Cash flow management in construction is critical for the success and sustainability of a venture. This particularly applies to regions like the UAE, known for architectural marvels and ambitious undertakings. The complexity of projects, combined with the unique economic and legal landscape, presents distinct challenges in cash flow management. This detailed guide aims to unpack the intricacies of cash flow in construction within the construction sector, offering practical strategies and insights to navigate and improve financial operations in this dynamic industry.

Understanding Cash Flow in Construction

At its core, cash flow for a construction company refers to the balance of funds flowing in and out of a project or a firm itself. It reflects your ability to manage the finances effectively and indicates the overall project's health.

Cash flow in construction projects can be categorized into two primary types, simply recognized as positive and negative. Each type plays a crucial role in financial management. Their ratio is paramount for maintaining project momentum and ensuring financial stability.

Positive cash flow is good news. It demonstrates that your company yields more inflow than it is spending, which is essential for long-term sustainability. Conversely, negative cash flow can signal financial distress, potentially inducing delays, halted projects, or even bankruptcy.

Formulas for Construction Project Cash Flow

Key metrics in managing construction project cash flow rely on the following formulas. You need to develop strong cash flow management practices and ensure these formulas are applied consistently to keep financial health on track.

Net Cash Flow

Total Cash Inflows - Total Cash Outflows = Net Cash Flow

This is a basic formula for measuring the difference between the cash inflow and outflow during a certain period. In other words, it calculates what's left after all expenses are paid. This is an essential tool in cash management practices and overall management in construction projects.

Operational Cash Flow

Net Income + Amortization + Depreciation + Net Working Capital Changes = Operating Cash Flow

The operational cash flow formula calculates the income generated from the project's functional activities. It expands the net cash flow formula with additional factors such as non-cash charges.

Free Cash Flow Formula

Operating Cash Flow - CapEx = Free Cash Flow

The free cash flow formula indicates the funds remaining after paying for big expenses like equipment or new buildings.

Cash Flow to Debt

Operating Cash Flow / Total Debt = Cash Flow to Debt

The flow to debt formula measures your company’s ability to pay off its debts with the cash generated from operations.

Cash Flow Yield

Operating Cash Flow / Market Capitalization = Cash Flow Yield

The yield formula compares the operational cash flow to the project's market value, offering a perspective on overall financial efficiency.

Investment Cash Flow

Capital Expenditures + Marketable Securities + Business Acquisitions - Divestitures = Investment Cash Flow

While variable, the investment formula stems from this commonly accepted version. It relates to the financial decisions made for long-term growth and sustainability. This formula includes but is not limited to investments in advanced technology, new machinery, or expansion into new markets.

Always know where your money is going

Monitor cash flow in FirstBit ERP

Request a demo

Key Stages of Cash Flow in a Construction Project

Project Initiation Phase

Cash outflows typically exceed inflows at the start of a new construction project — materials, equipment, and labor

investment start before you issue the first invoice to the client.

For example, envision a commercial building project in Dubai where the initial months involve heavy spending on steel, concrete, and workforce, yet payment from clients is scheduled upon reaching certain milestones.

Mid-Project Cash Flow

As the project progresses, your goal is to reach a positive cash flow where regular client payments cover ongoing expenses.

Take a residential development project as an example: as homes are pre-sold or leased, the inflow from these transactions can fund the ongoing construction costs, gradually reducing the initial financial strain.

Project Completion Phase

In the construction industry, it’s common for the customer to withhold paying a certain percentage of the total contract, usually 5% to 10%, until the project is finished.

Towards the end of the project, the focus shifts to settling all accounts and ensuring all receivables are collected. In many cases, final client payments or bonuses for early completion can significantly boost your cash flow, allowing the company to clear debts and consider reinvestment in future projects.

Challenges in Cash Flow Management of a Construction Project

Several facets can affect a construction project's cash flow.

Payment Terms

Longer payment terms with clients can lead to cash shortages, whereas shorter periods with suppliers may require early cash outlays.

Construction projects inherently face a variety of issues that can disrupt a company’s financial management.

[?] One of the most prevalent problems is the delay in cash inflow.

Typically, a payment application in construction takes 30 to 40 days to be certified by the customer, and most of the time, the amount certified is less than what was applied for. This period of certification until payment is very crucial.

