Cash flow is the backbone of any construction business. With projects that can stretch over months and costs that shift unexpectedly, managing cash flow is both challenging and essential. Without a clear view of money coming in and going out, even profitable projects can turn into financial headaches.

This guide breaks down cash flow forecasting for construction. You’ll learn what it is, why it matters, and how it helps you stay on top of finances and plan for growth.

What is Construction Cash Flow Forecasting?

Cash flow is the backbone of any construction business. With projects that can stretch over months and costs that shift unexpectedly, managing cash flow is both challenging and essential. Without a clear view of money coming in and going out, even profitable projects can turn into financial headaches.

Why Effective Cash Flow Forecasting is Essential in Construction Projects

Construction cash flow forecasting is the process of anticipating and tracking the flow of funds throughout a project. This includes predicting when payments from clients will arrive and when costs for materials, labor, and equipment will be due. By accurately forecasting these inflows and outflows, you can ensure your construction business has the liquidity it needs to cover expenses and keep the project on track, avoiding delays or cash flow issues.

In construction, the difference between a smooth project and a financial nightmare often comes down to cash flow. With project timelines that change, unexpected costs popping up, and different financial needs at every stage, staying on top of your finances can feel overwhelming. Here’s why getting it right matters.

Key Benefits of Cash Flow Forecasting in Construction

-

Covering upfront costs with long payment wait times. Construction projects often require significant upfront costs for materials, labor, and equipment, but client payments can take weeks or even months to arrive. Cash flow forecasting helps you identify these gaps early, so you can arrange short-term credit or negotiate extended payment terms with suppliers.

-

Handling different costs at different project stages. Each stage of a construction project has unique costs such as land preparation, foundation work, or finishing touches. By predicting costs at each stage, you can ensure you have enough funds available without scrambling for resources mid-project.

-

Dealing with changing material costs. Material costs can fluctuate unexpectedly due to supply chain issues or market demand. By closely monitoring material prices and incorporating these changes into your cash flow forecast, you can stay ahead of rising costs.

-

Building good relationships with suppliers and contractors. This is essential to keeping a project on track, and cash flow forecasting can help you build and maintain these relationships. By forecasting payments and aligning them with your suppliers' needs, you can negotiate better payment terms and keep them paid on time. This leads to more trust, better pricing, and often preferential treatment, all of which help smooth the flow of the project.

-

Keeping up with loan payments and credit terms. Construction projects often involve loans or lines of credit, and keeping up with loan payments is essential for maintaining financial health. Cash flow forecasting helps you track when loan payments are due and ensures you have enough funds to meet those obligations. By planning ahead, you can avoid late fees or penalties and maintain a good credit standing, which is important for securing future financing.

-

Preparing for unexpected costs. Construction projects are unpredictable, and unexpected costs, such as accidents, delays, or changes in regulations, can arise at any time. A cash flow forecast should include a contingency fund to cover these surprises. By setting aside a portion of your budget for unforeseen expenses, you can avoid scrambling for cash when the unexpected occurs, ensuring your project stays on track even in the face of uncertainty.

Key Elements of Cash Flow Forecasting for Construction Companies

Construction cash flow forecasting involves several key factors. When these factors are accurately predicted and managed, they can provide valuable insights into your business’ financial health and potential success. Let’s take a look at a few of these important elements.

1. Revenue Streams

Revenue streams focus on where your income comes from and the schedule tied to these sources. In construction, payments often arrive in stages such as progress payments or milestone completions and each project might follow a unique payment structure. The challenge lies in predicting these revenue flows accurately, especially if delays are common.

The goal is to map out your revenue streams clearly. Are payments tied to specific project benchmarks? Do clients have a history of late payments? Knowing this helps you predict when money should flow into your business, giving you a better handle on your income patterns.

Think of revenue streams as the big picture of your income — where it’s coming from and when you can expect it. It’s not about expenses or timing mismatches (that’s cash flow timing); it’s about making sure you have a clear view of your income sources.

