In the UAE construction sector, thousands of workers, ranging from site laborers to project managers, depend on end-of-service benefits (EOSB). These benefits serve as a safeguard for their financial security when their employment ends. For employers, these payments are not optional; they are a statutory obligation under UAE labour law.

Getting EOSB right is more than a compliance exercise. Miscalculations or delays can quickly escalate into disputes, legal actions, or reputational damage. This is especially true in industries such as construction, where large teams and complex contracts are the norm. At the same time, new reforms such as the new end-of-service benefits UAE savings scheme are changing how companies manage and disburse these entitlements.

This guide explains everything you need to know: what EOSB is, who qualifies, how to calculate end-of-service benefit in the UAE, and how the rules apply in real construction scenarios.

What Are End-of-Service Benefits (EOSB)

End-of-service benefits (EOSB) are a form of statutory gratuity payment that employers in the UAE are legally required to provide to eligible employees when their employment ends. The calculation is based on the employee’s basic salary and the length of continuous service with the employer. This entitlement is outlined under the UAE Labour Law (Federal Decree-Law No. 33 of 2021). It applies to both expatriate and local employees working in the private sector, including the construction industry.

The purpose of EOSB is twofold:

-

For employees, it provides financial stability and recognition of their years of service. For many expatriates in the UAE, EOSB is often their only form of retirement savings if they are not part of a company pension plan.

-

For employers, it ensures compliance with UAE labour regulations and reduces the risk of disputes, penalties, or litigation that may arise from unpaid or miscalculated settlements.

In the construction sector, end-of-service benefits play an especially important role. Companies in the region employ large and diverse workforces under various contract types, including site workers, equipment operators, engineers, supervisors, and administrative staff. Each of these groups is entitled to EOSB under the law, but the calculations may differ depending on the contract type and years of service.

It is also important to distinguish EOSB from regular salaries or allowances. End-of-service benefits are separate from monthly wages, overtime, or bonuses and are not optional. They must be calculated and settled by the employer at the end of the employee’s contract. Failure to do so can result in heavy fines, reputational damage, and strained relations with the workforce.

With recent reforms, such as the introduction of the new end-of-service benefits UAE savings scheme, companies now have more structured options to manage these obligations. Traditional lump-sum EOSB continues to exist, but employers may opt for a savings scheme that provides ongoing contributions to investment funds on behalf of employees.

Eligibility Criteria of End-of-Service Benefits: UAE

Not every employee automatically qualifies for EOSB. The UAE Labour Law sets out specific conditions regarding who is entitled, the minimum service required, and the situations where benefits may be reduced or forfeited. For construction companies employing large, diverse teams, understanding these criteria is essential to avoid disputes and remain compliant.

Who Qualifies

End-of-service benefits are available to most employees working under UAE labour contracts, but the scope depends on the type of employment arrangement.

-

Full-time employees. Site workers, engineers, supervisors, and administrative staff on full-time contracts qualify for end-of-service benefits once they complete the required service period.

-

Part-time, temporary, and flexible contracts. Employees under these arrangements are also entitled, but their EOSB is calculated on a pro-rata basis depending on hours worked compared to a full-time schedule.

-

Exclusions. Employees who leave service before completing the minimum required period, or those dismissed for gross misconduct under Article 44 of the UAE Labour Law, are not entitled to EOSB.

This means that regardless of whether an employee is a site worker on a daily wage or an engineer on a fixed-term contract, they can still qualify, provided they meet the legal service requirements.

Minimum Service Period

The law requires employees to complete at least one year of continuous service with their employer before end-of-service benefits become payable. Any period less than one year does not qualify.

-

Continuous service. This includes situations where an employee is reassigned across different projects under the same employer, ensuring their service is still counted as unbroken.

-

Unpaid leave. Periods of unpaid leave are not included in the calculation of end-of-service benefits. Paid leave (such as annual leave or sick leave), however, is considered part of continuous service.

For construction firms, this rule is particularly important, as workforce mobility between projects is common. Employers must ensure that service continuity is properly tracked across different sites to avoid disputes over entitlement.