Chaudhry Ubaid-Ur-Rehman

Project Manager at First Bit Implementation Team

In addition, you may experience delays due to clients' financial constraints, impacting your ability to pay suppliers or labor on time.

Change Orders

Modifications or additions to the original project scope can cause unexpected expenses or delays in payment.

Furthermore, fluctuating material prices often affect the processes. The cost of raw materials like steel and concrete can vary significantly, impacting your budgeting and cash flow. Case in point: a long-term infrastructure project may face substantial budgeting challenges if the price of steel rises unexpectedly during the construction phase.

Project Delays

Due to weather, supply chain issues, or regulatory approvals, construction delays can lead to extended terms where expenses continue, but revenue is stalled.

Unforeseen expenses can also arise from project scope changes, estimation errors, or site conditions. Your project in the desert or at the coastline, for instance, may encounter unexpected ground challenges requiring additional foundation work, leading to significant unplanned costs.

Seasonality

Seasonal fluctuations in construction may induce periods of tight cash inflow.

Finally, there is a cyclical nature of work. Construction work is often seasonal, with periods of high activity followed by idle phases. This can lead to inconsistent cash flow, making it difficult for companies to balance their finances effectively.

8 UAE-Specific Challenges of Managing Cash Flow in Construction

The UAE's construction sector, while booming, faces its unique set of quagmires.

1. Strict Regulations

The legal framework in the UAE, including compliance with standards and practices, can impact the construction project cash flow. For example, a new regulation requiring enhanced safety measures might lead to unplanned expenditures for a construction firm.

2. Long Payment Cycles

According to one report, contractors have to wait an average of 90 days to be paid (also known as days sales outstanding).

[?] Payment practices in the UAE often involve longer cycles compared to other regions.

3. High Competition and Market Pressure

According to TechSci Research, UAE's construction market is projected to achieve a CAGR of more than 5% during 2024-2028.

[?] However, its competitive nature often leads to tight margins and aggressive bidding. A small construction firm might underbid to win a project but then struggle with cash flow due to thin profit margins.

4. Dependence on Expatriate Workforce Availability and Costs

The UAE construction sector heavily relies on an expatriate workforce. Fluctuations in law, visa regulations, or geopolitical situations can influence labor availability and costs, forcing companies to increase wages or face delays.

5. Real Estate Market Volatility

The UAE's real estate market is known for its rapid growth, which naturally leads to occasional fluctuations in demand. A downturn in building activity can lead to project cancellations or postponements, directly affecting contractors' finances.

6. Environmental Factors and Sustainability Requirements

The summer season in UAE sees extreme heat, up to 50°C in the south, with scarce rainfall. The UAE averages 140-200 mm annual rainfall and experiences occasional shamal dust storms. Consequently, an increasing motivation towards sustainable construction practices and green building requirements often means additional investment in materials, training, or certifications.

7. Technological and Innovation Pressures

The rapid pace of technological change demands that companies in the UAE construction sector continuously adapt and invest in new technologies. This is especially hard for smaller firms lacking the capital to invest in advanced construction technologies, such as Building Information Modeling (BIM) or automated machinery.

8. Impact of Global Market Trends

Global economic and political events, like trade disputes, disrupt the supply chain through delays in material procurement and increased costs. A construction company in the UAE might also face interruptions in receiving imported materials due to global shipping issues.

Currency fluctuations notably impact expenditures for projects reliant on foreign labor or materials acquired from abroad. A sudden weakening of the local currency, for instance, could increase the cost of imports, affecting the overall project budget.

The risk with currencies applies worldwide; however, when it comes to USD, its rate is fixed. For UAE companies that deal in USD, currency fluctuations are not a major concern.

Chaudhry Ubaid-Ur-Rehman

Project Manager at First Bit Implementation Team

Manage your cash flow with confidence

Request a demo

Construction Cash Flow Analysis Step by Step

Conducting a thorough cash flow analysis is crucial to understanding and improving the financial health of your construction projects.

1. Review Financial Statements

Start the process with a thorough review of the company's financial statements, including profit and loss accounts, balance sheets, and cash flow statements. This is a baseline for your deep understanding of the company's current financial health.