2. Expense Categories

Expenses in construction can be broken into direct costs (labor, materials, subcontractors, and equipment) and indirect costs (insurance, office costs, etc.). These expenses vary throughout the project.

It’s important to understand when each cost will be incurred to keep your cash flow in check. A detailed cash flow forecast should map out when different expenses will be needed at each stage of the project.

For example, in the early stages of the project, you may spend more on materials and labor, while later stages may require spending on finishing work or site cleanup. You should also keep track of costs that may fluctuate, like material prices. If the price of steel or lumber is expected to rise, it’s wise to account for these price hikes in your forecast.

3. Cash Flow Timing

Cash flow timing zooms in on how well your incoming revenue aligns with your outgoing expenses. Even if you know when your revenue streams are supposed to arrive, the timing of expenses like materials, wages, or equipment rentals can create cash flow challenges if the two don’t sync up.

For instance, you might have to buy materials or pay workers before a project starts, but your client won’t pay you until the end of that phase. This creates a cash flow gap — a period where your expenses outweigh your available income. That gap can make or break your ability to keep things running smoothly.

To manage cash flow timing, you need to look beyond just the payment schedule. Map out exactly when you’ll have large expenses and whether your revenue will cover them in time. If there’s a gap, plan ahead — whether that’s securing short-term financing, negotiating with suppliers, or shifting timelines. By keeping an eye on this, you can ensure your cash outflows are always backed by timely inflows.

4. Project Financing

For large projects or when cash flow is tight, construction companies often need additional financing. This could be in the form of loans, lines of credit, or even investor funding. Properly forecasting cash flow helps you figure out when extra funds will be necessary, and when to secure them.

Make sure to keep an eye on financing terms, like interest rates and repayment schedules. You don’t want to over-borrow or take on debt that you can’t pay back on time. A good practice is to regularly review your forecast and adjust if new financing options become available or if project timelines shift.

How to Create a Cash Flow Forecast for a Construction Project

Creating a cash flow forecast is a must for any construction project. The best time to start is during the estimation or planning phase. This helps you spot any cash flow gaps in your project early on, meaning you can tweak payment terms or arrange financing before the project even kicks off.

Here’s a simple step-by-step guide to get you started.

1. Get Your Project Budget Together

The first step is to gather all the numbers. Start by pulling together all costs for the project. This can include labor, materials, equipment, subcontractors, permits, and any

overheads costs. This gives you a clear understanding of what you're working with financially. By having everything in one place, you can start to see how much you'll need at different stages of the project.

Let’s say you’re constructing a commercial building and need to purchase $50,000 worth of steel. This purchase might be split over several months, depending on when you need the materials delivered. By having this upfront cost included in your budget, you’ll know exactly when that payment will be due and can adjust your forecast accordingly.

2. Check Your Current Spending

Before you start predicting future expenses, take a step back and look at what you've already spent. Review any current spending on things like labor, materials, and subcontractors. Make sure all invoices have been accounted for, and ensure that any ongoing or expected costs are included in the forecast. This helps you track where you stand right now and lets you adjust your projections based on actual spending.

If you’ve already paid $20,000 for labor and material costs in the first month of a six-month project, that’s money you can subtract from future forecasts. If your budget originally allowed for $30,000 in the first month, you’re ahead of the game and might have more flexibility moving forward, or you might need to adjust if you’ve overspent.

3. Estimate What’s Left to Finish

Now that you know what’s already been spent, it's time to estimate what’s left to finish the project. This includes accounting for materials, labor, and any other costs that still need to be covered. Break down these remaining costs by

project phase, so you know when major expenses will be due. By doing this, you can predict exactly when money will be needed and ensure that you’ll have enough to cover it.

If you're building a house and have $15,000 in electrical work and plumbing to complete, you’ll need to account for those costs in your forecast. Spread out that $15,000 over the coming months so you know when to expect these payments. If the work will be done over two months, break the cost into $7,500 each month, so you can plan for those outflows.