Protect your rights under UAE law

Manage contracts efficiently with FirstBit

Request a demo

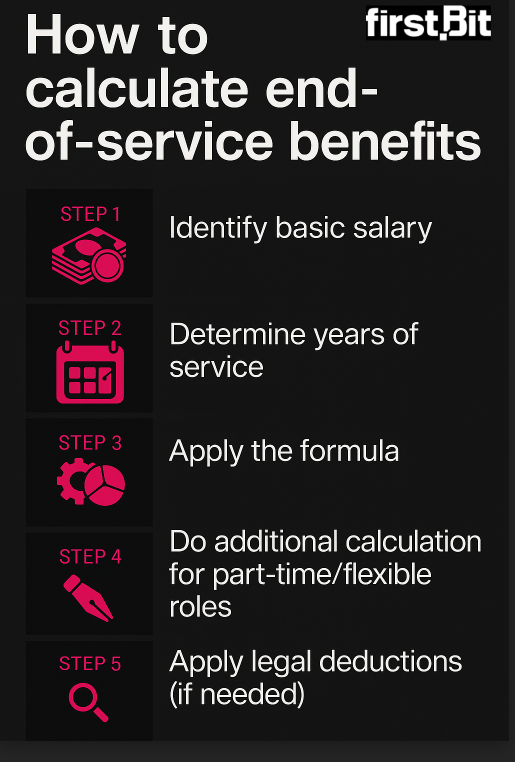

How to Calculate End-of-Service Benefit in the UAE

The UAE Labour Law lays down a clear framework for how EOSB is to be calculated, but applying it correctly requires attention to detail. In the construction sector, where large teams and multiple types of contracts are common, even small mistakes can lead to disputes or penalties.

UAE law requires that all end-of-service payments be settled within 14 days of the employee’s last working day, and failure to do so can result in fines for non-compliance[?].

Following the steps below ensures your calculations are accurate, transparent, and aligned with the law.

Step 1: Identify Basic Salary

The first step is to determine the employee’s basic salary. It forms the foundation for all calculations of end-of-service benefits in the UAE.

-

Basic salary is the amount stated in the labour contract, excluding allowances such as housing, transport, utilities, overtime, commissions, or bonuses.

-

For example, if a worker earns AED 2,500 as basic pay plus AED 1,000 housing and AED 500 transport, only AED 2,500 is considered in the EOSB formula.

-

Employers should double-check that payroll records match the official employment contract to avoid disputes later.

In construction projects, where many employees receive allowances for accommodation or transport, making this distinction is essential to prevent inflated or contested EOSB claims.

Step 2: Determine Years of Service

EOSB entitlement depends on the employee’s length of continuous service.

-

Employees qualify once they complete one full year of service with the same employer.

-

Service continuity remains intact even if employees are moved between different project sites, as long as the sponsoring employer is the same.

-

Unpaid leave (e.g., unpaid absences or extended personal leave) is excluded from the calculation, while paid leave (annual leave, sick leave, etc.) counts as part of continuous service.

-

Fractions of a year are included on a pro-rata basis. For example, if an employee works 7 years and 4 months, gratuity must be calculated for 7.33 years.

For construction firms managing rotating teams across projects, properly tracking continuity is critical to ensuring workers are neither overpaid nor underpaid.

Step 3: Apply the Formula

Once basic salary and years of service are established, apply the legal gratuity formula:

-

For the first 5 years of service. End-of-service benefits in the UAE = 21 days of basic salary per year of service

-

For service beyond 5 years. End-of-service benefits = 30 days of basic salary per year of service

-

Cap. The total EOSB cannot exceed the equivalent of two years’ basic salary

Example:

If a site worker has a basic salary of AED 3,000 and has worked 7 years:

-

First 5 years = 21 × 5 = 105 days of salary = AED 10,500

-

Next 2 years = 30 × 2 = 60 days of salary = AED 6,000

-

Total EOSB = AED 16,500

This step provides the backbone of EOSB calculations and applies across most employment types in the UAE.

Step 4: Do Additional Calculation for Part-Time/Flexible Roles

With the rise of flexible working arrangements, end-of-service benefits must be calculated pro rata for part-time and temporary staff.

The formula is:

EOSB = (Actual Annual Working Hours ÷ Standard Full-Time Annual Hours) × EOSB (Full-Time Equivalent)

Where:

-

Standard Full-Time Annual Hours = 2,080 hours (40 hours × 52 weeks)

For example, if a part-time engineer works 20 hours per week instead of the standard 40 hours:

-

Their working ratio = 20 ÷ 40 = 0.5

-

If their full-time EOSB entitlement is AED 40,000, their actual EOSB = AED 20,000.

This ensures fair payouts while proportionally reflecting hours worked.

Step 5: Apply Legal Deductions (If Needed)

Before releasing end-of-service benefits, employers must check if any lawful deductions apply:

-

Outstanding loans or advances. Employers may deduct amounts that are officially recorded in payroll or loan agreements.

-

Notice period compensation. If either party fails to serve the notice period, compensation equivalent to the employee’s wage for that period may be deducted or added, depending on the case.

