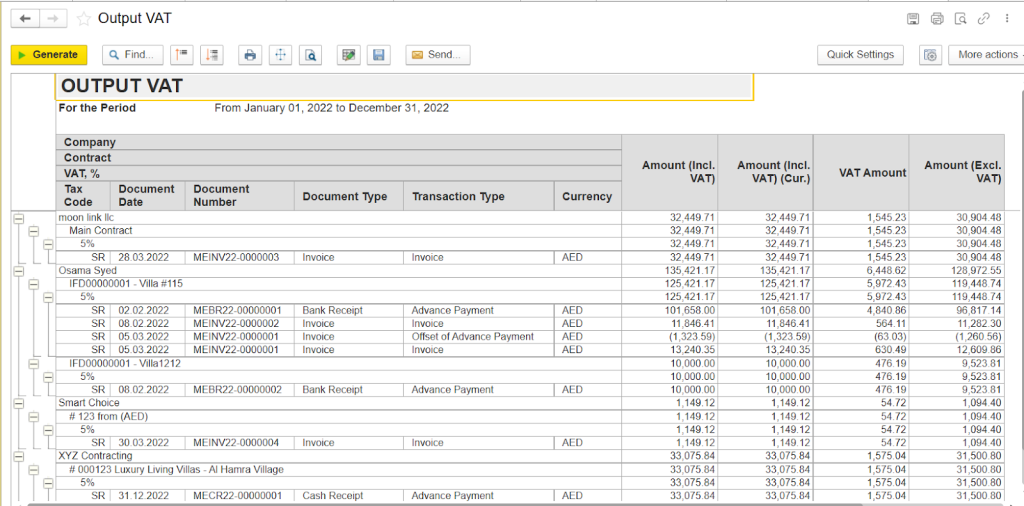

Currency exchange rates available at FirstBit

Flexible Transaction Currency Support

FirstBit enables users to create and process sales invoices, purchase orders, bank transactions, and customer payments in any supported foreign currency. You don’t need to convert amounts manually or use separate systems. The ERP automatically converts to the company’s base currency using the predefined exchange rate, ensuring that both local and consolidated records are aligned. This capability is essential when working with international vendors or billing clients in their preferred currency.

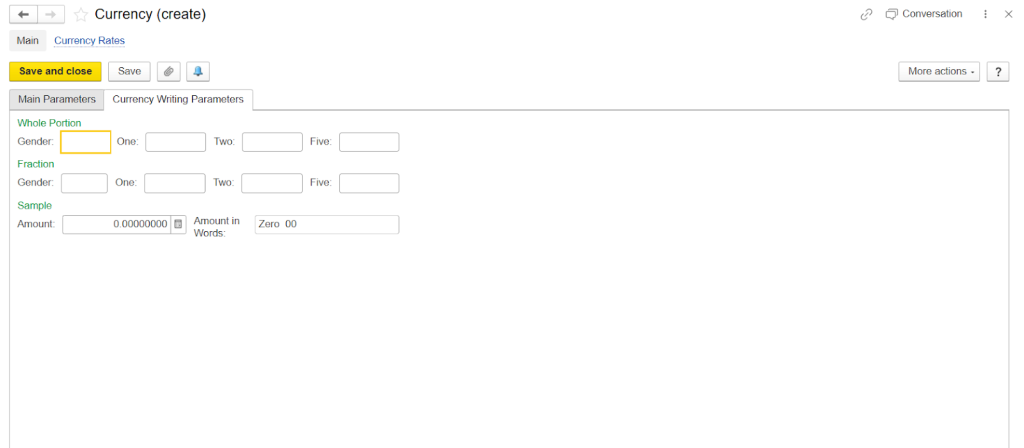

Robust Exchange Rate Management

Exchange rates can vary daily, and FirstBit provides the flexibility to manage them accordingly. Users can import daily exchange rates or manually enter fixed or average rates, depending on internal accounting policies. The system records historical exchange rate data, and each transaction is linked to the rate used at the time of entry. This traceability improves reporting accuracy and simplifies audits or financial reviews.

Manually entering the currency rates option in FirstBit

Automated End-of-Period Revaluation

FirstBit automates the revaluation process for foreign currency balances at the end of each month.. Accounts such as foreign currency bank balances, payables, and receivables can be revalued using the latest applicable exchange rate. Any resulting gain or loss is automatically posted to the correct general ledger accounts based on your chart of accounts structure. This feature reduces the need for manual journal entries and ensures your books reflect accurate values at the reporting date.

Transparent Audit Trails

Every foreign currency transaction and revaluation entry in FirstBit is logged with a complete audit trail. Users can track the exchange rate used, the source of the rate (manual or imported), and the corresponding document or transaction. This transparency supports internal controls, facilitates audit readiness, and helps prevent disputes during financial reviews or tax inspections.

Local VAT Compliance with Central Bank Rates

In jurisdictions like the UAE, the Federal Tax Authority requires that VAT invoices issued in foreign currencies be converted using the Central Bank’s published exchange rates. FirstBit supports this regulation by allowing you to define which official rate source should be applied when issuing tax invoices. This ensures that all VAT reporting remains compliant and reduces the risk of fines or audit complications due to incorrect currency conversions.

Output VAT report in FirstBit

Final Thoughts

Multi-currency accounting is a necessity for growing businesses, but it doesn’t need to be a risk. The real challenge lies not in the number of currencies, but in how they’re managed, converted, and reported.

By automating routine tasks, enforcing compliance with accounting standards, and using the right tools to centralize control, finance teams can handle the complexity without compromising accuracy or efficiency.

The right accounting system, one that supports flexible currency handling, automated revaluation, and full auditability, is essential. For companies operating in or expanding across currency zones, getting this foundation right can make the difference between clean financials and costly corrections.

Prevent cost overruns

Register expenses in FirstBit ERP

Request a demo

FAQ

How can businesses manage exchange rate risk effectively?

Businesses can reduce exchange rate exposure by using strategies like forward contracts to lock in rates, setting up multi-currency bank accounts to avoid unnecessary conversions, and aligning expenses and revenues in the same currency (natural hedging). Regular monitoring and automated revaluation through accounting systems further help mitigate risk.

What is a multi-currency bank account, and how does it help?

A multi-currency bank account allows a business to hold, receive, and send funds in different currencies without converting them to the base currency immediately. This helps reduce conversion fees, avoid losses from poor exchange rates, and streamline payments with foreign clients and suppliers.

What types of businesses need multi-currency accounting?

Any business that engages in cross-border transactions, such as exporting, importing, international contracting, or operating overseas subsidiaries, needs multi-currency accounting to accurately manage financial operations and ensure compliance with local tax and reporting requirements.

How do I choose the correct exchange rate for different transactions?

The appropriate rate depends on the nature of the transaction. Spot rates are typically used for one-time payments, while average rates may be used for recurring expenses like salaries. The closing rate is used for revaluing balances at the end of each month.. It's important to define and apply your policy consistently to ensure compliance and auditability.

What happens if I skip the revaluation of foreign currency balances?

If revaluation is skipped, financial statements may not reflect the true value of assets and liabilities. This can lead to inaccurate profit reporting, misstatements in consolidated accounts, and problems during audits or regulatory reviews. Unrealized gains or losses from exchange fluctuations must be accounted for at period-end to maintain accuracy.

Umme Aimon Shabbir

Editor at First Bit

Aimon brings a deep understanding of the modern construction business to her articles by providing practical content.