4. Spread Out Future Costs

Once you’ve got your remaining expenses, it’s time to spread them out over the expected timeframes. This helps you predict when cash will be needed. Don’t forget to account for

labor costs, material purchases, and any subcontractor payments. Spreading out future costs helps ensure you're prepared for each phase of the project and prevents surprises when it's time to pay.

Let’s say you need $10,000 worth of materials every month for the next three months. If you add this into your forecast, you’ll know when that money will be due and how it aligns with client payments. For example, if your client pays after each project milestone, you can sync your material costs with those payments to avoid cash flow gaps.

5. Visualize Your Cash Flow

Now it’s time to put all that information into something visual. This can be a spreadsheet or cash flow software. Lay out when you expect money to come in and when it will go out.

A clear visual timeline helps you see where the gaps are and where the surplus will be. You’ll know exactly when you'll have enough cash to cover your upcoming costs, and when you might need to adjust your forecast if payments are delayed or costs increase.

If you’re expecting a 20% upfront deposit for a $100,000 project, mark that $20,000 payment right at the start of your forecast. As the project progresses and you reach milestones, you can plot out your incoming payments. Meanwhile, if you have regular monthly payments for materials, labor, and subcontractors, you can track these outflows alongside your incoming payments. This way, you can see if your outflows outpace inflows and can

optimize costs, such as pushing for earlier payments from the client or adjusting payment schedules with suppliers.

Managing Cash Flow Risks in Construction Projects

Construction projects often encounter unexpected challenges, like payment delays and fluctuating material costs. The good news is, with the right strategies in place, you can minimize these risks and maintain a steady cash flow. Let’s explore some of the most common cash flow pitfalls and practical solutions to protect your bottom line.

1. Dealing with Payment Delays

Payment delays are one of the biggest challenges for construction companies. If you rely on a small number of clients, delays from just one of them can create a big gap in your cash flow.

To protect yourself, it’s important to:

-

Diversify your client base and contracts. By working with more clients, you spread the risk — if one client delays a payment, it won’t throw everything off.

-

Set clear payment terms in your contracts, like progress payments or milestone payments.

Let’s say you’ve done several projects for a particular client, but they tend to pay late. This has put you in a tough spot in the past when you were waiting for a big final payment. To fix this, you start diversifying your client base, adding new projects with clients who pay promptly, and negotiating milestone payments that allow you to get paid at key stages of the project, not just at the end.

2. Handling Change Orders and Scope Creep

In construction, changes to the original project scope are inevitable. Whether it’s a client request or something that comes up during construction, change orders can quickly lead to extra costs that affect your cash flow.

To avoid these issues, it’s important to make sure your contract outlines how changes will be handled, how they’ll be priced, and when payment will be due. This way, unexpected costs don’t get lost in the shuffle.

Let’s say, you're building an office building, and halfway through, the client decides to change the layout of the lobby. Without a clear change order process, this could lead to delays and unbilled costs. But by having a change management procedure in place — where the client must approve any changes in writing, along with a new budget and payment schedule — you can ensure that changes are properly documented and paid for.

3. Managing Fluctuating Material Costs

Material costs can be unpredictable in construction. Prices can spike due to supply chain disruptions or changes in demand. These fluctuations can wreak havoc on your cash flow if you’re not prepared.

One solution is to use hedging strategies. This could mean:

-

Locking in prices for materials ahead of time

-

Buying in bulk when prices are low

-

Negotiating fixed price contracts with suppliers

If you’re working on a large construction project and the price of steel has been rising steadily, you could negotiate with your supplier to lock in the price now for delivery later. This helps you avoid price hikes during the project and keeps your material costs stable, so you don’t get hit with unexpected bills.

4. Addressing Project Delays

Delays are part of the construction process, whether they’re caused by weather, labor shortages, or unforeseen site issues. These delays can affect your timeline and cash flow.