-

Misconduct cases. Under Article 44 of the UAE Labour Law, employees dismissed for gross misconduct can lose their EOSB entitlement. However, this must be carefully applied and supported with documentation to avoid legal challenges.

For construction firms where loans for relocation or housing allowances are common, documenting these deductions is essential to avoid disputes during settlement.

This structured process ensures EOSB calculations are not only accurate but also compliant with UAE law. For construction employers, adopting a consistent step-by-step approach minimizes disputes, builds trust with workers, and protects the business from penalties.

Examples of End-of-Service Benefits in Construction

Let’s break down two practical cases to see how end-of-service benefits are applied in the UAE construction industry. These examples combine the legal formula with clear calculations so you can follow each step easily.

Example 1: Site Worker (Full-Time)

Imagine a site worker who has been employed on a full-time continuous contract for 7 years, with a basic salary of AED 2,500.

To work out his EOSB:

- First, calculate the daily basic salary. Since gratuity is based only on basic pay, we divide

AED 2,500 by 30 days → AED 83.33 per day. - For the first five years, the worker is entitled to 21 days’ pay for each year of service.

83.33 × 21 × 5 = AED 8,750 - For the remaining two years, the entitlement rises to 30 days per year.

83.33 × 30 × 2 = AED 5,000 - Add them together to get the total EOSB.

8,750 + 5,000 = AED 13,750

So, after seven years, this worker would be entitled to AED 13,750 in gratuity, in addition to his final salary and any other dues.

Example 2: Project Engineer (Part-Time)

Now take a project engineer working on a part-time contract of 20 hours per week (half the standard full-time hours). His full-time equivalent basic salary is AED 12,000, and he has completed 4 years of service.

To calculate his end-of-service benefits:

- Work out the daily basic salary: 12,000 ÷ 30 = AED 400 per day.

- If he were full-time, his EOSB for 4 years would be: 400 × 21 × 4 = AED 33,600.

- But because he works half the hours of a full-time role, the amount must be adjusted. Full-time hours = 2,080 per year, while he works 1,040 per year. Ratio = 1,040 ÷ 2,080 = 0.5.

- Apply the ratio: 0.5 × 33,600 = AED 16,800.

This means the engineer’s EOSB entitlement is AED 16,800, reflecting his reduced working hours while still ensuring fair treatment under the law.

This step-by-step method shows how EOSB varies depending on salary, service length, and contract type. For construction companies, it highlights why accurate records are essential to ensure both compliance and fairness when settling employee entitlements.

Navigate UAE construction laws with an ERP built for the UAE market

Request a demo

Employer Obligations Regarding End-of-Service Benefits

UAE labour law does not stop at defining how EOSB is calculated. It also sets clear rules on when and how payments must be made, along with penalties for non-compliance. For construction companies managing large workforces, these obligations are critical to avoid disputes and legal consequences.

Settlement Deadlines

Employers must settle end-of-service benefits within 14 days of the employee’s last working day. Any delay beyond this window can lead to fines and damage to the company’s reputation.

Example:

If a site worker finishes employment on 30th June, the full EOSB payment, along with final salary and any unused leave compensation, must be credited no later than 14th July. Failing to do so would put the employer in breach of UAE labour law.

Penalties for Non-Compliance

The law imposes financial penalties on companies that fail to pay EOSB correctly or on time. Fines vary depending on the seriousness of the violation and the size of the workforce affected.

-

Non-payment or repeated delays can lead to fines ranging from AED 100,000 to AED 1,000,000 for companies, particularly if large groups of employees are impacted.

-

If the issue escalates into a formal complaint with the Ministry of Human Resources and Emiratisation (MOHRE), employers may also face restrictions on new work permits until the matter is resolved.

Example:

A construction company with 200 workers fails to process EOSB on time for 50 employees. Beyond the statutory fines (which could exceed AED 500,000 depending on severity), the company risks losing its ability to recruit new staff until compliance is restored, a major operational setback in an industry that relies heavily on manpower.

This makes it clear that EOSB is not just about calculation; timely settlement and compliance are just as important as accuracy. For construction employers, planning to manage payouts ensures smoother operations and avoids costly penalties.

Alternative EOSB: Savings Scheme in the UAE

In 2023, the UAE introduced an alternative end-of-service benefits system often called the EOSB savings scheme. Instead of paying gratuity as a lump sum when an employee leaves, employers who opt into the scheme make monthly contributions into licensed investment funds. These funds grow over time, and employees can withdraw at termination or, in some cases, during service.

This system is voluntary for private-sector employers, but it is becoming increasingly attractive in industries like construction, where companies manage large workforces and need predictable financial planning.