2. Analyze Your Cash Flow at Project Level

Construction project cash flow analyses include tracking the progress of each task independently, including associated costs and revenue generation over time.

3. Conduct a Cash Flow Forecasting

Cash flow forecast is a critical component of the process. It allows you to estimate upcoming inflows and outflows based on ongoing events, expected revenues, impending expenses, and planned investments.

4. Identify Variance

In this step, you will compare actual cash flow with forecasted figures to identify conflicts and weak points. The goal is to understand whether the deviations are due to internal inefficiencies, market dynamics, or other external factors.

5. Perform Scenario Analysis

Going through ‘what-if' scenarios will help you understand the impact of potential changes in the business environment, such as delays in receivables, cost escalation, or unplanned expenditures.

6. Employ Software Tools

Leverage specialized software for cash flow analysis to obtain real-time data and predictive analytics for more accurate forecasting.

Reasons for Cash Flow Analysis

Studies have found that 84% of construction companies report having cash flow problems.[?]

-

Risk management. It helps you identify potential financial risks early, enabling proactive measures to mitigate them. For example, if a cash flow forecast shows potential liquidity issues, you can take steps to arrange financing in advance. It’s crucial to do it before the project execution will become slow due to a lack of financing.

-

Informed decision-making & strategic planning. Construction project cash flow analysis provides you with a solid foundation for making business decisions, such as bidding for a new project, investing in new equipment, or hiring additional staff. Insightful analysis also informs strategic judgments, aiding in resource allocation, project phase scheduling, and other financial planning that companies may undertake to ensure better execution..

-

Resource optimization. The effective allocation of resources is one of the key reasons for conducting cash flow analyses. Understanding the patterns ensures your funds are available where and when they are needed most.

-

Financial health monitoring. Regular cash flow analysis helps you continuously monitor the financial health of the company, ensuring that it remains viable and profitable.

-

Investor and stakeholder confidence. Demonstrating a solid grasp of cash flow management in construction can build confidence among your investors and stakeholders, which is crucial for securing funding and support.

-

Regulatory compliance. In some cases, regular financial analysis, including cash flow, is required for compliance with financial regulations or contractual obligations.

Get paid faster and on time

Automate invoice creation by milestones with FirstBit

Request a demo

Strategies to Manage Cash Flow in Construction

There are several strategies you can employ to navigate the complexities of cash flow in the UAE's construction sector.

-

Invoices. Efficient invoicing and swift collection processes ensure a steady flow of incoming funds.

-

Expense tracking.Inventory tracking, along with rigorous monitoring and control of expenses, prevents cost overruns and maintains financial balance.

-

Negotiating payment terms. Establishing favorable payment terms with clients and suppliers can smooth out cash flow, accommodating the long payment cycles typical in the region.

-

Accurate construction cash flow forecast. Regularly updating construction project cash flow forecasts to reflect actual progress and future projections.

-

Contingency planning. Setting aside a contingency fund to manage unexpected expenses without disrupting the cash flow.

Improving Cash Flow with ERP Technology

Leveraging technology, particularly ERP systems, offers a transformative approach to managing cash flow in construction projects.

ERP can bring automation and integration to financial management, enhancing the efficiency and accuracy of cash flow control.

One of the key advantages of ERP systems is their ability to provide real-time access to financial data. This helps you monitor the cash flow closely, allowing for more timely and informed decision-making.

ERP systems can simplify a myriad of financial management processes, integrating aspects from invoicing and payroll to budgeting and reporting. In addition, they can scale with the business, accommodating new assignments, diversifying operations, and expanding into new markets without the need for entirely new software systems.

Keep every project on budget

Request a demo

Partner With First Bit to Get Control of Your Cash Flow

FirstBit ERP offers unique advantages for construction cash flow management. First of all, rapid access to comprehensive reports and interactive dashboards empowers your team to make informed, timely decisions. At the same time, it gives you thorough control over the resources deployed on projects, ensuring optimal utilization and budget adherence.