-

The first key is building a contingency plan into your budget. This means setting aside extra funds to cover unexpected delays or costs. By including a buffer, you can avoid scrambling for cash when things don’t go according to plan.

-

Regular communication with your team, contractors, and clients will also help you manage delays effectively.

For example, you’re working on a commercial development, and a sudden storm causes delays for a week. Without a contingency fund, you might struggle to cover labor costs during that period. But by including a 10% contingency in your budget for unexpected delays, you have the flexibility to absorb those costs without impacting your cash flow.

5. Planning for Seasonal Construction Fluctuations

Seasonal fluctuations can affect construction work, particularly in regions with harsh winters or hot summers. These changes in weather can lead to delays, or you may face fewer projects during off-peak months, which can create cash flow challenges.

To handle seasonal fluctuations, plan ahead:

-

During the busier months, save a portion of your profits to cover leaner times.

-

You can also look for ways to generate revenue during the off-season, like taking on smaller, quicker projects or offering discounts to clients who want to schedule work in the slower months.

If you operate in a region where winter weather makes construction difficult, and business slows down. To avoid a cash flow crunch, you plan ahead during the busy summer and fall months, saving 15% of your revenue for the slower winter period. You also sign smaller renovation contracts during the off-season to keep cash coming in.

Examples of Effective Cash Flow Forecasting

Good cash flow forecasting is the key to keeping a business running smoothly, especially in industries with high expenses like construction. Here are some real-world examples to help you visualize what an effective cash flow forecast looks like.

1. Construction Project: High-Rise Apartment Complex

Project duration for the month: July

Payment terms:

-

Initial payment received on July 5th: $200,000 (This is part of a larger $1.2 million contract).

-

Progress payment expected on July 20th: $100,000.

Forecasted Expenses for July

Direct costs:

-

Labor: $120,000 (Including wages for workers, supervisors, and subcontractors on-site).

-

Materials: $90,000 (For concrete, steel, and electrical supplies for the foundation and initial structure).

-

Equipment rental: $20,000 (Rental fees for cranes, scaffolding, and other heavy machinery used throughout the month).

Indirect costs:

-

Site security: $7,000 (Security personnel and surveillance equipment to monitor the site 24/7).

-

Utilities: $4,500 (Electricity and water used during construction and for temporary offices).

-

Project management: $5,000 (Software subscriptions, reporting, and administrative costs).

Total expenses for July: $246,500

Cash Flow Summary for July

Learnings:

-

Budget surplus. When there's extra money in the budget, the project manager can set some aside for unexpected expenses or buy materials ahead of time for future phases.

-

Optimizing labor. Labor costs add up fast, so by fine-tuning schedules and workforce use, project managers can cut down on unnecessary overtime and avoid workers sitting idle.

-

Project acceleration. With a budget surplus, the team can speed up other parts of the project, which might boost cash flow even more and help hit key milestones ahead of schedule.

2. Construction Project: Retail Store Expansion

Project duration for the month: August

Payment terms:

-

First payment received on August 10th: $75,000 (Out of a total $400,000 contract).

-

Final payment due on completion, expected in September.

Forecasted Expenses for August

Direct costs:

-

Labor: $50,000 (For construction crew and site management overseeing the expansion work).

-

Materials: $40,000 (For flooring, lighting, electrical wiring, and installation of retail fixtures).

-

Equipment rental: $8,000 (Leasing of forklifts and other tools necessary for the installation phase).

Indirect costs:

-

Marketing and permits: $2,500 (Cost for marketing materials and compliance with local regulations for expansion).

-

Utilities: $2,000 (Electricity, water, and internet for the temporary site office and construction).

-

Office supplies: $1,500 (Office expenses related to project management, such as communication and documentation).

Total expenses for August: $104,000

Cash Flow Summary for August

Learnings:

-

Short-term financing. If there's a cash shortfall, the project manager might look into a line of credit or ask the client for an advance to bridge the gap until the final payment arrives.