Monthly Employer Contributions

The contribution rate is set by law and depends on the employee’s length of service:

-

5.83% of basic salary for employees with less than 5 years of service

-

8.33% of basic salary for employees with 5 years or more of service

Example:

A project supervisor earns AED 10,000 as basic salary.

-

For the first four years: 10,000 × 5.83% = AED 583 per month paid into the scheme.

-

From the fifth year onward: 10,000 × 8.33% = AED 833 per month.

Over time, these contributions accumulate and are invested, creating a growing fund instead of a one-time lump sum.

Investment Options

Funds under the scheme are managed by licensed providers and give employees a choice:

-

Capital guarantee portfolios (safer, used for unskilled or lower-income workers to protect principal)

-

Growth portfolios (higher potential returns, but with more risk)

-

Sharia-compliant options for those who require them

This flexibility allows employees to align their EOSB savings with their long-term financial goals.

Benefits of Savings Scheme in the UAE

The introduction of the new end-of-service benefits UAE savings scheme marks a major shift from the traditional gratuity system. Instead of uncertain lump-sum liabilities, employers make regular monthly contributions, while employees gain more visibility and control over their entitlements.

For Employers: Improved Cash Flow and Predictability

In industries like construction, companies manage hundreds or even thousands of employees. In such cases, traditional end-of-service benefits in the UAE can create sudden financial strain when multiple workers leave at once. The savings scheme spreads the cost over time, helping businesses plan and maintain liquidity.

Example:

A mid-sized construction firm with 200 employees on an average basic salary of AED 3,000 would contribute:

3,000 × 5.83% = AED 175 per employee × 200 = AED 35,000 per month.

Instead of facing lump-sum payouts worth millions when large teams finish contracts, the employer manages EOSB as a steady, predictable expense.

For Employees: Better Retirement and Financial Security

For expatriate employees who make up the majority of the UAE construction workforce, EOSB often represents their main form of retirement savings. The new scheme offers them:

-

Transparency. It balances grow in licensed funds, visible to both the employer and the employee.

-

Choice. Options include capital-guaranteed, growth, or Sharia-compliant portfolios.

-

Flexibility. Voluntary employee contributions (up to 25% of salary) are allowed, and partial withdrawals may be possible during service.

This means long-serving engineers, supervisors, and site staff can plan for the future with more certainty than under the traditional lump-sum system.

According to MOHRE, the scheme ensures that employers’ contributions are safeguarded in investment funds, protecting workers’ rights while giving businesses a sustainable alternative to large EOSB liabilities[?].

Voluntary Employee Contributions

Alongside the mandatory monthly contributions made by employers, the new end-of-service benefits UAE savings scheme also allows employees to make voluntary top-ups. This option gives workers the ability to grow their EOSB savings further and build a stronger financial safety net.

Employees can contribute up to 25% of their monthly salary to the scheme, in addition to what their employer pays. These amounts are invested in the same licensed funds chosen by the employer, giving employees access to growth or capital-protected options.

Example:

If a project engineer earns AED 15,000 per month:

-

Employer’s contribution (first 5 years at 5.83%) = 15,000 × 5.83% = AED 875 per month

-

Employee decides to voluntarily contribute 10% of salary = 15,000 × 10% = AED 1,500 per month

-

Total monthly contribution into the fund = 875 + 1,500 = AED 2,375

Over time, these voluntary contributions can make a significant difference, especially for long-serving employees planning their retirement.

The scheme also allows employees to withdraw part of their voluntary savings during service, giving them flexibility in case of emergencies or major expenses. This feature is especially useful for expatriates in construction, who may need to send money back home for education, housing, or medical costs while still maintaining their EOSB entitlements.

Under the UAE savings scheme, employees can voluntarily contribute up to 25% of their monthly salary into the fund, with the flexibility to make withdrawals during service[?].