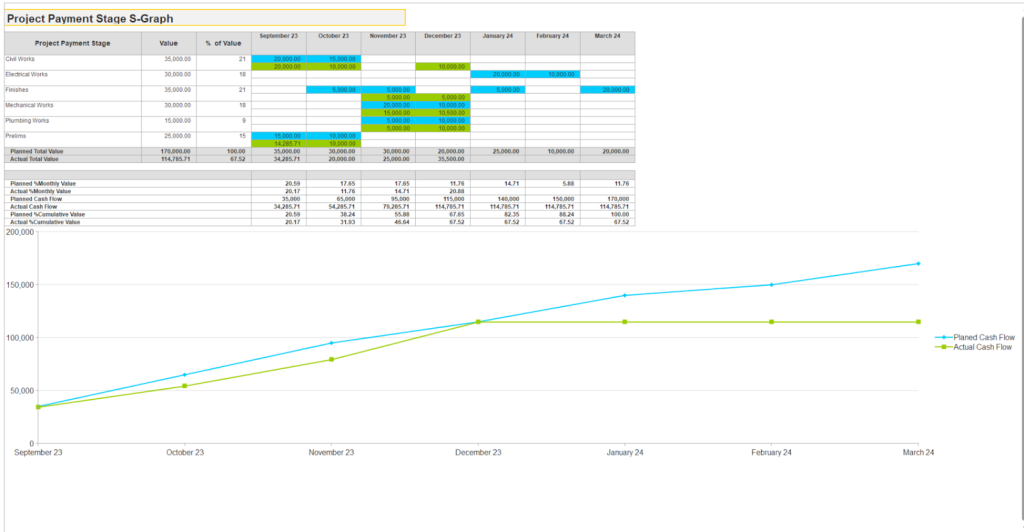

Project Payment Stage S-Graph by FirstBit ERP

Tailoring to your unique needs, our system allows for customized reports based on your specific layouts. And don’t worry about information confidentiality. At First Bit, we prioritize data security, offering robust protection in both cloud and on-premises versions.

Most importantly, FirstBit ERP platform guarantees full compliance with UAE Tax regulations, providing peace of mind and legal assurance.

Advanced ERP solutions provide powerful construction cash flow forecast tools, enabling you to model and predict future finance based on current data and trends. This predictive capability is vital for strategic planning and risk management.

Enhanced Collaboration and Reporting

FirstBit ERP software solution is meticulously crafted to streamline processes and foster seamless collaboration among employees. The result is a significantly reduced need for manual data entry, boosting your team's overall efficiency in return. The flexibility of web access allows your teams to stay connected and productive from any location, at any time, and on any device, ensuring business continuity.

By centralizing financial data, First Bit also improves collaboration among different departments and stakeholders. Teams can access the same up-to-date information, crucial for coordinated decision-making and project management. You can see the cost, site progress, time, and revenue data, making it a 360° view of each project.

The processes involve robust reporting capabilities, generating detailed financial reports that can be used for internal analysis or shared with external parties, like investors or financial institutions. They also assist in maintaining compliance with financial regulations and reporting standards, handling various adherence requirements, and reducing the risk of penalties or legal issues in return.