-

Cash flow adjustments. Cutting back on optional expenses or holding off on non-essential purchases like office supplies until the next payment comes in can help make the current funds last longer.

-

Client communication. The project manager may need to reach out to the client to see if they can speed up the final payment, helping keep the project on track without delays.

How FirstBit ERP Can Help You Forecast Cash Flows in Construction

Cash flow management can be a struggle in the construction industry, where upfront costs, delayed payments, and fluctuating expenses are common. FirstBit ERP helps businesses like yours forecast cash flows with ease.

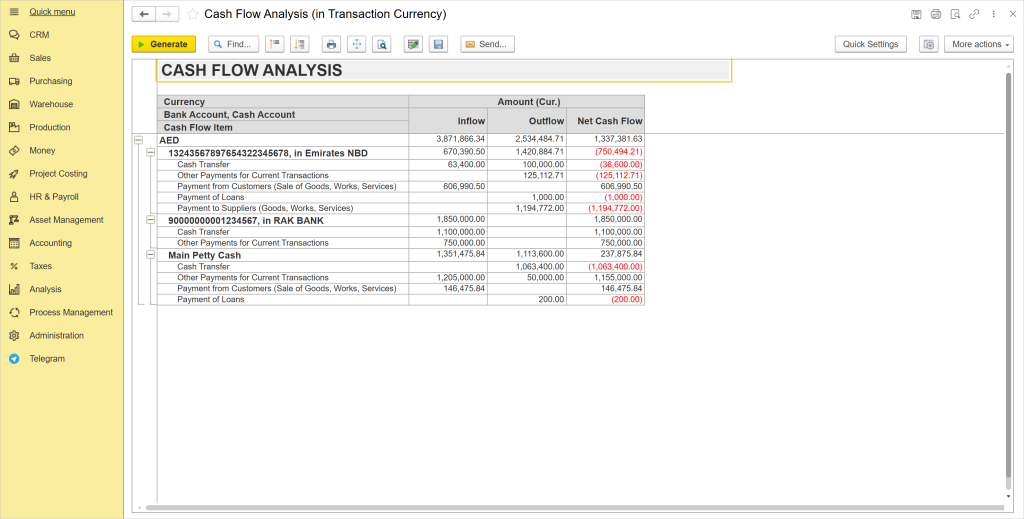

1. Improving Financial Management

FirstBit ERP helps you gain real-time insights into your finances, improving transparency and cash flow management. Our system simplifies profit and loss calculations and offers advanced reports on assets, so you can

stay on top of your financial situation and manage project budgets more effectively.