ERP tailored to UAE legislation

Navigate UAE construction laws effortlessly

Request a demo

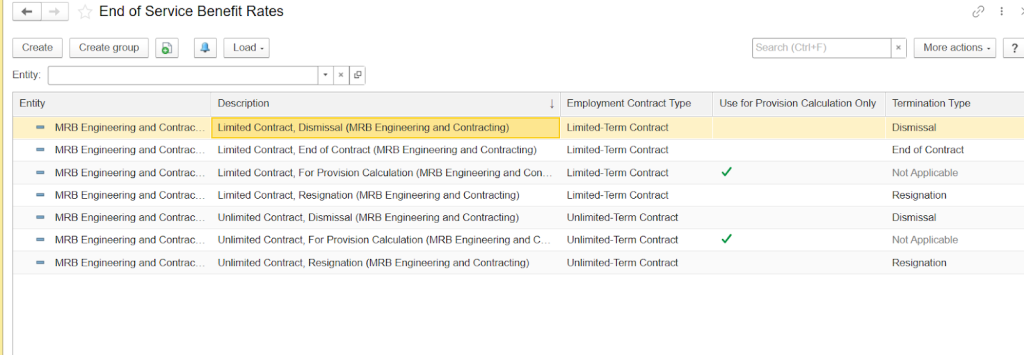

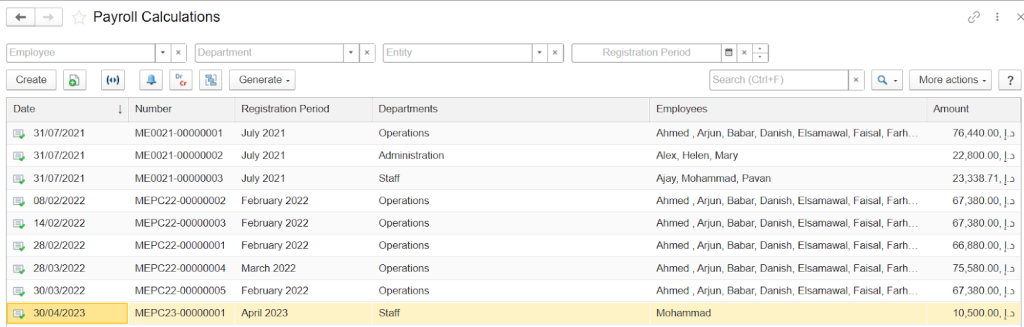

How FirstBit ERP Helps With EOSB Management

Managing end-of-service benefits in the UAE can be complex, especially in construction, where large, diverse teams are employed under different contracts. Manual calculations increase the risk of errors, while compliance deadlines leave little room for delay. FirstBit ERP provides tools that simplify and automate the process, ensuring accuracy and compliance with UAE labour law.

-

Automated EOSB calculations. FirstBit ERP’s payroll module is designed to automatically calculate EOSB based on employee records. It applies the correct formula according to length of service, contract type, and basic salary, reducing the risk of human error.

-

Compliance with UAE Labour Law. The system is updated to align with the UAE Labour Law (Federal Decree-Law No. 33 of 2021). Employers can generate EOSB reports instantly, helping them meet the legal requirement to settle dues within 14 days of termination.

-

Handling different contract types. Whether an employee is full-time, part-time, or on a flexible arrangement, FirstBit ERP can manage pro-rata calculations and ensure fairness across the workforce.

-

Integration with payroll and finance. EOSB calculations are linked directly with payroll and financial reporting. This ensures EOSB liabilities are visible in company accounts, making it easier to plan cash flow and avoid sudden financial strain when large numbers of employees leave.

-

Support for the New Savings Scheme. For employers opting into the new end-of-service benefits UAE savings scheme, FirstBit ERP can track monthly contributions, generate reports, and integrate payments with approved fund providers. This makes it easier to manage both the traditional EOSB system and the new savings model in one platform.

Conclusion

For the UAE construction industry, end-of-service benefits are more than just a statutory payout. They are a reflection of fair employment practices and a measure of a company’s compliance culture. Whether calculated under the traditional gratuity system or managed through the new end-of-service benefits UAE savings scheme, EOSB remains a key obligation that affects both financial planning for businesses and long-term security for employees.

Accurate calculations, timely settlements, and proper recordkeeping are essential to avoid disputes and penalties. At the same time, the shift toward savings-based EOSB structures highlights the UAE’s focus on sustainability and workforce protection. Companies that adopt digital tools for payroll and compliance are better positioned to handle these changes smoothly, ensuring transparency with employees and predictability in their financial planning.

Ultimately, end-of-service benefits are not just about closing a contract; it’s about strengthening trust between employers and their workforce, a trust that is vital in an industry as demanding and labour-intensive as construction.

Meet all of the UAE legal requirements with FirstBit ERP

Request a demo

FAQ

What are end-of-service benefits (EOSB) in the UAE?

Who is eligible for end-of-service benefits in the UAE?

What is the new end-of-service benefits rule in the UAE?

Is EOSB taxable in the UAE?

Umme Aimon Shabbir

Editor at First Bit

See FirstBit ERP solutions in action

Discover how our system solves the unique challenges of contractors in a personalized demo.

After the demo you will get a quotation for your company.

After the demo you will get a quotation for your company.