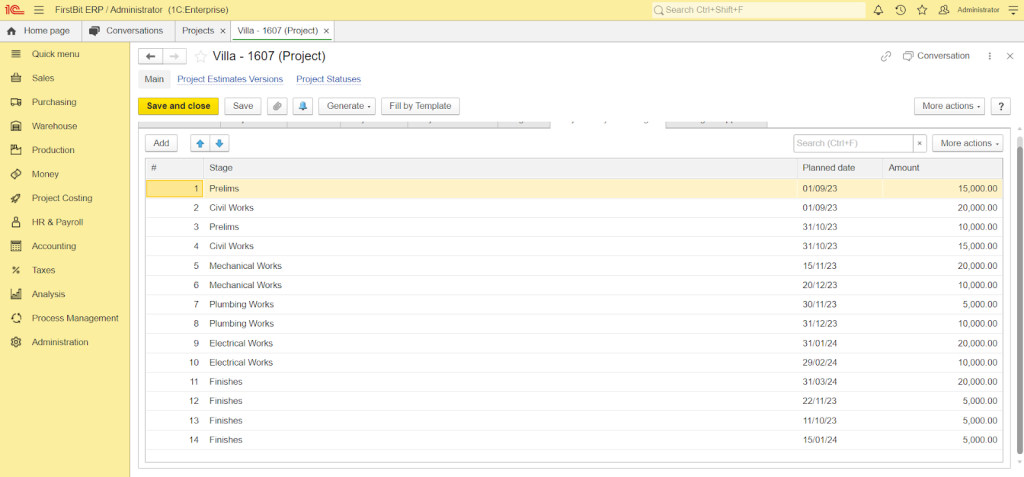

Project Management Tools by FirstBit ERP

Final Thoughts

Effective cash flow management is a cornerstone of success in the UAE's construction industry. Implementing robust strategies and embracing technological advancements like ERP systems allows construction companies to navigate the financial complexities of the industry, ensuring stability and fostering growth.

In other words, by employing the power of ERP, construction professionals in the UAE take the fast lane to optimize their financial operations and secure the future of their projects and businesses.

Always know where your money is going

Monitor cash flow in FirstBit ERP

Request a demo

FAQ

1. What is cash flow management in construction?

Cash flow management in construction is the practice of actively monitoring, forecasting, and balancing the timing and amount of cash moving in and out of a project—ensuring there’s enough liquidity to pay for labor, materials, and overhead while awaiting client payments. It’s vital because construction involves heavy upfront costs and milestone-driven income, so effective management prevents project delays, cost overruns, and financial stress.

2. What is the formula for cash flow in construction?

In construction, cash flow is calculated using the formula: Cash Flow = Total Cash Inflows – Total Cash Outflows, where inflows include client payments and advances, and outflows cover expenses like labor, materials, overhead, and equipment costs. This simple calculation helps project managers monitor financial health, manage liquidity, and ensure funds are available when needed throughout the project lifecycle.

3. What is cash flow management?

Cash flow management is the systematic process of tracking, forecasting, and optimizing the money entering and leaving a business to ensure there's always enough available cash to cover obligations, support operations, and enable strategic decisions.

4. What is FCF in construction?

In construction, FCF (Free Cash Flow) refers to the cash a company has remaining after it covers its operating expenses and capital expenditures on physical assets like equipment, buildings, or infrastructure. It’s calculated as:

FCF = Operating Cash Flow – Capital Expenditures, providing insight into the project’s or company’s financial flexibility for reinvestment, debt repayment, or buffering against financial risks.

5. What is cash management technique?

A cash management technique refers to a strategic method—such as cash pooling, sweep accounts, zero-balance accounts, or credit sweeps—used to optimize the timing, location, and utilization of cash in order to enhance liquidity and reduce borrowing costs. These tools help businesses centralize funds, manage short-term liquidity efficiently, and make the most of their available cash resources through disciplined mechanisms.

6. What are the strategies for cash flow management?

Effective cash flow management involves optimizing working capital—by accelerating collections, extending payables, and minimizing inventory—and leveraging cash flow forecasting, financial technology, and electronic payment systems to enhance visibility, liquidity, and control.

7. How to forecast cash flow in construction?

In construction, you generally forecast cash flow by projecting all expected cash inflows and outflows based on the project budget and schedule, and allocating those amounts across the timeline using methods like front‑loading, back‑loading, or bell‑curve distributions to align spending with the work schedule; for example, you’d calculate the remaining budget (Total Budget – Actual Costs to Date), then map those projections into phases using cash flow curves aligned with your schedule of values.

8. What do the cash flows of a project include?

Cash flows include all expected cash inflows, such as revenue, client payments, investment income, or financing proceeds, and all projected cash outflows, including costs like equipment, materials, labor, operating expenses, and debt servicing. These figures are typically broken down into operating, investing, and financing activities, helping assess liquidity and the timing of funds during the project’s lifecycle.

9. What are the cash flow risks in construction?

Construction projects often suffer from delayed payments, whether due to client sluggishness, disputes, or billing inefficiencies, which disrupt the inflow of funds and impair liquidity across the project chain. Additionally, cost overruns, unexpected expenses, poor change-order management, and material/equipment shortages can inflate expenses beyond planned budgets, further straining cash flow and undermining financial stability.

Katarina Skipic

Contributing Author

With an everlasting passion for reliable facts, Katarina has been a contributing voice in the technical and creative industries for almost a decade.