FirstBit ERP showing a cash flow analysis

2. Simplifying Accounting Records

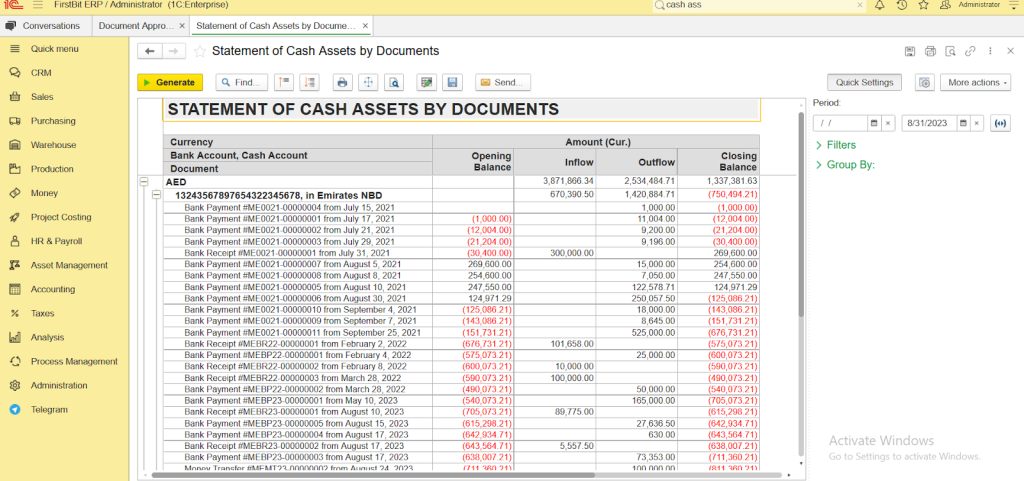

Firstbit ERP follows

IFRS standards and handles multi-currency transactions, cost accounting, and bank reconciliations. It also ensures your financial records are audit-ready, with features like period-end closing to prevent errors and maintain compliance with tax regulations.

3. Streamlining Budget Management

With tools to track accounts payable and receivable, bank reconciliations, and cash asset balances,

FirstBit ERP makes it easier to manage your construction budgets. The cheque clearing control helps prevent issues like bounced cheques, keeping your cash flow predictable and your finances in order.

FirstBit ERP showing a statement of cash assets

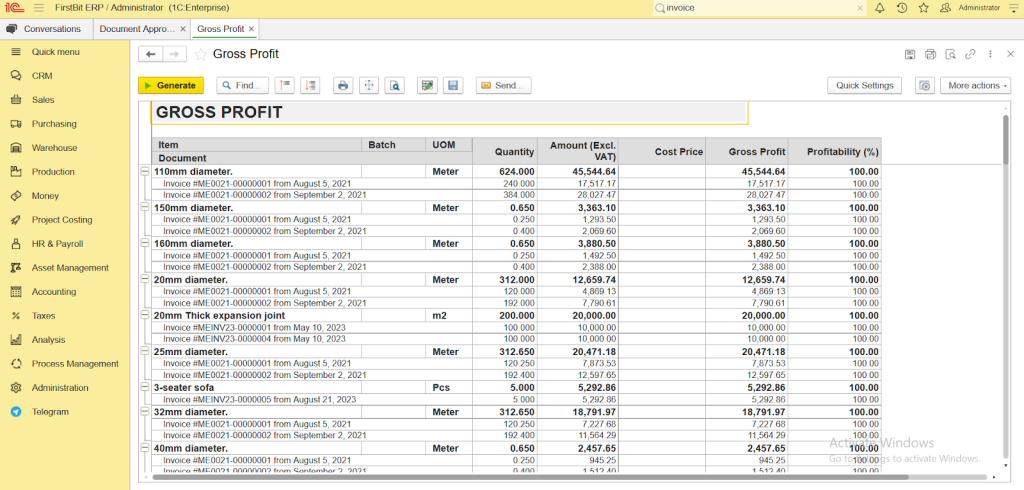

4. Providing Valuable Financial Insights

Get detailed insights into your business’s financial health with customized profit and loss reports and a clear view of assets, liabilities, and equity.

FirstBit ERP makes it easier to track your financial position and adjust forecasts accordingly, so you can make informed decisions.

FirstBit ERP showing a gross profit report

5. Helping with Payment Schedules

FirstBit ERP’s payment schedule feature allows you to plan ahead for payments, helping you stay organized and avoid missed deadlines. It ensures you maintain good relationships with vendors and clients while keeping your projects on track.

Mastering Cash Flow Forecasting for Construction Success

Cash flow forecasting isn’t just a financial tool — it’s essential for the success of any construction project. It allows you to make informed decisions, protect your business from financial risks, and prepare for the unexpected.

To get started, create a detailed cash flow forecast, monitor your revenue and expenses closely, and adjust as needed as your projects progress. With solid cash flow management, you'll keep your business on track, even when faced with challenges.

For an easier way to manage this, consider using FirstBit ERP. It’s designed to streamline cash flow management, giving you the tools you need to set your projects up for success. Take control of your financial planning today.

Umme Aimon Shabbir

Editor at First Bit

Aimon brings a deep understanding of the modern construction business to her articles by providing practical content.